Prices of crude oil shot up after OPEC+ (Organization of Petroleum Exporting Countries and allies) announced on October 5 to further tighten global crude supply by slashing oil production.

The intergovernmental organization cut oil supplies by nearly 2 million barrels per day to support weakening oil prices that were trading near eight-month lows until last month.

The new production cap levels are said to come into force from November 2022 and will remain in place until December 2023.

But why should you know this?

If OPEC+ cuts oil supplies vigorously, it would lead to a rise in oil prices and subsequently lead to inflation peaking further.

Analysts say that such output cuts would squeeze supplies in an already tight market and further hamper economic growth globally.

Also read: In Pics | OPEC+ cuts oil production; here are possible economic, geopolitical impacts

In reaction, U.S. President Joe Biden also expressed disappointment over OPEC+’s decision last week and said the U.S. was looking at all possible alternatives to keep prices from rising. Some of those options include releasing more oil from the Strategic Petroleum Reserve or exploring a curb on energy exports by U.S. companies.

Why did oil prices fall in the first place?

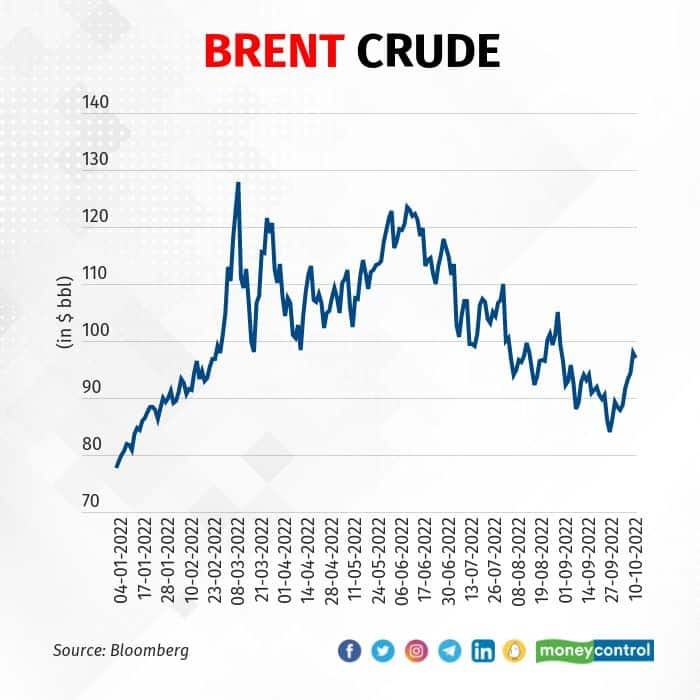

Last month, oil prices had fallen sharply because concerns related to recession across major global economies dampened investor sentiment.

Fears related to an impending global recession pushed crude oil prices to their lowest in eight months and pushed international benchmark Brent as low as $ 84 a barrel on September 26 for the first time since January.

Moreover, China’s COVID-19 restrictions weighed on demand for crude, raising concerns about a potential global economic slowdown.

Also read: Oil takes a breather, eases off 5-week highs

But wait, when and why did crude prices actually peak?

Crude oil prices had peaked at their highest level since 2008 at $ 140 a barrel during the onset of the Russia-Ukraine war in March. Market participants remained concerned over a possible ban on Russian oil imports due to sanctions over the war in Ukraine, which stoked fears about higher inflation, slowed economic growth, and a higher current account deficit for India.

How does higher current account deficit (CAD) & steep movements in oil prices affect India?

India is the world’s third-largest importer of crude oil and a rise in oil prices increases India’s import bill, which leads to a further rise in the country’s CAD. This eventually leads to the weakening of the Indian currency as importers rush to lock in dollar purchases when they foresee crude prices rising.

Let’s divide the effect of rise in oil prices on India into two parts:

DIRECT IMPACT:

A steep rise in crude oil prices leads to a sharp increase in fuel and gas prices, which directly dictate domestic pricing. This leads consumers to shell out more Indian rupees from their pockets.

