The Nifty closed the week gone by at 17837, with a gain of around 1.55 percent and gyrated between 17,642 and 17,887. On the OI (Open Interest) front, short covering built-up was witnessed in Nifty over the week gone by as there was an increase in OI.

On the other hand, Bank Nifty gained about 0.91 percent and closed the week around 41160. Its future gyrated between 41,636 to 41,015, in the last week. Overall, Bank Nifty ended the week with gain of about 371 points.

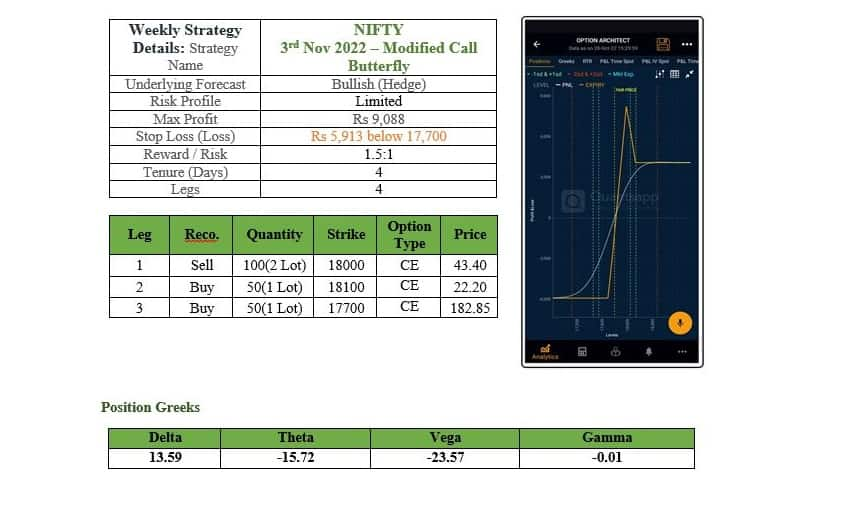

Further diving into the Nifty upcoming weekly expiry, Nifty immediate resistance stands at 18,000 levels where nearly 51.88 lakh shares is the open interest followed by vital resistance at 18,200 levels where about 50.66 lakh shares is the open interest. On the lower side immediate support level is at 17,700 where nearly 50.10 lakh shares is the PE options open interest followed by 17,600 where nearly 43.20 lakh shares is the PE options open interest.

Looking at the Bank Nifty upcoming Weekly expiry data. On the upside, Bank Nifty immediate and vital resistance is at 41500 where nearly 28.1 lakh shares is the CE open interest, whereas, on the lower side immediate and vital support is at 41,000 where 18.30 lakh shares is the PE open interest.

India VIX, fear gauge, decreased to 15.90 from 17.28 over the week. India VIX is trading at low levels. Decrease in India VIX has allayed the fear in the market. Further, any downtick in the volatility index can push the upward move in Nifty further and vice versa.

Looking at the sentimental indicator, Nifty OI PCR for the week has increased to 1.115 from 1.032. Bank Nifty OIPCR over the week decreased to 0.69 from 1.152 compared to last Friday. Overall data indicates PE writers are more aggressive than CE writers in the Nifty.

Moving further to the weekly contribution of sectors to the Nifty. Private Bank and auto contributed the most on positive side in the Nifty i.e., by 88.31 and 52.22 points respectively. Oil & Gas and Information Technology contributed about 23.05 and 22.95 points respectively on positive side in the Nifty.

PSU Bank and Power contributed positively by about 12.68 and 18.58 points, respectively. FMCG and NBFC contributed 24.60 and 25.86 points respectively on negative side in Nifty.

The Nifty monthly rollover stands 74.66 percent in October to November series expiry, while Bank Nifty rollover stands at 74.45%.

Oberoi Realty has the highest stock wise rollover of 99.12 percent, followed by Honeywell Automation and Page Industries with rollover standing at 98.82 percent and 98.64 percent, respectively, while NMDC has the lowest rollover of 40.19 percent, followed by Alkem and Aarti Industries with rollover standing at 68.77 percent and 71.58 percent, respectively.

Looking towards the top gainer & loser stocks of the week in the F&O segment. MCX topped by gaining over 15.2 percent, followed by BHEL rising 13 percent, IGL 10.70 percent, Maruti Suzuki 9.9 percent, Whereas NMDC lost -22.3 percent, Laurus Lab has lost over -8.7 percent, Page Industries -7.4 percent, over the week.

The upcoming week can be approached with a low-risk strategy like Modified Call Butterfly in Nifty.