In the truncated week beginning today, the index may march towards its last week’s high of 18,178, followed by 18,350 (the high of 2022). If the index manages to sustain these levels, then a record high of 18,604 can’t be ruled out with strong support at 18,000-17,900 levels

Sunil Shankar Matkar

November 07, 2022 / 09:16 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] < 0){ // $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); // $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); //} if(resData[stkKey][‘percentchange’] >= 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] < 0){ $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); //$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); $ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); } $ (‘#volumetxt_’+articleId).show(); $ (‘#vlmtxt_’+articleId).show(); $ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]); $ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]); $ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]); $ (‘#rightcol_’+articleId).show(); }else{ $ (‘#volumetxt_’+articleId).hide(); $ (‘#vlmtxt_’+articleId).hide(); $ (‘#stkvol_’+articleId).text(”); $ (‘#td-low_’+articleId).text(”); $ (‘#td-high_’+articleId).text(”); $ (‘#rightcol_’+articleId).hide(); } $ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’); } } } }); } $ (‘.bseliveselectbox’).click(function(){ $ (‘.bselivelist’).show(); }); function bindClicksForDropdown(articleId){ $ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){ stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’)); $ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’); $ (this).find(‘a’).addClass(‘active’); stockWidget(‘N’,stkId,articleId); }); $ (‘#stk-b-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘B’,stkId,articleId); $ (‘.bselivelist’).hide(); }); $ (‘#stk-n-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘N’,stkId,articleId); $ (‘.bselivelist’).hide(); }); } $ (“.bselivelist”).focusout(function(){ $ (“.bselivelist”).hide(); //hide the results }); function bindMenuClicks(articleId){ $ (‘#watchlist-‘+articleId).click(function(){ var stkId = $ (this).attr(‘stkId’); overlayPopupWatchlist(0,2,1,stkId); }); $ (‘#portfolio-‘+articleId).click(function(){ var dispId = $ (this).attr(‘dispId’); pcSavePort(0,1,dispId); }); } $ (‘.mc-modal-close’).on(‘click’,function(){ $ (‘.mc-modal-wrap’).css(‘display’,’none’); $ (‘.mc-modal’).removeClass(‘success’); $ (‘.mc-modal’).removeClass(‘error’); }); function overlayPopupWatchlist(e, t, n,stkId) { $ (‘.srch_bx’).css(‘z-index’,’999′); typparam1 = n; if(readCookie(‘nnmc’)) { var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.length > 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); }); function redirectToTradeOpenDematAccountOnline(){ if (stock_isinid && stock_tradeType) { window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’); } }

Bulls kept the market charged up last week, despite some volatility because of global factors, and pushed Nifty50 firm up above the psychological 18,000 mark with support at 17,900. After recent policy meetings, volatility too cooled down considerably to below 16 levels, giving more headroom to bulls.

The 50-share NSE benchmark gained nearly 2 percent during the week ended November 4 to settle at 18,117 on Friday with all sectors participating in the rally.

The Nifty50 traded firmly above all important exponential moving averages, and maintained higher high higher lows for the third straight week.

If the upbeat momentum sustaining, this week, though a truncated one because of Gurunanak Jayanti on November 8, may see the index may marching towards its last week’s high of 18,178, followed by 18,350 (the high of 2022). If the index manages to sustain these levels then a record high of 18,604 can’t be ruled out, with strong support at 18,000-17,900 levels, experts said.

“The market posted a weekly close above 18,100 last Friday. This is a clear indication of how strong our markets have been of late. Undoubtedly, the bulls continue with their hegemony in the domestic markets and are eying record highs now,” Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One, said.

If there is no aberration globally, the Nifty is good to go towards 18,250 – 18,350 first and then a march towards previous high of 18,600 looks very much on cards in the ongoing calendar year, he feels.

As far as supports are concerned, 18,000 followed by 17,900 should be treated as sacrosanct zone and any intra-week decline would provide opportunities to create fresh longs.

Sameet advised traders to continue with an optimistic approach and now. “With other sectors chipping in, we expect a good broad-based buying in the forthcoming week.”

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the November 4 closing prices:

Expert: Subash Gangadharan, Senior Technical & Derivative Analyst at HDFC Securities

Dalmia Bharat: Buy | LTP: Rs 1,742 | Stop-Loss: Rs 1,575 | Target: Rs 2,000 | Return: 15 percent

Dalmia Bharat has corrected from a high of Rs 2,548 touched in September 2021. The stock recently found support around the Rs 1,212 levels in June 2022. This is close to the previous intermediate highs, indicating the change of polarity principle is at work. The stock has subsequently bounced back and made higher bottoms in the last few months.

