Bonds and stocks may be getting back to their usual relationship, a plus for investors with a traditional mix of assets in their portfolios amid fears that the U.S. faces a recession this year.

“The bottom line is the correlation now has shifted back to a more traditional one, where stocks and bonds do not necessarily move together,” said Kathy Jones, chief fixed-income strategist at Charles Schwab, in a phone interview. “It is good for the 60-40 portfolio because the point of that is to have diversification.”

That classic portfolio, consisting of 60% stocks and 40% bonds, was hammered in 2022. It’s unusual for both stocks and bonds to tank so precipitously, but they did last year as the Federal Reserve rapidly raised interest rates in an effort to tame surging inflation in the U.S.

While inflation remains high, it has shown signs of easing, raising investors’ hopes that the Fed could slow its aggressive pace of monetary tightening. And with the bulk of interest rate hikes potentially over, bonds seem to be returning to their role as safe havens for investors fearing gloom.

“Slower growth, less inflation, that’s good for bonds,” said Jones, pointing to economic data released in the past week that reflected those trends.

The Commerce Department said Jan. 18 that retail sales in the U.S. slid a sharp 1.1% in December, while the Federal Reserve released data that same day showing U.S. industrial production fell more than expected in December. Also on Jan. 18, the U.S. Bureau of Labor Statistics said the producer-price index, a gauge of wholesale inflation, dropped last month.

Stock prices fell sharply that day amid fears of a slowing economy, but Treasury bonds rallied as investors sought safe-haven assets.

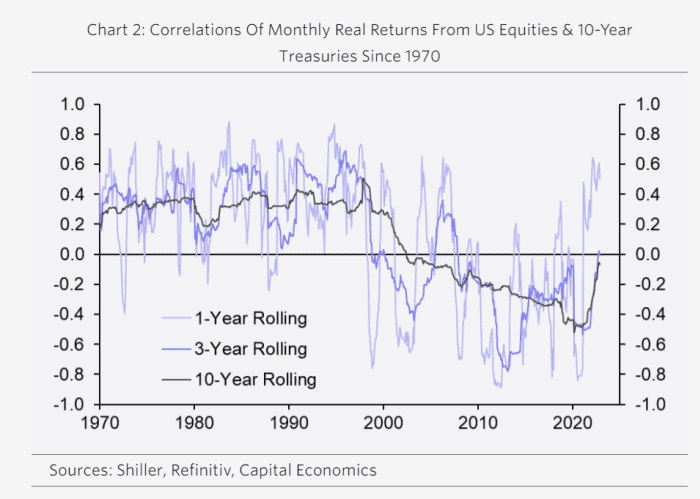

“That negative correlation between the returns from Treasuries and U.S. equities stands in stark contrast to the strong positive correlation that prevailed over most of 2022,” said Oliver Allen, a senior markets economist at Capital Economics, in a Jan. 19 note. The “shift in the U.S. stock-bond correlation might be here to stay.”

A chart in his note illustrates that monthly returns from U.S. stocks and 10-year Treasury bonds were often negatively correlated over the past two decades, with 2022’s strong positive correlation being relatively unusual over that time frame.

CAPITAL ECONOMICS NOTE DATED JAN. 19, 2023

“The retreat in inflation has much further to run,” while the U.S. economy may be “taking a turn for the worse,” Allen said. “That informs our view that Treasuries will eke out further gains over the coming months even as U.S. equities struggle.”

The iShares 20+ Year Treasury Bond ETF TLT, -1.62% has climbed 6.7% this year through Friday, compared with a gain of 3.5% for the S&P 500 SPX, +1.89%, according to FactSet data. The iShares 10-20 Year Treasury Bond ETF TLH, -1.40% rose 5.7% over the same period.

Charles Schwab has “a pretty positive view of the fixed-income markets now,” even after the bond market’s recent rally, according to Jones. “You can lock in an attractive yield for a number of years with very low risk,” she said. “That’s something that has been missing for a decade.”

Jones said she likes U.S. Treasurys, investment-grade corporate bonds, and investment-grade municipal bonds for people in high tax brackets.

Read: Vanguard expects municipal bond ‘renaissance’ as investors should ‘salivate’ at higher yields

Keith Lerner, co-chief investment officer at Truist Advisory Services, is overweight fixed income relative to stocks as recession risks are elevated.

“Keep it simple, stick to high-quality” assets such as U.S. government securities, he said in a phone interview. Investors start “gravitating” toward longer-term Treasurys when they have concerns about the health of the economy, he said.

