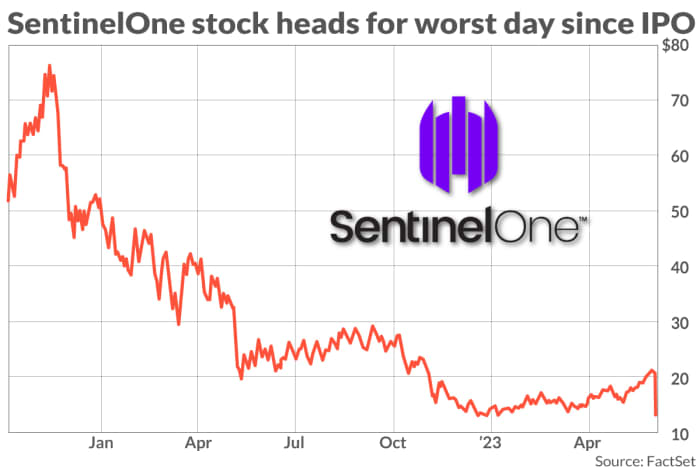

SentinelOne Inc.’s stock suffered its worst day since its initial public offering as the cybersecurity company struggles to find new business amid a tough business spending environment, prompting one analyst to downgrade the stock.

Not only did SentinelOne shares S, -35.14% on Friday experience their worst one-day percentage drop ever, but also they nearly closed at their lowest price ever, falling to as much as 38% to an intraday low of $ 12.86, or below previous record closing low of $ 13.08 set on Dec. 27, 2022.

Friday’s closing price represents an 82% drop from their all-time high close of $ 76.30 set on Nov. 12, 2021, and 62% below their higher-than-expected IPO pricing of $ 35.

Shares traded at their highest daily volume ever with more than 61 million shares exchanged, compared with their previous high of 27.7 million shares on March 18, and a 52-week average daily volume of 4.5 million shares.

Late Thursday, SentinelOne lowered its outlook for the year, announced layoffs, and trimmed its annualized recurring revenue, or ARR, by 5%.

Uncredited

From June 2021: SentinelOne stock bolts out of gate on first day, closes 20% above IPO price

Guggenheim analyst Raymond McDonough, who has a buy rating and a $ 16 price target, down from $ 24, said SentinelOne reported “a surprisingly weak quarter as necessary revisions to historical ARR figures clearly impeded management’s ability (and ours) to forecast revenue and ARR with any sort of accuracy.”

Nvidia CEO feels ‘perfectly safe’ sourcing from Taiwan’s TSMC amid China tensions

“Outside of critical ARR revisions, weakness in the quarter is hard to reconcile with management’s commentary around gross retention being stable, upsell and new business being in line with expectations, and competitive win rates remaining unchanged,” McDonough said in a note. “To us, it looks like new business fell off a cliff.”

On Friday, D.A. Davidson analyst Rudy Kessinger downgraded SentinelOne to neutral from buy, and cut his price target to $ 13.50 from $ 22, because of “new business / ARR growth rapidly declining.”

Read: Zscaler results, outlook top Street view, but shares dip amid tough cloud-software environment

Of the 29 analysts who cover SentinelOne, 14 have buy ratings, 14 have hold ratings, and one has a sell rating. Of those, 18 slashed price targets resulting in an average target price of $ 17.48, down from a previous $ 20.72, according to FactSet data.

Read: CrowdStrike stock drops more than 10% after less-than-perfect earnings outlook

Cybersecurity companies like Zscaler Inc. ZS, +5.40%, CrowdStrike Holdings Inc. CRWD, -3.95%, and identity-management company Okta Inc. OKTA, -1.15% all reported results this past week against a struggling software market where recessionary fears have slowed business spending.

Also read: Palo Alto Networks, software industry to undergo AI ‘transformation’ over next 12 months, CEO says

Friday’s selloff wiped out the stock’s gains for the year. At Friday’s close SentinelOne shares were down 7.9% for the year, compared with an 11.5% gain by the S&P 500 index SPX, +1.45%, a 26.5% increase by the tech-heavy Nasdaq Composite Index COMP, +1.07%, and an 11.9% gain by the ETFMG Prime Cyber Security ETF HACK, +0.41%.