ONGC has seen a decent correction from the highs in last couple of months as the crude Oil prices have cooled off from their highs. However, the prices are now showing signs of some pullback move as it has given a breakout from a trendline resistance.

Sunil Shankar Matkar

October 10, 2022 / 11:25 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] < 0){ // $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); // $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); //} if(resData[stkKey][‘percentchange’] >= 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] < 0){ $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); //$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); $ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); } $ (‘#volumetxt_’+articleId).show(); $ (‘#vlmtxt_’+articleId).show(); $ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]); $ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]); $ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]); $ (‘#rightcol_’+articleId).show(); }else{ $ (‘#volumetxt_’+articleId).hide(); $ (‘#vlmtxt_’+articleId).hide(); $ (‘#stkvol_’+articleId).text(”); $ (‘#td-low_’+articleId).text(”); $ (‘#td-high_’+articleId).text(”); $ (‘#rightcol_’+articleId).hide(); } $ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’); } } } }); } $ (‘.bseliveselectbox’).click(function(){ $ (‘.bselivelist’).show(); }); function bindClicksForDropdown(articleId){ $ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){ stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’)); $ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’); $ (this).find(‘a’).addClass(‘active’); stockWidget(‘N’,stkId,articleId); }); $ (‘#stk-b-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘B’,stkId,articleId); $ (‘.bselivelist’).hide(); }); $ (‘#stk-n-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘N’,stkId,articleId); $ (‘.bselivelist’).hide(); }); } $ (“.bselivelist”).focusout(function(){ $ (“.bselivelist”).hide(); //hide the results }); function bindMenuClicks(articleId){ $ (‘#watchlist-‘+articleId).click(function(){ var stkId = $ (this).attr(‘stkId’); overlayPopupWatchlist(0,2,1,stkId); }); $ (‘#portfolio-‘+articleId).click(function(){ var dispId = $ (this).attr(‘dispId’); pcSavePort(0,1,dispId); }); } $ (‘.mc-modal-close’).on(‘click’,function(){ $ (‘.mc-modal-wrap’).css(‘display’,’none’); $ (‘.mc-modal’).removeClass(‘success’); $ (‘.mc-modal’).removeClass(‘error’); }); function overlayPopupWatchlist(e, t, n,stkId) { $ (‘.srch_bx’).css(‘z-index’,’999′); typparam1 = n; if(readCookie(‘nnmc’)) { var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.length > 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); }); function redirectToTradeOpenDematAccountOnline(){ if (stock_isinid && stock_tradeType) { window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’); } }

The Nifty50 snapped a three-week losing streak and gained more than 1 percent to settle above 17,300 as well as 50 DEMA (days exponential moving average) of 17,275 in the week ended October 7, backed by buying across sectors barring FMCG.

The 50-share NSE benchmark has formed a decent bullish candlestick pattern on the weekly scale following a hammer pattern formation in the previous week, confirming the bullish bias. Now the index needs to hold on to 17,200, the immediate support level, as above the same level, 17,400 is expected to be immediate hurdle followed by 17,500, experts said. The crucial support remains at psychological 17,000 mark.

The index settled the last week with more than 200 points losses at 17,315, while there was outperformance in broader space as the Nifty Midcap 100 and Smallcap 100 indices gained 2.4 percent and 2.6 percent respectively.

“Since Nifty has managed to surpass 17,200 and is maintaining its position above this, 17,200 – 17,000 now becomes a sacrosanct zone for the market. Additionally, we can now observe yet another technical indicator i.e. positive crossover in daily ‘RSI-Smoothened’ is likely to provide a helping hand for bulls,” Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One said.

He further said, “If the global market supports, we being the stronger market is likely to continue in the upward direction.”

As far as levels are concerned, 17,400 – 17,500 – 17,650 are to be seen as immediate hurdles for the Nifty50.

Sameet Chavan advises traders to remain sanguine and better to keep focusing on stock-specific moves.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the October 7 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

Phoenix Mills: Buy | LTP: Rs 1,451.65 | Stop-Loss: Rs 1,350 | Target: Rs 1,600 | Return: 10 percent

It has been consolidating between the rectangle trading range of Rs 1,450 and Rs 1,300 for the past two months. However, the volume indicator was only supporting the formation when it was about to break above the upside barrier of the range.

On Friday, the stock closed above the level of Rs 1,450. It is a bullish break-out formation for the stock and will help the stock to rally towards Rs 1,600 in the near term.

Buying is advisable at current levels and on declines up to Rs 1,400. One can place a stop-loss at Rs 1,350 for the same.

Poonawalla Fincorp: Buy | LTP: Rs 330.10 | Stop-Loss: Rs 315 | Target: Rs 370 | Return: 12 percent

Since the stock has fallen to Rs 280 levels, it is slowly moving upwards. On Friday, the stock managed to close above the level of Rs 330, where it has a major resistance.

