U.S. equities could face a sharper-than-expected selloff in 2023 from a recession shock that pushes stocks down another 22% from the current levels, according to Morgan Stanley’s Michael Wilson.

The chief equity strategist, who correctly predicted the 2022 stock-market selloff, which saw all three major indexes cement their worst annual losses since 2008, suggested on Monday that the S&P 500 SPX, +0.62% could find a bottom around 3,000 points by the end of 2023. The index was trading around 3,919 at last check, according to FactSet.

Market consensus currently suggests the U.S. economy will experience a mild recession starting in the first half of 2023, followed by a recovery in the second half as the Federal Reserve is expected to stop its rate hikes and possibly cut rates in response to the worsening economic conditions.

However, Morgan Stanley’s strategists led by Wilson said that the Equity Risk Premium (ERP) for stocks, or excess returns investors could receive for holding stocks over risk-free assets, remains “way too low given the high earnings risk,” while corporate earnings forecasts for 2023 are “materially too high.”

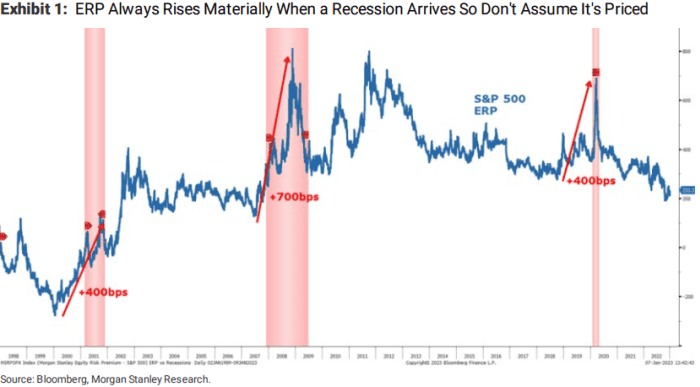

“When a recession arrives, the ERP always rises significantly from whatever level you are starting at. In other words, if you think a mild recession is coming, you cannot assume the market has priced it given the ERP is at its lowest level since the run up to the Great Financial Crisis in 2008,” strategists said (see chart below).

SOURCE: BLOOMBERG, MORGAN STANLEY RESEARCH

Morgan Stanley’s 2023 base case forecast for S&P 500 earnings per share (EPS) of $ 195, while their bear case forecast is $ 180. EPS refers to net income divided by the number of shares outstanding, and could indicate how much money a company makes for each share of stock. However, most of the bank’s clients are in the camp that the S&P 500 EPS won’t be as bad as its equity strategists think, with the team pegging the average client estimating a ratio around $ 210 to $ 215.

“Falling demand from higher interest rates and higher prices and payback from the pull-forward during COVID is happening just as supply is catching up to these formerly well-above trend levels of consumption,” Wilson said in the note. “That combination has already caught many companies off guard who are unable to reverse the rising costs fast enough. The result has been disappointing margins relative to expectations, and we don’t think that reset is near completion.”

That is why a 3,500-3,600 S&P 500 range is not consistent with the consensus view for a mild recession, said Wilson and his team. “The consensus might be right directionally, but wrong in terms of magnitude… We think it’s in the magnitude of the move lower led by much weaker earnings and a Fed committed to fighting inflation, making 3,900 an easy sale.”

Wilson, one of Wall Street’s most vocal bears, isn’t alone in his view that stock-market investors may see even worse declines this year on the back of earnings expectations that may be too optimistic.

Michael Kantrowitz at Piper Sandler & Co. said in a CNBC interview last week that he expects the benchmark index to fall to about 3,225 by the end of this yea, or about a 16% slump from current levels.

See: History shows odds favor a 20% stock-market return in 2023 after a brutal 2022, Fundstrat says

U.S. stock indexes traded higher on Monday to extend Friday’s rally after an employment report shows wage gains cooled in December, fueling hopes that the Fed’s interest rate hikes are starting to have the desired effect on the economy. The Dow Jones Industrial Average DJIA, +0.09% advanced 26 points, or 0.1%, to 33,651. The S&P 500 rose 0.6%, while the Nasdaq Composite COMP, +1.57% gained 1.4%.