Nifty closes the week, around 17,453, losing about 1.23 percent and gyrated between 17,863 and 17,367 during the week. On the OI (open interest) front, a short build-up was witnessed in Nifty Jan Futures over the week gone by as there was an increase in OI, with losses witnessed in Nifty on a weekly closing basis.

On the other hand, Bank Nifty Futures lost about 1.97 percent as it closed the week around 40,606 and gyrated between 41,799 to 40,462, the last week. Overall, Bank Nifty ended the week with a loss.

Further diving into the Nifty upcoming weekly expiry, Nifty immediate resistance stands at 17,500 levels where nearly 83.25 lakh shares is the CE options open interest followed by vital resistance at 18,000 levels where about 101.39 lakh shares is the CE options open interest. On the lower side, the immediate support level is at 17,400 where nearly 60.34 lakh shares is the PE options open interest followed by 17,300 where nearly 47.82 lakh shares is the PE options open interest.

Looking at the Bank Nifty upcoming weekly expiry data, on the upside, Bank Nifty’s immediate and vital resistance is at 41,500 where nearly 29.35 lakh shares is the CE open interest, whereas, on the lower side immediate and vital support is at 40,000, about 17.21 lakh shares, which is the PE open interest. At 40,500, PE open interest stood at about 26.57 lakh shares.

INDIA VIX, fear gauge, increased to 13.41 over a week-to-week basis from 12.18. Any further uptick in INDIA VIX could accentuate the downward move in Nifty and vice versa.

Looking at the sentimental indicator, Nifty OI PCR for the week has decreased to 0.894 from 1.17 and Bank Nifty OIPCR over the week decreased to 0.664 from 1.277 compared to last Friday. Overall data indicates PE writers are less aggressive than CE writers in Nifty.

Moving further to the weekly contribution of sectors to Nifty. FMCG contributed positively by 22.10 points, private bank and NBFC contributed negatively by -20 and -13.74 points, respectively. Oil also contributed marginally negatively to the index by -2.19 points.

Auto and metal contributed positively to Nifty by about 3.71 and 4.61 points respectively.

Pharma, IT contributed negatively to Nifty by -5.94 and -10.98 points, respectively, while infra and capital goods contributed positively to the index by 12.35 and 9.36 points, respectively.

Looking towards the top gainer & loser stocks of the week in the F&O segment. Balrampur Chini Mills topped by gaining over 8.8 percent, followed by Mahanagar Gas 8.8, Manappuram Finance 8 percent. Whereas RBL Bank lost -7.5 percent, Intellect Design Arena has lost over -6.4 percent, Dr Lal PathLabs lost -6.3 percent over the week.

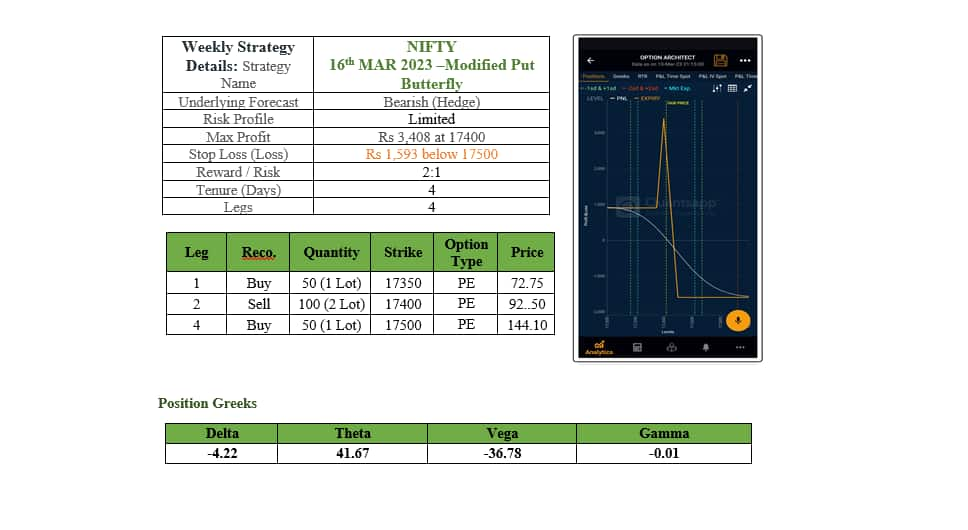

The upcoming week can be approached with a low-risk strategy like a modified Put Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.