Even if Federal Reserve Chairman Jerome Powell and his cohorts stopped hiking policy rates soon, the 30-year fixed mortgage rate still would climb to 10%, according to Christopher Whalen, chairman of Whalen Global Advisors.

That’s because the Fed’s torrid pace of rate increases in 2022 takes time to seep back into mortgage rates, especially with the fed-funds rate already jumping to a 3%-3.25% range in late September, from almost zero a year before.

“Lenders only slowly adjust their rates,” Whalen told MarketWatch. “They are not used to seeing rates moving this fast, and typically would change rates only once a month or once every other month.”

Borrowers pay a premium above risk-free Treasury rates on mortgages to help account for default risks. The 30-year Treasury rate TMUBMUSD30Y, 4.223% rose to 4.213% Thursday, its highest since 2011, according to Dow Jones Market Data.

Freddie Mac on Thursday said the 30-year mortgage rate was averaging 6.94% in its latest weekly survey, a 20-year high that has severely curtailed demand for new home loans.

But with U.S. inflation showing no signs of a clear pullback from a 40-year high, expectations have been running high for the Fed to increase its policy rate by another 75 basis points at its November meeting, and potentially by the same amount again in December, according to the CME FedWatch tool.

The CME odds on Thursday favored a 4.75%-5% fed-funds rate to kick off February.

“There is a lag effect in mortgages,” Whalen said, adding that even if central bankers decided to hit pause on additional rate increases after their December meeting, the 30-year mortgage rate still would “easily touch 10% by February.”

Whalen, an investment banker, author and specialist focused on banking and mortgage finance, urged the U.S. Securities and Exchange Commission in 2008 to move complex and opaque derivatives “back into the daylight,” after banks and investors saw hundreds of billions of dollars in losses tied to structured debt, including subprime mortgage exposure. He also provided testimony to Congress in 2009 about systemic risks of the banking industry.

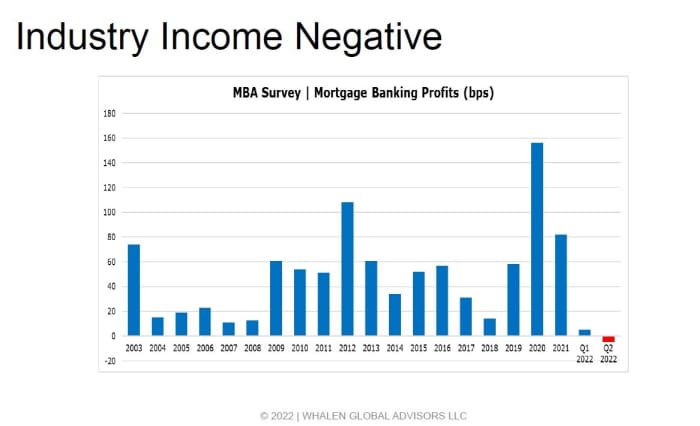

Now, Whalen sees another major shakeout coming in mortgage banking as profitability continues to get pinched (see chart) and the housing market sputters.

Mortgage banking profits are in the red, even as rates continue to rise

Whalen Global Advisors

Importantly, Whalen also sees potential for home prices to give back all of their pandemic gains if rates stay high for all of 2023.

That’s a bigger call than estimates for a 10%-15% correction in home prices from prices that surged 45% nationally during the pandemic.

But Whalen pointed to speculative home flipping volumes that reached almost $ 150 billion, or 10% of total home sales in 2022, and the cold blanket of double-digit mortgage rates as catalysts for a steeper home price retreat.

Economists at Mizuho Securities on Thursday pegged median home sales prices as down 2.5% from their peak, in a client note, and characterized the housing market as “deteriorating,” but mostly in line with expectations given the sharp jump in mortgage rates.

Mortgage loan rates can be traced directly to the mortgage-backed securities, or MBS, market, which are bonds that trade on Wall Street, mostly with government backing, that finance the bulk of the near $ 13 trillion U.S. mortgage debt market.

With the Fed’s race to raise rates, it has jolted financial markets, sunk stocks and led to a stark decline in mortgage bond issuance this year, while also making it more expensive for corporations, municipalities and households to borrow as part of its inflation fight.

“It will take us months to get the bond market and lending market in sync so people can make money again,” Whalen said.

Stocks closed lower for a second straight day on Thursday, leaving the S&P 500 index SPX, -0.80% off 23% on the year at 3,665.78, and the 10-year Treasury rate TMUBMUSD10Y, 4.232% at 4.225%, its highest since June 2018.