Traders should keep focusing on stock-specific moves and should ideally remain light on positions till the time key indices consolidate in the recent congestion zone, Sameet Chavan of Angel One advised

Sunil Shankar Matkar

January 16, 2023 / 09:52 AM IST

‘);

$ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$ (‘#volumetxt_’+articleId).show();

$ (‘#vlmtxt_’+articleId).show();

$ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$ (‘#rightcol_’+articleId).show();

}else{

$ (‘#volumetxt_’+articleId).hide();

$ (‘#vlmtxt_’+articleId).hide();

$ (‘#stkvol_’+articleId).text(”);

$ (‘#td-low_’+articleId).text(”);

$ (‘#td-high_’+articleId).text(”);

$ (‘#rightcol_’+articleId).hide();

}

$ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$ (‘.bseliveselectbox’).click(function(){

$ (‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’));

$ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$ (this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$ (‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($ (this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$ (‘.bselivelist’).hide();

});

$ (‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($ (this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$ (‘.bselivelist’).hide();

});

}

$ (“.bselivelist”).focusout(function(){

$ (“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$ (‘#watchlist-‘+articleId).click(function(){

var stkId = $ (this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$ (‘#portfolio-‘+articleId).click(function(){

var dispId = $ (this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$ (‘.mc-modal-close’).on(‘click’,function(){

$ (‘.mc-modal-wrap’).css(‘display’,’none’);

$ (‘.mc-modal’).removeClass(‘success’);

$ (‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$ (‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$ (‘#backInner1_rhsPop’).html(data);

$ .ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$ (‘#poprhsAdd’).html(popretStr);

//$ (‘.btmbgnwr’).show();

var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId; window.open(postfolio_url, ‘_blank’); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”);

$ (“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$ (“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($ (window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $ (window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$ (‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

} The market rebounded from a week-long correction and closed a volatile week on January 13 with half a percent gains on the back of easing inflation and good set of earnings by IT companies.The Nifty50 has formed Long-Legged Doji kind of pattern on the weekly scale, indicating lack of direction among bulls and bears, but the index has defended the 17,800 level quite smoothly several times during the week and eventually closed above the 17,900 mark. On the daily charts, the index has seen support-based buying in the last couple of sessions, indicating the possibility of further uptrend. It has taken support at 100 DEMA (day exponential moving average – 17,883)On the higher side, 18,000-18,200 are the key levels to watch out for as a rise beyond this level decisively may take the index towards 18,500, whereas a crucial support is expected at 17,750 as a breach of which could pull the index down to the 17,600-17,500 zone, experts said.”For the coming week, the 18,150 mark, which is almost the high of Doji, would be a trigger point for positive momentum, whereas a close below 17,775 would drag the index further,” Jigar S Patel, Senior Manager – Equity Research at Anand Rathi, said.As of now there seems to be a possibility of Budget relief rally but even that would get confirmed above 18,150, he feels.Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One, continues to remain hopeful and expects some positivity to trigger in the coming days.Traders should keep focusing on stock-specific moves and should ideally remain light on positions till the time key indices consolidate in the recent congestion zone, advised Chavan.Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the January 13 closing prices:Expert: Nagaraj Shetti, Technical Research Analyst at HDFC SecuritiesBEML: Buy | LTP: Rs 1,527 | Stop-Loss: Rs 1,420 | Target: Rs 1,675 | Return: 10 percentAfter a sharp upside bounce in December 2022, the stock price (BEML) has shifted into a rangebound movement in the last couple of weeks. The stock price is now in an attempt of break above the said range and also a resistance of down sloping trend line at Rs 1,530 level.Hence, a sustainable upside from here is likely to be a sharp positive impact for the stock price ahead. The stock price has started to move up from near the cluster support of 10 and 20-day EMA (exponential moving average) and also 200-day EMA around Rs 1,485-1,500 levels. Volume has started to expand with up-move in the stock price and daily RSI (relative strength index) shows positive indication.Buying can be initiated in BEML at CMP (Rs 1,527), add more on dips down to Rs 1,465, wait for the upside target of Rs 1,675 in the next 3-5 weeks with a a stop-loss of Rs 1,420. Rain Industries: Buy | LTP: Rs 183.55 | Stop-Loss: Rs 171 | Target: Rs 202 | Return: 10 percentThe weekly timeframe chart of the stock price indicates a sustainable upside bounce in last week. The stock price is in an attempt of upside breakout of the resistance of descending trend line around Rs 185 level.Hence, further sustainable move from here could be considered as a significant upside breakout and the stock price could move up sharply. Volume has started to rise during upside breakout in the stock price and weekly RSI shows positive indication.One may look to buy Rain at CMP (Rs 183.55), add more on dips down to Rs 176 and wait for the upside target of Rs 202 in the next 3-5 weeks. Place a stop-loss of Rs 171.

