Nifty closes the week on a negative note around 17,107 with a loss of around 1.32%. During the week, Nifty gyrated between 17,211 and 16,764.

On the OI (Open Interest) front, long unwinding was witnessed in Nifty over the week gone by as there was a decrease in OI.

On the other hand, Bank Nifty lost about 2% as it closed the week around 38,851. Its futures gyrated between 39,319 and 37,524, in the last week.

Overall, Bank Nifty ended the week with a loss of about 791 points and witnessed long unwinding on OI front in the week gone by.

Further diving into the Nifty’s upcoming Weekly expiry, the index’s immediate resistance stands at 17,200 levels where nearly 35.45 lakh shares is the open interest followed by vital resistance at 17,500 levels where 44.95 lakh shares is the open interest.

On the lower side, immediate support level is at 17,000 where nearly 40 lakh shares is the PE options open interest followed by 16,700 where nearly 53 lakh share is the PE options open interest.

Now let’s look at the Bank Nifty’s upcoming weekly expiry data. On the upside, the index’s immediate and vital resistance is at 39,000 where nearly 20 lakh shares is the CE open interest, whereas, on the lower side immediate and vital support is at 38,000 where 17.36 lakh shares is the PE open interest.

India VIX, fear gauge, decreased to 19.98 from 20.59 over the week. India VIX is again trading below 20. Decrease in the IV has allayed fear in market. Further, any downtick in India VIX can push the upward move in Nifty further.

Looking at the sentimental indicator, Nifty OI PCR for the week has increased to 1.22 from 0.756. Bank Nifty OIPCR over the week increased to 1.05 from 0.559 compared to last Friday.

Overall, the data indicates PE writers are more aggressive than CE writers in Nifty.

Moving further to the weekly contribution of sectors to Nifty. Private banking, oil, NBFC, AUTO and FMCG have contributed on the negative side in the Nifty by 198.92, 102.49, 98.84, 57.22 and 43.20 points respectively. IT and PHARMA also contributed about 31.34 and 30.49 points on the positive end. CAP GOODS and INFRA contributed 14.07 and 19.43 points to Nifty on the negative end.

Nifty monthly rollover stands 73.82% in September to October series expiry while Bank Nifty rollover stands at 78.72%. Ramco Cement has the highest stock-wise rollover of 94.7% followed by Honeywell Automation India and Eicher Motors with rollover standing at 93.74% and 93.52% respectively, while IDEA has the lowest rollover of 47.38% followed by HUL and Alkem with rollover standing at 56.26% and 59.03% respectively.

Looking towards the top gainer & loser stocks of the week in the F&O segment. Zydus Life topped by gaining over 8.9%, followed by Abbott India 7.5%, Granules 7.3%, Whereas Aarti Industries has lost over -12.7%, Adani Ports -9.8%, Hero MotoCorp -7.4% over the week.

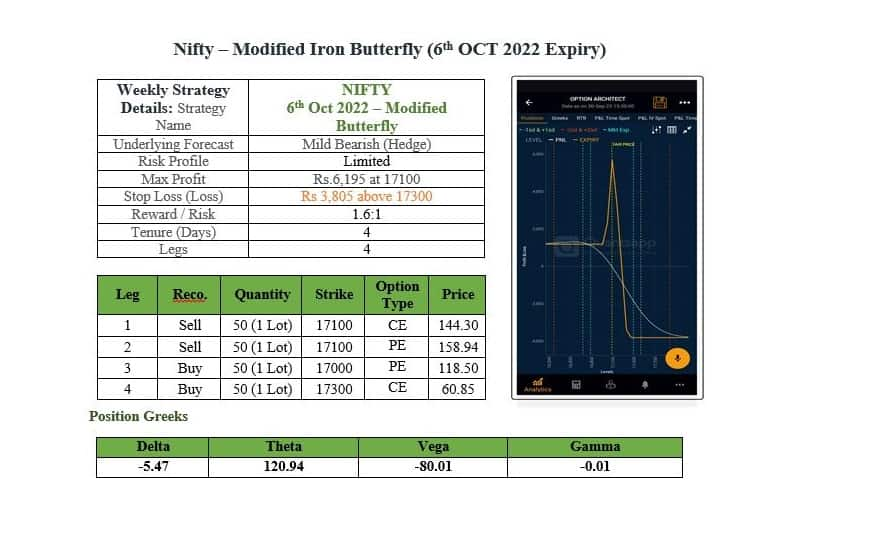

Considering the mild bearish mood, this week can be approached with a low-risk strategy like Modified Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.