Some last-hour buying helped the Nifty close higher on November 4 in a volatile session, with the ending 65 points higher at 18,117.

It formed a bullish candlestick on the daily as well as weekly charts as the closing was higher than the opening levels, indicating that the momentum is still with the bulls.

If the index sustains 17,900-18,000 then the high of 2022 (18,350) can be reclaimed in the coming sessions, experts said.

“A bullish candle on weekly charts and uptrend continuation formation on daily charts is indicating the continuation of an uptrend in the near future,” Amol Athawale, Deputy Vice President – Technical Research at Kotak Securities said.

As long as the index trades above the 10-day simple moving average (SMA) of 17,900, the uptrend is likely to continue and can take it to 18,300-18,500, he said.

If the index closes below the 10-day SMA, it can slide to 17,800-17,700, the market expert said.

Also read: Pain period likely over, cement makers gear up to deliver stronger in second half

India VIX, an indicator of volatility expected over the next 30 days, was down by 1.8 percent at 15.66 levels.

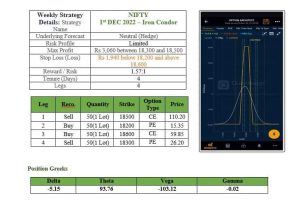

On the options front, the maximum Call open interest was seen at 18,500 strike followed by 19,000 strike, with Call writing at 18,400 strike then 18,500 strike.

The maximum Put open interest was seen at 17,000 strike followed by 17,500 strike with Put writing at 18,000 strike then 17,800 strike.

The data indicates that for the coming sessions, the broader trading range for the Nifty will be 17,600-18,600.

Banking index

The Bank Nifty opened moderately higher at 41,315, but witnessed some profit booking and failed to hold above 41,500. It picked up momentum in the last hour of the session to close 40 points down at 41,258.

Also read: Three IPOs open next week to raise around Rs 4,280 crore as market stays buoyant

The banking index formed a small-bodied bearish candle or a high wave pattern on the daily frame with longer wicks on both sides indicating swings during the day.

“Now it has to hold above 41,250 level to make an up move towards 41,650 and 41,840 levels, whereas supports are placed at 41,000 and 40,750 levels,” Shivangi Sarda, Senior Executive – Analyst at Motilal Oswal Financial Services said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.