Representative image.

Festive fervour is at its peak and fast-moving consumer goods (FMCG) companies are expecting it to spark a revival in consumption, which has been tepid for some time. However, despite the prices of commodities such as palm oil and fuel dipping, these companies, while rolling out promotional offers and discounts, are yet to introduce widespread price cuts.

FMCG companies have instituted price hikes quarter after quarter over the past year on the back of skyrocketing commodity prices. While there has been an expectation that they would lower prices in the wake of input costs ebbing, the FMCG players have taken a cautious stance.

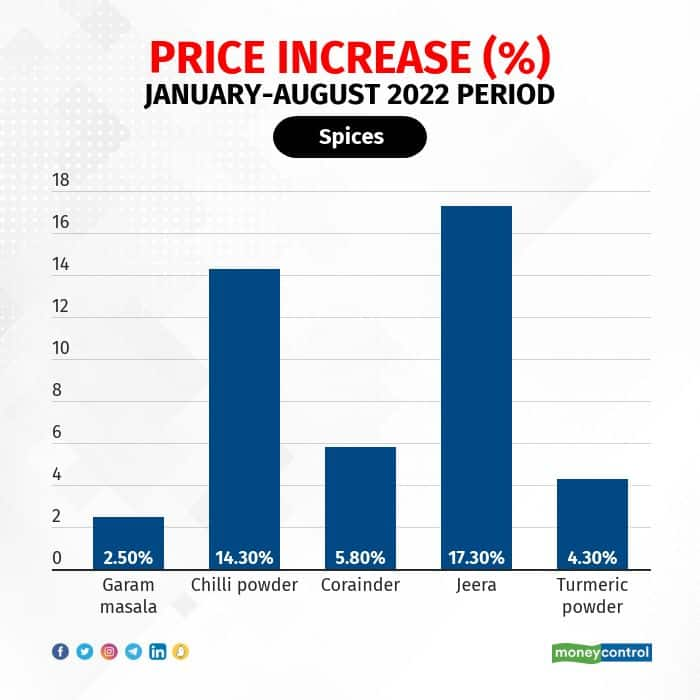

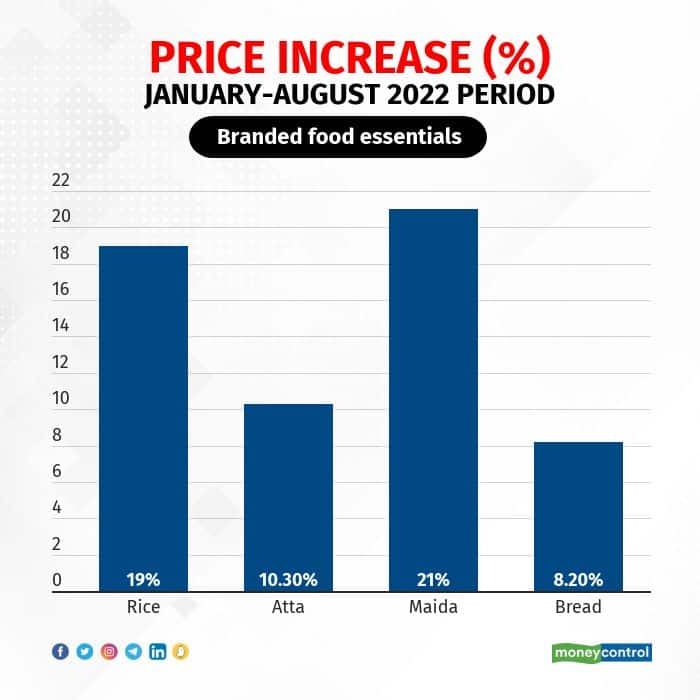

“Across FMCG products, we have seen strong inflation since the start of the year for some spices and branded food items such as rice and wheat products. However, strong price cuts for edible oils, especially palm oil, have helped rein in these prices and increased consumption for the category,” said Akshay D’Souza, chief of growth and insights at Bizom.

Source: Bizom

Source: Bizom

Source: Bizom

Here is an explainer on why companies are reluctant to introduce price cuts and when consumers can expect to see prices of their daily essential products drop.

