APL Apollo Tubes has formed long bullish candle on the daily charts with above average volumes, making higher high higher low for second straight session with momentum oscillator RSI trading above 60 level.

Sunil Shankar Matkar

January 19, 2023 / 06:55 AM IST

‘);

$ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$ (‘#volumetxt_’+articleId).show();

$ (‘#vlmtxt_’+articleId).show();

$ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$ (‘#rightcol_’+articleId).show();

}else{

$ (‘#volumetxt_’+articleId).hide();

$ (‘#vlmtxt_’+articleId).hide();

$ (‘#stkvol_’+articleId).text(”);

$ (‘#td-low_’+articleId).text(”);

$ (‘#td-high_’+articleId).text(”);

$ (‘#rightcol_’+articleId).hide();

}

$ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$ (‘.bseliveselectbox’).click(function(){

$ (‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’));

$ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$ (this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$ (‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($ (this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$ (‘.bselivelist’).hide();

});

$ (‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($ (this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$ (‘.bselivelist’).hide();

});

}

$ (“.bselivelist”).focusout(function(){

$ (“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$ (‘#watchlist-‘+articleId).click(function(){

var stkId = $ (this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$ (‘#portfolio-‘+articleId).click(function(){

var dispId = $ (this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$ (‘.mc-modal-close’).on(‘click’,function(){

$ (‘.mc-modal-wrap’).css(‘display’,’none’);

$ (‘.mc-modal’).removeClass(‘success’);

$ (‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$ (‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$ (‘#backInner1_rhsPop’).html(data);

$ .ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$ (‘#poprhsAdd’).html(popretStr);

//$ (‘.btmbgnwr’).show();

var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId; window.open(postfolio_url, ‘_blank’); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”);

$ (“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$ (“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($ (window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $ (window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$ (‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