A fall in oil prices helps India cut down on its import bill as well as strengthen its local currency. A price fall will also help fuel retailers to limit losses that they incurred on selling petrol and diesel as they kept retail prices unchanged earlier despite a steep rise in the crude oil price.

Meanwhile, last month, Minister of Petroleum and Natural Gas Hardeep Singh Puri said that state-owned fuel retailers like Indian Oil Corporation, Bharat Petroleum Corporation, and Hindustan Petroleum Corporation are unlikely to cut retail prices of petrol and diesel despite a sharp correction in crude oil prices.

When questioned whether the retail price of fuel will be lowered given a fall in crude prices during September, Puri explained that oil companies needed more time to recover their losses. He described the state-owned oil marketing companies as “good corporate citizens” for not increasing fuel prices further.

Also read: Moneycontrol Pro Panorama | The pot boils for oil, will India feel the heat?

INDIRECT IMPACT:

Given that India’s largest chunk of imports constitutes oil, a surge in oil prices ultimately leads to ‘imported inflation in the country. A surge in oil prices also leads the rupee to depreciate against the dollar as import bills continue to be high for refiners.

Currently, the November contract of Brent crude on the Intercontinental Exchange trades near $ 92 per barrel, against last month’s low of nearly $ 84 a barrel.

What next, now?

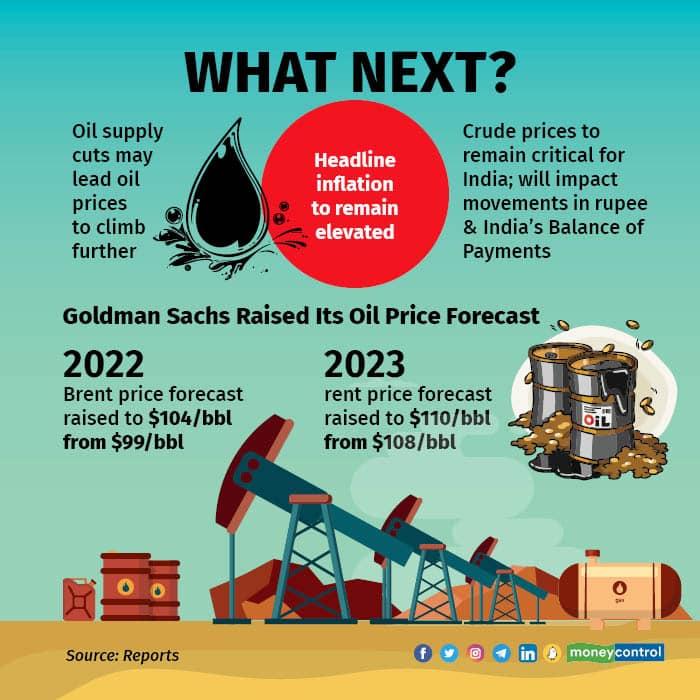

Analysts believe that the decision by OPEC+ to cut oil output will likely lead oil prices to climb further. As a result, headline inflation will not go down anytime soon because the major contributor to the rising headline inflation are the high oil prices.

Rahul Singh, investment chief of equities at Tata Mutual Fund, had told CNBC TV18 that crude prices remain critical for India as they directly affect the country’s macro parameters. Singh also said that crude and commodity prices are likely to impact the rupee and, in turn, the country’s Balance of Payments (BoP).

“The probability of things going into a tailspin on the rupee or on the BoP is basically going to be a function of commodity prices, and more specifically crude prices because we are a net consumer of crude and various other commodities,” he had said.

Separately, Goldman Sachs has raised its oil price forecast for this year and 2023 as the bank expects OPEC+’s output cut to be “very bullish” for prices going forward. It raised its 2022 Brent price forecast to $ 104 per barrel from $ 99 per barrel and 2023 forecast to $ 110 per barrel from $ 108 per barrel.

Now, will a sudden surge in oil prices lead to a direct rise in petrol & fuel prices at home? Stay tuned to this space to know more!