You have to make a lot of decisions when you retire, and among the biggest is what to do with your workplace retirement savings. No matter how much money you have or how you intend to invest it, you have to first choose where your nest egg will live.

You have four basic choices.

- Remain in your employer’s plan and just let the money grow until you have to start taking the required minimum distributions (RMDs).

- Remain in your employer’s plan while taking installment payments.

- Roll over the assets to an IRA at an institution of your choosing.

- Take the account balance in cash and pay tax on the distribution to either spend it or roll it into a Roth IRA.

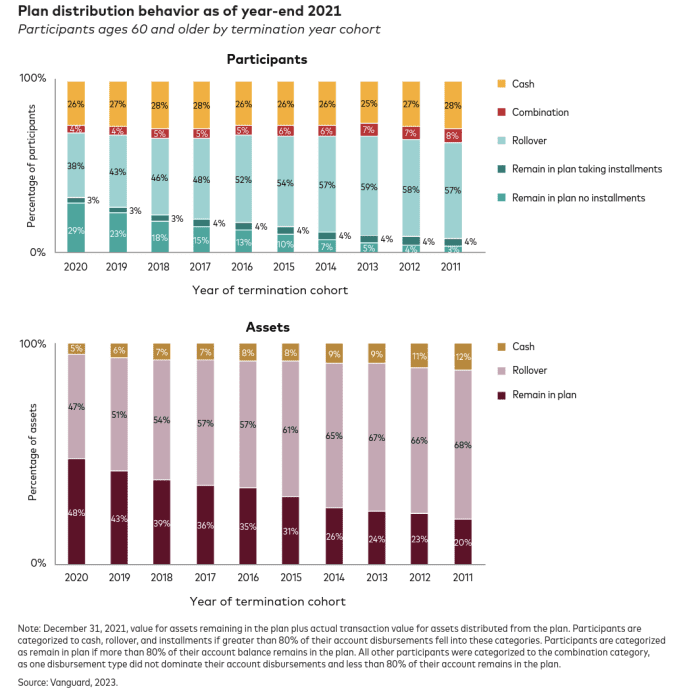

The good news, according to recent research from Vanguard, is that most people faced with this decision over 10 years, from 2011 to 2021, were able to preserve their retirement dollars. Seven out of 10 kept their assets in a tax-deferred environment, and 90% of the money stayed invested, and presumably, grew a bit. Average balances ranged from $ 239,300 to $ 418,900.

“More and more investors are on the right road to having a good experience with accumulations. We’re seeing improvements,” says Matt Brancato, chief client officer for Vanguard Institutional.

But, Brancato adds, “the average doesn’t tell you about individual experience.”

And for that, you have to look at some of the less good news, which is that Vanguard found that 30% cashed out their savings at age 60 or later, most with smaller balances. The average amount of these accounts was $ 39,700. Some had likely simply saved less, and some had been with the company plan for a short time, so had not accumulated a large amount.

The peril of cashing out

Cashing out a small balance might seem inconsequential to you at the time. The account could be one of many that you have, and the tax burden might not seem too much for you to bear. Or you could be intending to pay the income tax due on the distribution and roll the money into a Roth IRA in a conversion. Or the cash might be enticing – and then it’s gone.

“First of all, ‘small’ is a relative term,” says Brancato. “The dollar amount has to be proportionate to the intent. It’s a highly individualized decision.”

One important step if you’re thinking of cashing out is to consider how the amount involved could possibly grow over time and add to your retirement income later on. If your balance is $ 39,700 now and you think that isn’t much, it could be $ 78,000 in 10 years, if it grows at 7%.

At Ascensus, another large retirement plan administrator, they display those numbers to people when they initiate a decision that would impact their retirement savings, like reducing their 401(k) contribution. “We serve up a very quick estimate to connect the dots between what seems like a small amount to a much larger amount of money you’d forgo in retirement as a result,” says David Musto, CEO of Ascensus. After seeing that information, “30% of people ultimately choose not to reduce 401(k),” he adds.

That same kind of information may also help people make a decision between staying in their workplace plan after retiring or moving the money to a rollover IRA. While most eventually move money over to their own account within five years, Vanguard’s study shows that the numbers are shifting up for those staying in their workplace plan even after they retire.

Brancato sees the driver of that being flexible plan design, advice and financial-wellness tools that may be part of an employer package. If you want to tap into your money before you have to take RMDs, for instance, your plan would have to allow it, and Vanguard notes that the number of plans offering this nearly doubled in the past five years.

“It’s increasingly retiree-friendly,” Brancato says.

Got a question about the mechanics of investing, how it fits into your overall financial plan and what strategies can help you make the most out of your money? You can write me at beth.pinsker@marketwatch.com.