Rain Industries: Buy | LTP: Rs 183.55 | Stop-Loss: Rs 171 | Target: Rs 202 | Return: 10 percentThe weekly timeframe chart of the stock price indicates a sustainable upside bounce in last week. The stock price is in an attempt of upside breakout of the resistance of descending trend line around Rs 185 level.Hence, further sustainable move from here could be considered as a significant upside breakout and the stock price could move up sharply. Volume has started to rise during upside breakout in the stock price and weekly RSI shows positive indication.One may look to buy Rain at CMP (Rs 183.55), add more on dips down to Rs 176 and wait for the upside target of Rs 202 in the next 3-5 weeks. Place a stop-loss of Rs 171. Expert: Jatin Gohil, Technical and Derivative Research Analyst at Reliance SecuritiesSun Pharmaceutical Industries: Buy | LTP: Rs 1,031.6 | Stop-Loss: Rs 969 | Target: Rs 1,185 | Return: 15 percentAfter a higher level of reversal, the stock respected its 20-week EMA and resumed its up-move. The stock is poised for breakout from a bullish continuation pattern – Bullish Flag.In the past, the stock explored uncharted territory after testing its 20-week EMA. The stock has potential to move towards Rs 1,185, which coincides with its target point of bullish flag and also, with its prior high connecting rising trendline.The key technical indicators are in favour of the bulls on short-term timeframe chart.On the lower side, the stock will continue to find support around its 20-week EMA.

Expert: Jatin Gohil, Technical and Derivative Research Analyst at Reliance SecuritiesSun Pharmaceutical Industries: Buy | LTP: Rs 1,031.6 | Stop-Loss: Rs 969 | Target: Rs 1,185 | Return: 15 percentAfter a higher level of reversal, the stock respected its 20-week EMA and resumed its up-move. The stock is poised for breakout from a bullish continuation pattern – Bullish Flag.In the past, the stock explored uncharted territory after testing its 20-week EMA. The stock has potential to move towards Rs 1,185, which coincides with its target point of bullish flag and also, with its prior high connecting rising trendline.The key technical indicators are in favour of the bulls on short-term timeframe chart.On the lower side, the stock will continue to find support around its 20-week EMA. UltraTech Cement: Buy | LTP: Rs 7,249 | Stop-Loss: Rs 6,840 | Target: Rs 8,270 | Return: 14 percentThe stock formed a base around its prior point of polarity and poised for a fresh up-move. In the last week, the stock witnessed price volume breakout and rose to multi-month weekly-closing-high.We believe undergoing positive momentum will continue, as the key technical indicators are positively poised on major timeframe charts.This could lead the stock towards its highest level of January 2022 initially and its life-time-high subsequently, which are placed at Rs 7,946 and Rs 8,269, respectively.In case of any decline, its prior point of polarity will continue to work as a strong reversal point.

UltraTech Cement: Buy | LTP: Rs 7,249 | Stop-Loss: Rs 6,840 | Target: Rs 8,270 | Return: 14 percentThe stock formed a base around its prior point of polarity and poised for a fresh up-move. In the last week, the stock witnessed price volume breakout and rose to multi-month weekly-closing-high.We believe undergoing positive momentum will continue, as the key technical indicators are positively poised on major timeframe charts.This could lead the stock towards its highest level of January 2022 initially and its life-time-high subsequently, which are placed at Rs 7,946 and Rs 8,269, respectively.In case of any decline, its prior point of polarity will continue to work as a strong reversal point. SBI Life Insurance Company: Buy | LTP: Rs 1,313 | Stop-Loss: Rs 1,240 | Target: Rs 1,440 | Return: 10 percentContinuing its prior weekly rising trend, the stock witnessed a trendline breakout and rose to 4-month high.We have observed convergence w.r.t. its weekly-RSI, as it has also witnessed a trendline breakout. This could take the stock towards Rs 1,440, which coincides with its prior high connecting rising trendline.On the lower side, now the stock will find support around its 20-week EMA.