The bond market has signaled concerns for months about a potential economic contraction, with the inversion of the U.S. Treasury market’s yield curve. That’s when short-term rates are above longer-term yields, which historically has been viewed as a warning sign that the U.S. may be heading for a recession.

But more recently, two-year Treasury yields TMUBMUSD02Y, 4.159% caught the attention of Charles Schwab’s Jones, as they moved below the Federal Reserve’s benchmark interest rate. Typically, “you only see the two-year yield go under the fed funds rate when you’re going into a recession,” she said.

The yield on the two-year Treasury note fell 5.7 basis points over the past week to 4.181% on Friday, in a third straight weekly decline, according to Dow Jones Market Data. That compares with an effective federal funds rate of 4.33%, in the Fed’s targeted range of 4.25% to 4.5%.

Two-year Treasury yields peaked more than two months ago, at around 4.7% in November, “and have been trending down since,” said Nicholas Colas, co-founder of DataTrek Research, in a note emailed Jan. 19. “This further confirms that markets strongly believe the Fed will be done raising rates very shortly.”

As for longer-term rates, the yield on the 10-year Treasury note TMUBMUSD10Y, 3.472% ended Friday at 3.483%, also falling for three straight weeks, according to Dow Jones Market data. Bond yields and prices move in opposite directions.

‘Bad sign for stocks’

Meanwhile, long-dated Treasuries maturing in more than 20 years have “just rallied by more than 2 standard deviations over the last 50 days,” Colas said in the DataTrek note. “The last time this happened was early 2020, going into the Pandemic Recession.”

Long-term Treasurys are at “a critical point right now, and markets know that,” he wrote. “Their recent rally is bumping up against the statistical limit between general recession fears and pointed recession prediction.”

A further rally in the iShares 20+ Year Treasury Bond ETF would be “a bad sign for stocks,” according to DataTrek.

“An investor can rightly question the bond market’s recession-tilting call, but knowing it’s out there is better than being unaware of this important signal,” said Colas.

The U.S. stock market ended sharply higher Friday, but the Dow Jones Industrial Average DJIA, +1.00% and S&P 500 each booked weekly losses to snap a two-week win streak. The technology-heavy Nasdaq Composite erased its weekly losses on Friday to finish with a third straight week of gains.

In the coming week, investors will weigh a wide range of fresh economic data, including manufacturing and services activity, jobless claims and consumer spending. They’ll also get a reading from the personal-consumption-expenditures-price index, the Fed’s preferred inflation gauge.

‘Backside of the storm’

The fixed-income market is in “the backside of the storm,” according to Vanguard Group’s first-quarter report on the asset class.

“The upper-right quadrant of a hurricane is called the ‘dirty side’ by meteorologists because it is the most dangerous. It can bring high winds, storm surges, and spin-off tornadoes that cause massive destruction as a hurricane makes landfall,” Vanguard said in the report.

“Similarly, last year’s fixed income market was hit by the brunt of a storm,” the firm said. “Low initial rates, surprisingly high inflation, and a rate-hike campaign by the Federal Reserve led to historic bond market losses.”

Now, rates might not move “much higher,” but concerns about the economy persist, according to Vanguard. “A recession looms, credit spreads remain uncomfortably narrow, inflation is still high, and several important countries face fiscal challenges,” the asset manager said.

Read: Fed’s Williams says ‘far too high’ inflation remains his No. 1 concern

‘Defensive’

Given expectations for the U.S. economy to weaken this year, corporate bonds will probably underperform government fixed income, said Chris Alwine, Vanguard’s global head of credit, in a phone interview. And when it comes to corporate debt, “we are defensive in our positioning.”

That means Vanguard has lower exposure to corporate bonds than it would typically, while looking to “upgrade the credit quality of our portfolios” with more investment-grade than high-yield, or so-called junk, debt, he said. Plus, Vanguard is favoring non-cyclical sectors such as pharmaceuticals or healthcare, said Alwine.

There are risks to Vanguard’s outlook on rates.

“While this is not our base case, we could see a Fed, faced with continued wage inflation, forced to raising a fed funds rate closer to 6%,” Vanguard warned in its report. The climb in bond yields already seen in the market would “help temper the pain,” the firm said, but “the market has not yet begun to price such a possibility.”

Alwine said he expects the Fed will lift its benchmark rate to as high as 5% to 5.25%, then leave it at around that level for possibly two quarters before it begins easing its monetary policy.

“Last year, bonds were not a good diversifier of stocks because the Fed was raising rates aggressively to address the inflation concerns,” said Alwine. “We believe the more typical correlations are coming back.”