One week into Financial Literacy Month, the Personal Finance team at MarketWatch has prepared an abundance of articles covering various aspects of managing money.

It begins with this financial literacy quiz. Chances are some of the questions will be easy for you — but you’ll probably learn something, too, and sharing the quiz with family members might spur useful conversations. There’s even a bonus question!

Find more articles on the Financial Fitness page.

And here’s a lesson about life and business that Apple founder Steve Jobs shared with the iPhone maker’s current CEO, Tim Cook.

How to talk about money

Relationship problems often spring from money problems — or from poor communication about financial matters, regardless of wealth level. Brian Page, founder of Modern Husbands, shares tips and tools to help couples communicate about money and improve their support for each other.

Quentin Fottrell has advice for a man who is worried his sons may not make the best decisions while saving up money to buy homes. Here’s how he can maintain their trust while sharing life lessons about money.

How to shop for a home — and for a mortgage — in a difficult market

For Financial Literacy Month, TransUnion’s head of consumer education, Margaret Poe (left), spoke with MarketWatch’s Aarthi Swaminathan.

Barron’s Live

Aarthi Swaminathan interviews a home buyer with a fascinating career, which is actually one of several challenges he faced in getting a mortgage. Here’s her advice on how to shop in the current market and pay as little interest as possible.

And here’s how much income you need to afford a $ 500,000 home.

On a related note, don’t assume you know everything about credit reporting, especially if you are looking to borrow money to purchase a home or vehicle. Margaret Poe, who heads consumer education at TransUnion, shares the most common mistake people make when it comes to their credit score.

Do you want to retire early?

Getty Images/iStockphoto

Be careful — you might not be ready to retire as early as you expected to be, and your financial adviser might be afraid to give you the bad news, as Morey Stettner explains.

More on retirement planning:

- What’s the magic number for retirement savings? Americans say it’s more than $ 1 million, but most will fall short of that goal.

- The best way to boost retirement savings? Keep it simple — and automatic.

Where will you live when you retire?

Tims Ford Lake in Winchester, Tenn.

Getty Images/iStockphoto

MarketWatch’s Retirement Tool gives you the power to make detailed custom searches for possible places to live.

This week, Jessica Hall shares three possible locations to help a reader who is looking to move to a remote location similar to “a warm, sunny version of Alaska” on a low budget.

What is going on with bank interest rates?

Take a close look at the interest you are earning on your savings. You might be leaving money on the table.

Getty Images/iStockphoto

It pays to shop around. One local bank is paying 0.02% interest on savings accounts, while some large banks are offering 3.75% or more if you use an online savings account.

Joy Wiltermuth explains why interest rates on deposits haven’t been keeping up with the federal-funds rate, for which the Federal Reserve has set a target range of 4.75% to 5%.

People who are tired of being paid next to nothing on their bank deposits have been moving money to money-market mutual funds. These funds have stable share prices of a dollar and pay higher interest rates than most bank savings accounts. Joseph Adinolfi explains how this massive movement of money could hurt the U.S. economy.

There has also been an increasing flow of money into exchange-traded funds that hold bonds, as Christine Idzelis reports in this week’s ETF Wrap.

And what’s going on with the banks?

Bank earnings season kicks off on April 14, when JPMorgan Chase JPM, -0.11%, Citigroup C, +0.20% and Wells Fargo WFC, +2.74% are scheduled to announce their first-quarter results.

Here’s a sampling of Steve Gelsi’s ongoing coverage of the aftermath of the deposit flight that led to the failures of Silicon Valley Bank and Signature Bank of New York, as well as to concerns about other banks’ liquidity:

Mark Hulbert: Silicon Valley Bank’s failure isn’t the end of the banking crisis. History says it just might be the start.

For bearish and bullish investors

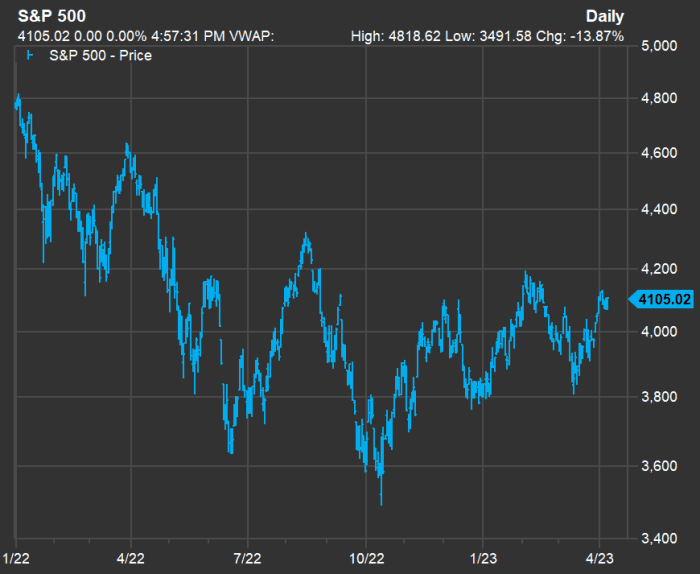

The S&P 500’s recovery from its October bottom has been bumpy — and partial.

FactSet

The bear market may not be over for stocks, despite this year’s 7.4% return for the S&P 500. Here are four reasons investors may be in for more pain over the short term.

For more of the gloomy view: A ‘credit crunch’ is already under way, economist warns

Then again, one investor’s fear is another investor’s opportunity. With so many professional money managers advising a low allocation to stocks, analysts at Bank of America see clear signal that it is time to buy.

How about some stock screens?

Auto sales heat up — for a surprising reason

Tesla CEO Elon Musk might be the subject of a shareholder proposal in the electric-vehicle maker’s annual proxy statement.

Getty Images

Tesla Inc.’s TSLA, -0.25% annual meeting will take place on May 15. This year’s proxy statement includes a shareholder proposal that might be especially interesting for CEO Elon Musk, as Claudia Assis reports.

Related: U.S. car sales got help from an unexpected corner of the market

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news, personal finance and investing advice.