SBI Life Insurance Company: Buy | LTP: Rs 1,313 | Stop-Loss: Rs 1,240 | Target: Rs 1,440 | Return: 10 percentContinuing its prior weekly rising trend, the stock witnessed a trendline breakout and rose to 4-month high.We have observed convergence w.r.t. its weekly-RSI, as it has also witnessed a trendline breakout. This could take the stock towards Rs 1,440, which coincides with its prior high connecting rising trendline.On the lower side, now the stock will find support around its 20-week EMA. Expert: Rohan Shah, Head – Technical Research at StoxboxGodrej Consumer Products: Buy | LTP: Rs 917.2 | Stop-Loss: Rs 885 | Target: Rs 980 | Return: 7 percentPost forming a bottom in March 2020, price has seen forming a series of higher highs and lows denotes bullish price action.Recently, the price registered a breakout from horizontal flat Cloud Line and Bullish Flag price pattern, indicating bullish signal for short to medium term trend.Relative Strength line against Nifty50 has concluded a breakout from the falling resistance trendline highlights bullish bias in price and overall strength in price compared to head index.MACD line inching higher converging around its average and trading into bullish territory compliments the bullish view on price.

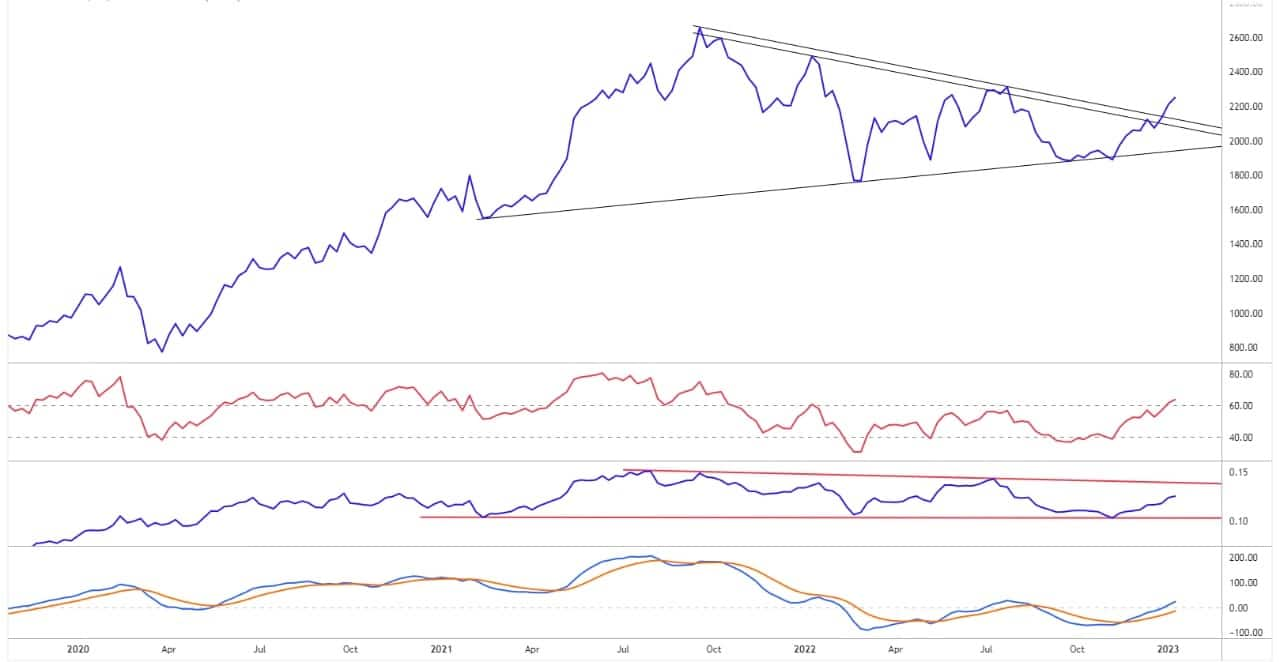

Expert: Rohan Shah, Head – Technical Research at StoxboxGodrej Consumer Products: Buy | LTP: Rs 917.2 | Stop-Loss: Rs 885 | Target: Rs 980 | Return: 7 percentPost forming a bottom in March 2020, price has seen forming a series of higher highs and lows denotes bullish price action.Recently, the price registered a breakout from horizontal flat Cloud Line and Bullish Flag price pattern, indicating bullish signal for short to medium term trend.Relative Strength line against Nifty50 has concluded a breakout from the falling resistance trendline highlights bullish bias in price and overall strength in price compared to head index.MACD line inching higher converging around its average and trading into bullish territory compliments the bullish view on price. Balkrishna Industries: Buy | LTP: Rs 2,233.40 | Stop-Loss: Rs 2,149 | Target: Rs 2,400 | Return: 7.5 percentThe stock price recently concluded a breakout from multi-month symmetrical triangle price pattern, signaling continuation of structural upmove.The breakout from the pattern has accompanied above average volumes, providing additional confirmation to the breakout.MACD line inching higher and has entered into bullish territory with MACD diverging from its average indicates momentum in price.RSI trading above the 60 readings and shows range shift to the elevated levels indicates momentum and strength in price.The Relative line against Nifty50 heads higher from the horizontal support line and is expected to continue higher towards the falling resistance line.