This week, the stock broke out of a trading range on the back of huge volumes, which is encouraging. Momentum readings like the 14-week RSI (relative strength index) too have bounced back and are in rising mode now.

With the intermediate technical setup too looking positive, we believe the stock has the potential to move higher in the coming weeks. We recommend buying the stock between Rs 1,720-1,760 levels, with a stop-loss at 1,575 and target at Rs 2,000.

Inox Leisure: Buy | LTP: Rs 527 | Stop-Loss: Rs 507 | Target: Rs 560 | Return: 6 percent

After correcting from a high of Rs 619 in August 2022, Inox Leisure found support around Rs 475 levels in September 2022. These are strong supports as they are just above the 50-week SMA (simple moving average).

Last week, the stock broke out of a narrow trading range on the back of above average volumes, indicating it is set to move higher in the coming weeks.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50 days SMA. Momentum readings like the 14-day RSI too are in rising mode and not overbought, which implies potential for further upsides.

With the intermediate setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 523-529 levels, with a stop-loss of Rs 507 and target of Rs 560.

Muthoot Finance: Buy | LTP: Rs 1,076 | Stop-Loss: Rs 1,036 | Target: Rs 1,140 | Return: 6 percent

Muthoot Finance has bounced back from a low of Rs 950 touched in September 2022 where it made a double bottom. The stock has since then been climbing higher and making higher bottoms in the process. Last week, the stock also broke out of its recent trading range, indicating it is set to move higher in the coming weeks.

Technical indicators are giving positive signals as the stock is trading above the 20 and 50 days SMA. Momentum readings like the 14-week RSI too are in rising mode and have given positive divergence signals.

With the intermediate setup too looking attractive, we expect the stock to move up towards its previous intermediate highs in the coming weeks. Buy between Rs 1,074-1,078 levels, with a stop-loss at Rs 1,036 and target at Rs 1,140.

Expert: Jatin Gohil, Technical and Derivative Research Analyst at Reliance Securities

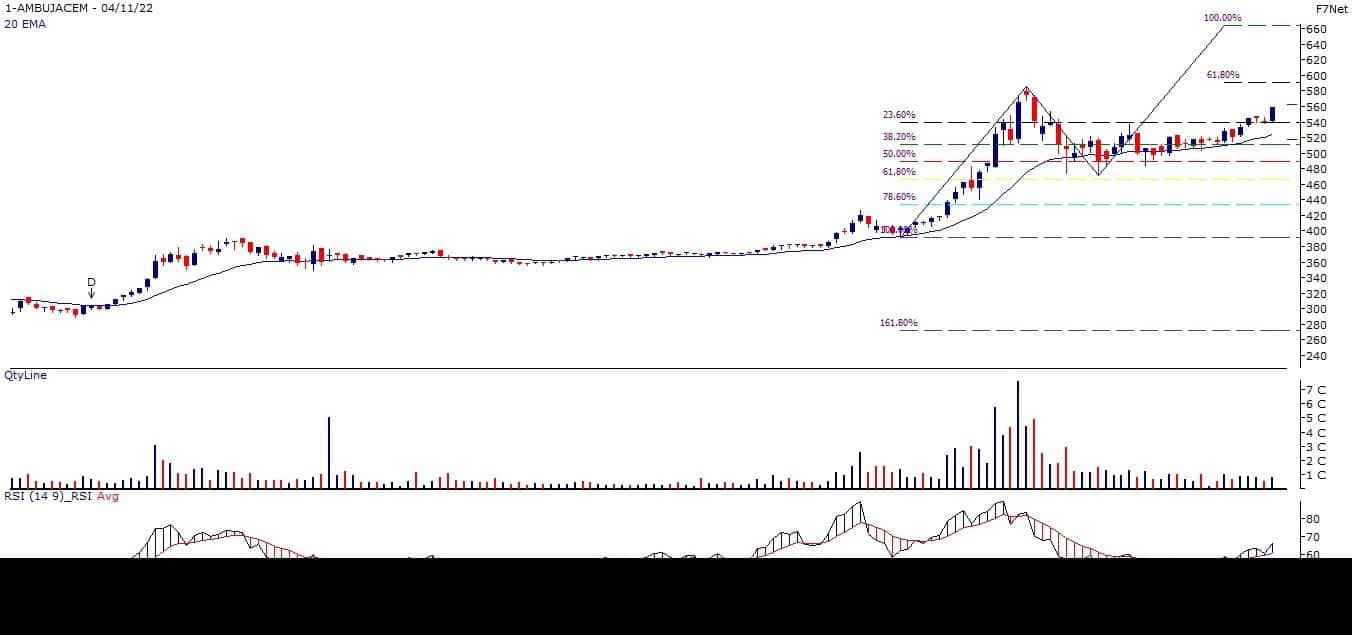

Ambuja Cements: Buy | LTP: Rs 559 | Stop-Loss: Rs 524 | Target: Rs 664 | Return: 19 percent

