Tesla Inc.’s stock chart suggests that bulls may be running out of breath after a record-long win streak, which could spell trouble for the stock in the near term.

The electric vehicle giant’s stock TSLA, -1.03% broke its previous win-streak record on Monday, then stretched it to 13 straight sessions on Tuesday. On Wednesday, the stock was in danger of snapping that streak, as it slipped 0.7% in afternoon trading.

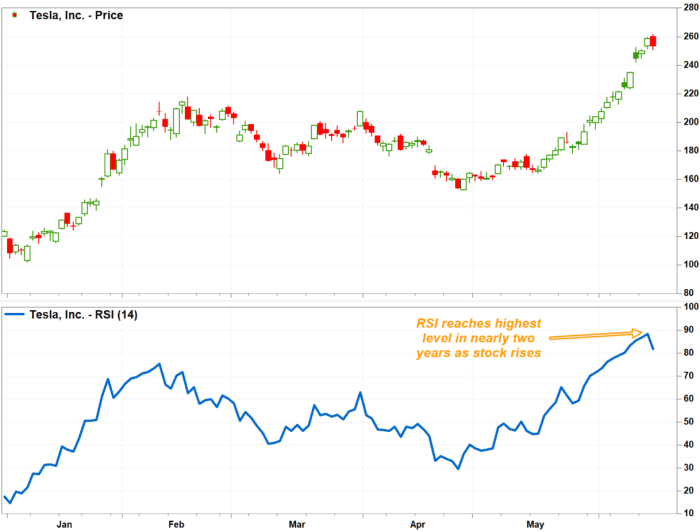

The stock’s Relative Strength Index, which is a momentum indicator that measures the magnitudes of recent gains against recent losses, rose to 88.46 on Tuesday, according to FactSet data, before slipping to 86.19 on Wednesday as the stock fell 0.7%.

Tuesday’s RSI reading was the highest since it peaked at a record 94.20 on Nov. 1, 2021.

FactSet, MarketWatch

Keep in mind that an overbought technical reading doesn’t mean the rally is over. Because technically, the stock has been overbought since the RSI crossed above the 70 level on May 30, when the win streak was just 3 days old.

There are also those on Wall Street who believe the ability to become overbought is a sign of underlying strength.

Read: Nvidia stock is the most overbought in 18 months, but that doesn’t mean the rally is over.

Nevertheless, the recent extreme RSI readings suggest each gain is taking more out of bulls than they are used to, and history suggests a pullback may be imminent.

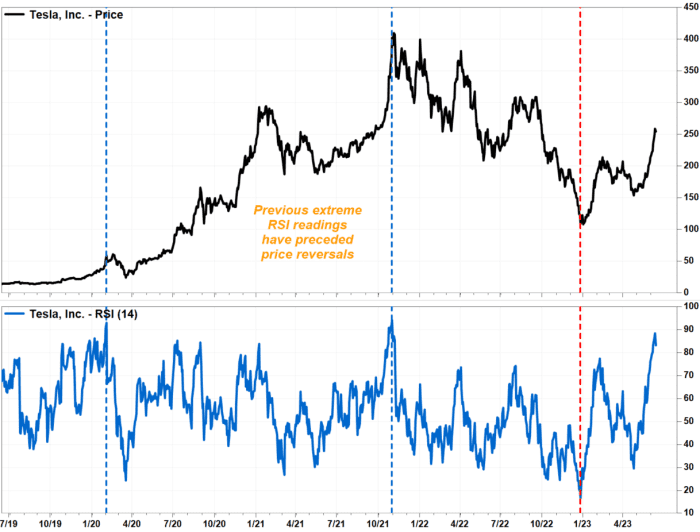

During the stock’s surge to its record close of $ 409.97 on Nov. 4, 2021, the RSI crossed the overbought threshold of 70 on Oct. 14, then first topped 80 on Oct. 18 and 90 on Oct. 25.

So the stock did continue to rise despite those extreme overbought readings, but not for very long. A software recall, Chief Executive Officer Elon Musk asking investors if he should sell 10% of his stock and director and Elon’s brother Kimbal Musk selling stock was just too much for tired bulls. The stock dropped 27% over the next six weeks.

FactSet, MarketWatch

On Feb. 4, 2020, the RSI reached an extreme reading of 93.06, after the stock doubled in a month to close at a split-adjusted record at the time of $ 54.14. After a 17.2% tumble the next day, the stock resumed its climb to a fresh record on Feb. 19, even as RSI never quite recovered.

See also: Tesla short sellers are down billions after stock’s winning streak

Meanwhile, the opposite was also true. When RSI hit an extreme oversold reading of 16.56 on Dec. 27, 2022, the stock closed at a more than two-year low of $ 109.10, It closed slightly lower ($ 108.10) four days later, that was it.

Basically, Tesla stock’s current extreme overbought reading doesn’t necessarily mean sell now, but it does suggest buyers should beware, as risks increase that a negative fundamental catalyst might have an outsized effect on a tired bulls.

On Wednesday, the stock’s decline accelerated after the Federal Reserve paused its interest-rate-hike cycle but indicated that more increases were likely. The stock went from a dip of just 0.2% before the rate announcement to an intraday loss of as much as 3.2% after the announcement, before paring losses.