Balkrishna Industries: Buy | LTP: Rs 2,233.40 | Stop-Loss: Rs 2,149 | Target: Rs 2,400 | Return: 7.5 percentThe stock price recently concluded a breakout from multi-month symmetrical triangle price pattern, signaling continuation of structural upmove.The breakout from the pattern has accompanied above average volumes, providing additional confirmation to the breakout.MACD line inching higher and has entered into bullish territory with MACD diverging from its average indicates momentum in price.RSI trading above the 60 readings and shows range shift to the elevated levels indicates momentum and strength in price.The Relative line against Nifty50 heads higher from the horizontal support line and is expected to continue higher towards the falling resistance line. SBI Life Insurance Company: Buy | LTP: Rs 1,313 | Stop-Loss: Rs 1,255 | Target: Rs 1,415 | Return: 8 percentThe primary trend of the stock remains bullish as on the higher degree time frame chart, the stock continues to form a series of higher highs and lows.Price scales higher taking support at intermediate rising trendline, furthermore, Ichimoku clouds, conversion line and base line trends higher denotes momentum and bullish signal in price.Within the channel, the stock has generated a breakout from intermediate resistance line signalling price to head higher towards the upper boundary of the channel.RSI rebounds higher from the neutral reading with bullish average crossing denoting strength in price.Relative strength line against Nifty50 rebounds higher from the support line and has a resolute breakout from intermediate resistance trendline indicating price likely to outperform the index.

SBI Life Insurance Company: Buy | LTP: Rs 1,313 | Stop-Loss: Rs 1,255 | Target: Rs 1,415 | Return: 8 percentThe primary trend of the stock remains bullish as on the higher degree time frame chart, the stock continues to form a series of higher highs and lows.Price scales higher taking support at intermediate rising trendline, furthermore, Ichimoku clouds, conversion line and base line trends higher denotes momentum and bullish signal in price.Within the channel, the stock has generated a breakout from intermediate resistance line signalling price to head higher towards the upper boundary of the channel.RSI rebounds higher from the neutral reading with bullish average crossing denoting strength in price.Relative strength line against Nifty50 rebounds higher from the support line and has a resolute breakout from intermediate resistance trendline indicating price likely to outperform the index. Expert: Ruchit Jain, Lead Research at 5paisaRain Industries: Buy | LTP: Rs 183.55 | Stop-Loss: Rs 174 | Target: Rs 197 | Return: 7 percentThe stock has been consolidating in a range since last few weeks and in Friday’s session, prices gave a breakout above its falling trendline resistance. The breakout was accompanied by rising volumes while the RSI oscillator too is hinting at a positive momentum.Hence, short term traders can look for buying opportunities around current price of Rs 183. The possible near term targets for the stock are expected around Rs 192 and Rs 197. The stop-loss for long positions should be placed below Rs 174.