The stock is in the strong up trend, as it bounced after forming multiple bottoms between its 50 percent and 61.8 percent Fibonacci Retracement levels of prior up-move (Rs 392-586), which was placed at Rs 489 and Rs 466, respectively.

The stock has potential to move towards its 100 percent Fibonacci Extension level of prior up-move. Its daily RSI gave buy signal after consolidating above its neutral line-50.

In case of any decline, the stock will find support at around its upward sloping 20-day EMA (exponential moving average). Since October 17, the stock remained above that exponential moving average and advanced gradually.

Siemens: Buy | LTP: Rs 2,973 | Stop-Loss: Rs 2,760 | Target: Rs 3,320 | Return: 12 percent

On November 4, the stock breached its prior daily falling trend and rose to one-month high. Since October 19, the stock is positively poised above its key moving averages and moved higher thereafter.

We believe undergoing positive momentum will continue and the stock will explore uncharted territory. On the higher side, the stock may face hurdle around its life-time-high of Rs 3,139 before an exponential rise.

However, a stable move above that high level will accelerate undergoing positive momentum. This could lead the stock towards its prior high connecting rising trendline.

On the lower side, the stock will find support at around its intermediate upward sloping trendline.

Bajaj Finserv: Buy | LTP: Rs 1,801 | Stop-Loss: Rs 1,724 | Target: Rs 1,932 | Return: 7 percent

After a higher level of reversal, the stock oscillated around its 50-day EMA and witnessed a range breakout subsequently. In the past, the stock respected that exponential moving average and continued its prevailing trend.

As per the current set-up, history may repeat itself, which could take the stock towards its life-time-high of Rs 1,932. Substantial rise in volume and increase in future open interest signals that major market participants are in favour of the bulls.

Its daily RSI is positively poised after a trendline breakout. In case of any decline, as per the change in polarity principle, the stock will find support around its upper band of the range.

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

UPL: Buy | LTP: Rs 739 | Stop-Loss: Rs 710 | Target: Rs 790 | Return: 7 percent

The stock is forming a symmetrical triangle on the weekly and daily charts. It is a difficult task for the trader to predict which side of the stock will break the trading range.

However, during the formation process, we can define specific resistance and support areas for stocks based on the boundaries of the formation. Based on it, we are expecting the stock to move towards Rs 770-790 levels in the near term.

It is a buy at current levels and on further dips with a final stop-loss at Rs 710.

Bharat Dynamics: Buy | LTP: Rs 980 | Stop-Loss: Rs 950 | Target: Rs 1,080 | Return: 10 percent

The stock is trading above the resistance of the ascending triangle, which is positive for the stock to maintain momentum. Also, it formed a Doji on Friday despite the markets being strong. These types of structures act as a continuum formation.

Above Rs 990 level, we are expecting the stock to move toward Rs 1,050-1,080 level in the near term. Buy at current levels and place stop-loss at Rs 950.

Expert: Ruchit Jain, Lead Research at 5paisa.com

Sun TV Network: Buy | LTP: Rs 553 | Stop-Loss: Rs 536 | Target: Rs 585 | Return: 6 percent

The stock has recently formed a ‘Higher Top Higher Bottom’ structure and has given a breakout from its resistance on the weekly charts. The price upmove has been supported by good volumes while the RSI oscillator is hinting at a positive momentum.

Traders can buy the stock around current market price of Rs 553 for potential short term target around Rs 585. The stop-loss on short positions should be placed below Rs 536.

Tata Steel: Buy | LTP: Rs 105 | Stop-Loss: Rs 100 | Target: Rs 114 | Return: 9 percent

The metal stocks were buzzing last week as we witnessed buying interest in some of the counters with good volumes. This stock has seen a breakout from a consolidation phase and has given a breakout from a falling trendline resistance.

The volumes have increased along with the upmove in prices which is a positive sign. The price volumes breakout hints at probability of an uptrend and hence, we advise traders to look for buying opportunities in the stock.

Traders can buy the stock around current market price of Rs 105 for potential short term target around Rs 114. The stop-loss on positions should be placed below Rs 100.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.