However, looking at the OBV (on-balance volume), we think it will cross Rs 330 and Rs 345 levels without any major effort.

It is in buy mode and would cross all major hurdles in the medium term. The strategy should be to buy between Rs 330 and Rs 320. Place a stop-loss at Rs 314 for a target of Rs 370.

Zomato: Buy | LTP: Rs 69.55 | Stop-loss: Rs 64 | Target: Rs 90 | Return: 29 percent

The stock made a remarkable comeback from the low of Rs 42. The positive divergence worked and supported the stock to move higher. On Friday, it crossed another level of resistance at Rs 69, which would send the stock to Rs 90 levels with a major hurdle at Rs 80.

Major oscillators are supporting the overall bullish formation of the stock. We are expecting a further upside in the stock from the current levels. It is a buy between Rs 70 and Rs 67. Place a stop-loss at Rs 64 for a target of Rs 90.

Expert: Ruchit Jain, Lead Research at 5paisa.com

Jubilant Ingrevia: Buy | LTP: Rs 545.85 | Stop-Loss:Rs 512 | Target: Rs 578-600 | Return: 6-10 percent

The stock has consolidated within a narrow range in last few weeks. In the last few days, the stock witnessed buying interest as the volumes increased gradually and prices have now given a breakout from the falling trendline resistance.

The ‘RSI Smoothed’ oscillator is hinting at a positive momentum and hence, we expect the stock to continue its upmove in the near term.

Traders can buy the stock around current market price of Rs 545 and look to add on dips around Rs 525 for potential short term targets of Rs 578 and Rs 600.

The stop loss on short positions should be placed below Rs 512.

ONGC: Buy | LTP: Rs 134 | Stop-Loss: Rs 124 | Target: Rs 150 | Return: 12 percent

The stock has seen a decent correction from the highs in last couple of months as the crude Oil prices have cooled off from their highs. However, the prices are now showing signs of some pullback move as it has given a breakout from a trendline resistance.

The RSI oscillator has also given a positive crossover indicating a buying momentum.

Hence, traders can buy the stock in the range of Rs 134-132 for potential short term target of Rs 150. The stop-loss on positions should be placed below Rs 124.

Expert: Jatin Gohil, Technical and Derivatives Research Analyst at Reliance Securities

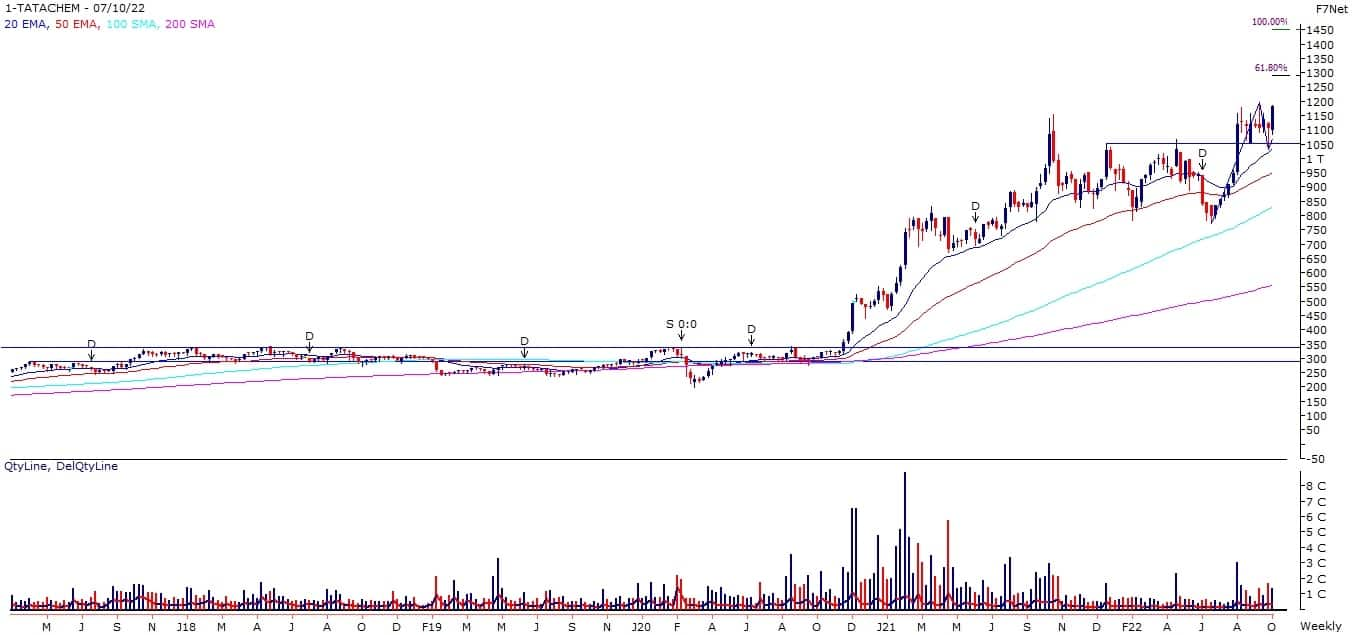

Tata Chemicals: Buy | LTP: Rs 1,181.80 | Stop Loss: Rs 1,032 | Target: Rs 1,450 | Return: 23 percent