Expert: Ruchit Jain, Lead Research at 5paisaRain Industries: Buy | LTP: Rs 183.55 | Stop-Loss: Rs 174 | Target: Rs 197 | Return: 7 percentThe stock has been consolidating in a range since last few weeks and in Friday’s session, prices gave a breakout above its falling trendline resistance. The breakout was accompanied by rising volumes while the RSI oscillator too is hinting at a positive momentum.Hence, short term traders can look for buying opportunities around current price of Rs 183. The possible near term targets for the stock are expected around Rs 192 and Rs 197. The stop-loss for long positions should be placed below Rs 174. Rallis India: Buy | LTP: Rs 257.65 | Stop-Loss: Rs 243 | Target: Rs 280 | Return: 9 percentThe stock has been trading in a rising channel and post the recent correction, the stock witnessed buying interest at the lower end of the channel.During last week, we witnessed higher volumes along with the price upmove which is a positive sign. The RSI oscillator too hints at a positive momentum and hence, the stock could rally further towards the higher end of the pattern.Traders can look to buy the stock in the range of Rs 256-254 for potential targets around Rs 270 and Rs 280. The stop-loss for long positions should be placed below Rs 243.

Rallis India: Buy | LTP: Rs 257.65 | Stop-Loss: Rs 243 | Target: Rs 280 | Return: 9 percentThe stock has been trading in a rising channel and post the recent correction, the stock witnessed buying interest at the lower end of the channel.During last week, we witnessed higher volumes along with the price upmove which is a positive sign. The RSI oscillator too hints at a positive momentum and hence, the stock could rally further towards the higher end of the pattern.Traders can look to buy the stock in the range of Rs 256-254 for potential targets around Rs 270 and Rs 280. The stop-loss for long positions should be placed below Rs 243. Expert: Jigar S Patel, Senior Manager – Equity Research at Anand RathiOil India: Buy | LTP: Rs 223 | Stop-Loss: Rs 210 | Target: Rs 250 | Return: 12 percentSince the last four months, the said counter has been making higher highs and higher lows structure. Recently it broke its previous swing high of Rs 218.60 along with the four-month-old trendline is maintained and currently is sustaining above it 200 DEMA (day exponential moving average) thus hinting upside in the counter.On the indicator front, daily DMI (directional movement index) is in bullish mode and also it broke its previous swing thus indicating bullishness in the counter. Also, daily MACD (moving average convergence divergence) has made bullish cross above zero line thus giving extra confirmation for upside in the said counter.One can buy in small tranches around Rs 221-224 and another around Rs 216-218, with a target at around Rs 250 and stop-loss at Rs 210.

Expert: Jigar S Patel, Senior Manager – Equity Research at Anand RathiOil India: Buy | LTP: Rs 223 | Stop-Loss: Rs 210 | Target: Rs 250 | Return: 12 percentSince the last four months, the said counter has been making higher highs and higher lows structure. Recently it broke its previous swing high of Rs 218.60 along with the four-month-old trendline is maintained and currently is sustaining above it 200 DEMA (day exponential moving average) thus hinting upside in the counter.On the indicator front, daily DMI (directional movement index) is in bullish mode and also it broke its previous swing thus indicating bullishness in the counter. Also, daily MACD (moving average convergence divergence) has made bullish cross above zero line thus giving extra confirmation for upside in the said counter.One can buy in small tranches around Rs 221-224 and another around Rs 216-218, with a target at around Rs 250 and stop-loss at Rs 210. Samvardhana Motherson International: Buy | LTP: Rs 77 | Stop-Loss: Rs 69 | Target: Rs 88 | Return: 14 percentSince the last 3 months, the said counter has been making higher highs and higher lows structure. Recently it broke its previous swing high of Rs 76.30 along with the 6-month-old trendline was broken and currently is sustaining above it thus hinting upside in the counter. Moreover, Hammer candle was seen taking support near 100 DEMA which is looking lucrative.On the indicator front, daily DMI is in bullish mode and also it broke previous swing high thus indicating bullishness in the counter.One can buy in small tranches around Rs 76-77 and another around Rs 73-74. Target is expected around Rs 88 and stop-loss would be Rs 69.

Samvardhana Motherson International: Buy | LTP: Rs 77 | Stop-Loss: Rs 69 | Target: Rs 88 | Return: 14 percentSince the last 3 months, the said counter has been making higher highs and higher lows structure. Recently it broke its previous swing high of Rs 76.30 along with the 6-month-old trendline was broken and currently is sustaining above it thus hinting upside in the counter. Moreover, Hammer candle was seen taking support near 100 DEMA which is looking lucrative.On the indicator front, daily DMI is in bullish mode and also it broke previous swing high thus indicating bullishness in the counter.One can buy in small tranches around Rs 76-77 and another around Rs 73-74. Target is expected around Rs 88 and stop-loss would be Rs 69. Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.