The Nifty started March on a positive note, snapping an eight-day losing streak to end higher on March 1 on the back of gains in metal, technology, banking & financial services, auto, and oil & gas names.

After opening higher at 17,360, the index remained in an uptrend throughout the session to hit an intraday high of 17,468. The index closed 147 points higher to 17,451.

It formed a bullish candlestick on the daily charts and negated the lower highs and lower lows formation of the last eight sessions.

The index decisively climbed above the 200-day moving average (DMA) of 17,392.

If the index sustains the uptrend and close above 17,600 then 17,800-18,000 is expected to be the key resistance area, with support at 17,300, experts said.

“As far as levels are concerned, 17,350-17,300 is likely to cushion any short-term blip, while the swing low of the 17,250 odd zone is expected to act as a sheet anchor for Nifty,” Osho Krishan, senior analyst, Technical & Derivative Research, Angel One, said. On the higher end, a breach of 17,600 can trigger the next leg of the rally.

Many stock-specific adjustments are likely to continue and provide substantial trading opportunities, the expert said.

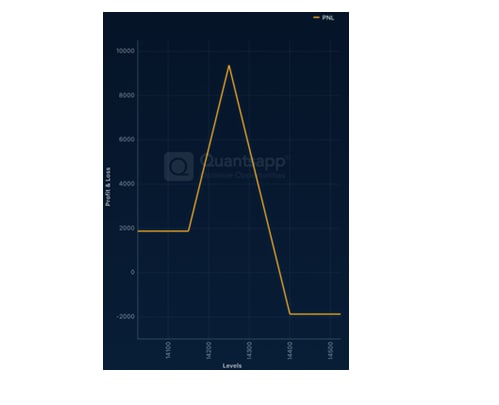

On the options front, the maximum Call open interest was seen at 17,500 strike followed by 17,600 strike, which are expected to be crucial resistance area for the Nifty in the coming sessions, with Call writing at 17,500 strike.

On the Put side, the maximum open interest was at 17,400 strike, followed by 17,300 strike, which are expected to act as a support area in near term, with writing at 17,400 strike, then 17,500 strike.

For March 2 expiry, Hedged Founder & CEO Rahul Ghose advised traders to look for a range of 17,400 on the downside and 17,600 on the upside barring any new news flow.

Open interest also indicates that traders are going into the weekly expiry with a bullish 17,500 short straddle position, he said.

Banking index

The Bank Nifty also traded higher and closed rising 429 points, or 1 percent, higher at 40,698.

The index formed a bullish candle on the daily charts, making higher highs and higher lows for the second consecutive session.

“On the higher end, it may move towards 41,000. On the lower end, support is placed at 40,400,” Kunal Shah, Senior Technical Analyst at LKP Securities said.

The momentum oscillator relative strength index is in a bullish crossover. A double-bottom formation on the daily RSI is likely to provide positive momentum in the space.

Volatility cooled down considerably. India VIX, the fear index, fell 7.31 percent to 13 levels.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.