The stock bounced back after testing its prior point of polarity (placed at around Rs 1,050) and poised for a fresh up-move. The stock has potential to explore uncharted territory, which could lead it towards its 61.8 percent and 100 percent Fibonacci extension levels of prior up-move (Rs 773-1,194), which are placed at Rs 1,290 and Rs 1,450, respectively.

Its key moving averages are sloping upwards on long-term as well as medium-term timeframe charts and the key technical indicators are also positively poised.

In case of any decline, the stock will continue to find support around its prior point of polarity. A stable move below that point will invalidate desired action in the stock.

Tata Communications: Buy | LTP: Rs 1,217.90 | Stop-Loss: Rs 1,096 | Target: Rs 1,520 | Return: 25 percent

The stock rose to four-and-half-month high of Rs 1,284 post a trendline breakout. After a higher level of reversal, the stock formed a base around its prior point of polarity (placed at around Rs 1,125) and bounced subsequently.

This could take the stock towards its highest level of April 2022 (Rs 1,401) initially and medium-term multiple tops (Rs 1,520) subsequently.

The stock is positively poised on the key moving averages on the short-term timeframe chart and its key technical indicators are also in favour of the bulls. On the lower side, the stock will continue to find support around its prior point of polarity. A convincing move below that point will negate possible up-move in the stock.

Shree Cements: Buy | LTP: Rs 21,284 | Stop-Loss: Rs 20,500 | Target: Rs 24,200 | Return: 14 percent

After a higher level of reversal, the stock formed a base around its 61.8 percent Fibonacci Retracement level of up-move (Rs 17,865-25,550) and poised for a breakout. This could lead the stock towards Rs 22,900-23,745-24,200 in the short-term.

The key technical indicators gave buy signal post bullish divergence.

At current juncture, the stock is providing better risk reward for desired action. In case of any decline, the stock will continue to find support around its 61.8 percent Fibonacci retracement level of prior up-move.

A stable move below that level will invalidate probable rise in the stock.

Expert: Nagaraj Shetti, Technical Research Analyst at HDFC Securities

Jubilant Ingrevia: Buy | LTP: Rs 545.85 | Stop-Loss: Rs 505 | Target: Rs 585-625 | Return: 7-14 percent

The attached weekly timeframe chart of Jubilant Ingrevia indicates a sustainable upmove in last week, after a gradual upside with rangebound action. The stock price is currently in an attempt of upside breakout of the crucial resistance of down sloping trend line at Rs 535-540 levels.

Hence, a sustainable move above the said resistance could open a sharp upside momentum for the stock price ahead. The positive chart pattern like higher tops and bottoms is intact as per weekly timeframe chart.

Volume and daily RSI shows positive indications. The overall chart pattern of Jubilant Ingrevia indicates long trading opportunity. One may look to create positional long as per the levels mentioned below.

Buying can be initiated in Jubilant Ingrevia at last traded price, add more on dips down to Rs 522, wait for the upside targets of Rs 585-625 in the next 3-5 weeks. Place a stop-loss of Rs 505.

Selan Exploration Technology: Buy | LTP: Rs 311.45 | Stop-Loss: Rs 290 | Target: Rs 332-360 | Return: 6-15 percent

The attached weekly timeframe chart of this oil exploration stock (Selan Exploration Technology) indicates a sharp uptrend over the last few sessions. The stock price has witnessed a decisive upmove over the last one month, as it moved as per larger positive sequence of higher tops and bottoms on the daily chart.

The recent downward correction seems to have reversed up sharply from near the bottom of Rs 257 levels later part of September. Having formed a new higher bottom, there is a possibility of further upmove in the stock price ahead.

Volume has started to expand during upmove in the stock price and daily 14 period RSI shows positive indication. The overall chart pattern of Selan indicates long trading opportunity. One may look to create positional buy as per the levels mentioned below.

Buy Selan at last traded price, add more on dips down to Rs 300 and wait for the upside targets of Rs 332-360 in the next 3-4 weeks. Place a stop-loss of Rs 290.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.