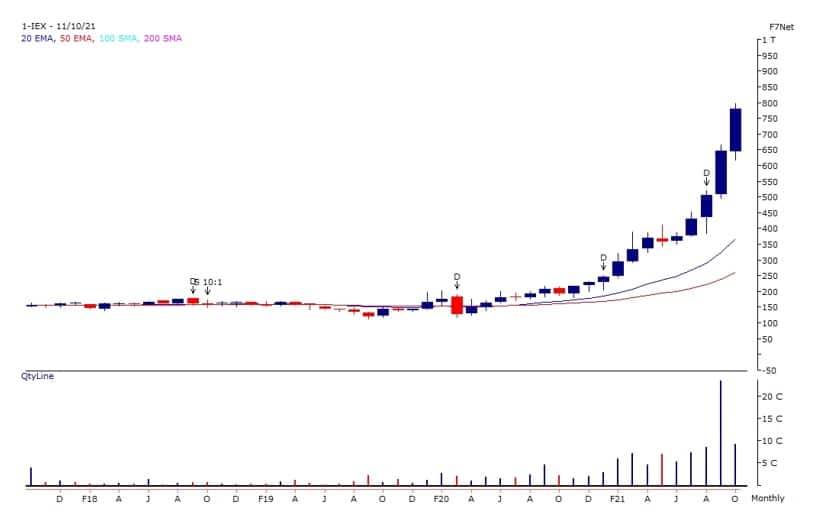

} The market has decisively surpassed hurdle of 50 DEMA (Day Exponential Moving Average – around 18,100) on the Nifty50 with formation of bullish candle on the daily charts with making higher high higher low formation for fourth consecutive session on January 18, indicating positive mood among market participants. Even the momentum oscillator RSI (relative strength index) moved above 50 mark giving positive signals.The Nifty50 rallied more than 110 points to 18,165, and the BSE Sensex jumped nearly 400 points to 61,046, but the breadth was not very strong, in fact, slightly tilted towards buyers.On the broader markets front, the Nifty Midcap 100 index gained half a percent and Smallcap 100 index was flat with a positive bias.Stocks that were in action included Polyplex Corporation which was the biggest gainer in the Nifty500 index, climbing 12 percent to Rs 1,675 – its highest closing level since December 14, 2022. The stock has formed robust bullish candle on the daily charts with strong volumes, closing above 50 DEMA as well as 9 DEMA and 21 DEMA. It has seen a breakout of downward sloping resistance trend line adjoining multiple touchpoints – November 21, November 23, and December 5, 2022.RITES shares jumped nearly 4 percent to Rs 340.5 and formed bullish candle which somewhat resembles Bullish Engulfing kind of pattern on the daily charts, with making higher high higher low formation, with momentum oscillator RSI (relative strength index) moving above 50 mark, indicating positive mood in the counter. The stock has taken a strong support at upward sloping support trend line adjoining multiple touchpoints – December 26, December 27, 2022 and January 11, 2023. On the upper side, it has seen a breakout of down ward sloping resistance trend line adjoining November 4 (record high), November 24 and December 13, 2022.APL Apollo Tubes advanced 4 percent to end at record closing high of Rs 1,189 apiece and formed long bullish candle on the daily charts with above average volumes, making higher high higher low for second straight session with momentum oscillator RSI trading above 60 level. The stock has been trading well above short term as well as long term moving averages like 9 DEMA, 21 DEMA, 50 DEMA, 100 DEMA and 200 DEMA, which is also a positive sign. It has seen a breakout of downward sloping resistance trend line adjoining December 5, 2022 (record high) and January 17, 2023.Here’s what Jigar S Patel of Anand Rathi Shares & Stock Brokers recommends investors should do with these stocks when the market resumes trading today:APL Apollo TubesThe rally which was started in May 2022 till date resulted in 47 percent appreciation. Currently, it is trading above the 12-21-50 daily exponential moving averages, which is a sign of strength in the counter.The previous trading session gave a clean breakout from the triangle pattern. On indicator front, daily 14 period RSI has taken support and then it has rebounded thus indicating further up move in APL Apollo Tubes.One can buy around Rs 1,180-1,190 with an expected target of Rs 1,300 and the stop-loss would be Rs 1,130 on a daily close basis. Polyplex CorporationAfter the free fall started from August 1, 2022 till December 23, 2022 which resulted in 39 percent. In the previous trading session, Polyplex had seen excellent buying interest. What is more interesting is that in the last month, any sort of buying interest is followed by massive volume (refer to the chart).In addition to the above technical rationale, the said counter has taken out the 6-month-old trendline (refer to the chart) along the daily 14 periods RSI has made a bullish divergence exactly in association with the double bottom price structure (refer to the chart).One can buy in the range of Rs 1,640-1,670 with an upside target of Rs 1,833. The stop-loss would be Rs 1,570 on a daily close basis.

Polyplex CorporationAfter the free fall started from August 1, 2022 till December 23, 2022 which resulted in 39 percent. In the previous trading session, Polyplex had seen excellent buying interest. What is more interesting is that in the last month, any sort of buying interest is followed by massive volume (refer to the chart).In addition to the above technical rationale, the said counter has taken out the 6-month-old trendline (refer to the chart) along the daily 14 periods RSI has made a bullish divergence exactly in association with the double bottom price structure (refer to the chart).One can buy in the range of Rs 1,640-1,670 with an upside target of Rs 1,833. The stop-loss would be Rs 1,570 on a daily close basis. RITESAfter registering a life-time high of Rs 428 during October 2022, the said counter has tanked almost 29 percent. In the current scenario, RITES has formed a piercing candlesticks pattern on a weekly scale which signals a possible reversal in the coming weeks.At present, the said counter has taken support above 200 DEMA and has formed a classic base near the 5-day exponential moving average.In addition, the daily 14-period RSI has taken out its 4-month-old trendline which hints towards up moves in coming sessions. One can buy around Rs 337-341 with a target price of Rs 384 and the stop-loss would be Rs 316 on a daily close basis.

RITESAfter registering a life-time high of Rs 428 during October 2022, the said counter has tanked almost 29 percent. In the current scenario, RITES has formed a piercing candlesticks pattern on a weekly scale which signals a possible reversal in the coming weeks.At present, the said counter has taken support above 200 DEMA and has formed a classic base near the 5-day exponential moving average.In addition, the daily 14-period RSI has taken out its 4-month-old trendline which hints towards up moves in coming sessions. One can buy around Rs 337-341 with a target price of Rs 384 and the stop-loss would be Rs 316 on a daily close basis. Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.