Grammage increases and other measures

Several FMCG companies, instead of reducing prices of products directly, are increasing grammage or sizes as commodity prices ebb. Godrej Consumer Products, for instance, is reported to have increased the grammage of its soap brands. Similarly, Britannia has increased the grammage of its products.

The strategy is similar to the one the FMCG companies adopted in their inflation battle when they reduced grammage to prevent consumer shocks instead of directly reducing prices.

For instance, Haldiram reduced the weight of its 55-gram Aloo Bhujia packet to 42 grams, while Nestle reduced the weight of its 80-gram Maggi pack to 55 grams. Similarly, Parle Products reduced the weight of its Rs 5 Parle-G biscuit pack to 55 grams from 64 grams.

“Several companies, instead of directly showing an impact on prices, are more likely to increase grammage,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

Commodities yet to decline to old levels

Though the price of palm oil, a key ingredient in products such as soaps and skincare products, has dropped substantially, it is yet to reach the level it was at before the coronavirus pandemic wreaked havoc on the industry and on commodity supplies.

The price of palm oil fell 36.6 percent quarter-on-quarter and 7.8 percent year-on-year in the second quarter of FY23, according to a note by Motilal Oswal, and is back at its January 2021 levels.

The price of crude oil, too, has corrected and is 34 percent below its peak level in March 2022. But both inputs are yet to drop to pre-pandemic levels. The decline, however, has brought some much-needed relief for consumers.

Industry stakeholders say it is a misnomer that commodity prices have fallen as they have simply stabilised and stopped surging.

Most companies claim that they have not passed on the full impact of the commodity price rise to consumers, keeping an eye on the tepid demand scenario.

Dairy major Amul, for instance, does not plan to reduce prices despite a reduction in freight costs. “We have not passed on the full impact of the rise in commodities to the consumer so we are still incurring higher costs than before, even though fuel prices have inched down,” said RS Sodhi, managing director of the Gujarat Cooperative Milk Marketing Federation (GCMMF), which owns the Amul brand.

Dairy brands have raised prices by 8-10 percent over the last eight months due to inflation, said a recent report by ICICI Securities.

Rupee fall

While several commodities have seen prices fall, companies that import raw materials are yet to factor in the benefit of the decline due to the fall in the value of the rupee, which has inflated their import costs.

“A lot of our grains are locally sourced but we import nuts and seeds used in our products and the source of inflation for companies that are importing commodities is also the falling rupee. The falling rupee has pushed our costs further,”? said Prashant Peres, MD, Kellogg South Asia.

Also, some commodities, especially food grains, are still witnessing price volatility and hence companies operating in the segment are cautious about passing on the price benefits obtained from palm oil and fuel declines.

“While the price of edible oil has dropped, the prices of other commodities, such as sugar, wheat and even rice, are yet to stabilise. We are seeing inflation of 15 percent due to these commodities and hence we are in a wait-and-watch mode to decrease prices for consumers,” said Mayak Shah, senior category head, Parle Products.

Parle Products, said Shah, is offering customer relief by way of discounts. The company is offering discounts to the tune of 10-15 percent on large packs but it is yet to take any pricing action on small packs, he added.

Other companies such as ITC are also offering discounts to consumers on food products this festive season instead of price reductions.

Festive anticipation

Another reason for the lack of pricing action by FMCG companies, according to analysts, is the high-cost inventory already sourced by these companies.

“FMCG players source and stock months of inventory in advance and it takes time for a commodity correction to reflect in companies’ consumption cost,” said Manoj Menon, head of research and a consumer analyst at ICICI Securities.

HDFC Securities’ Jasani is of the view that companies might be looking to bank on the rise in consumption during the festive period and hence have not reduced prices. “Demand during the festive season is quite robust, so at this point they want to make the most of it and recover some of the lost margins,” he said.

Margin impact

The companies will continue to feel the stress on their margins given their high inventory, indicated analysts.

“We expect gross margin to remain under pressure in the near term as companies are sitting on inventories purchased at higher costs, which will get consumed in the near term. Margin should start improving from 2HFY23, due to the dual effect of falling input costs and various price hikes taken by companies. If input prices correct further, companies may pass on the benefit to consumers immediately to improve the demand scenario,” Motilal Oswal said in a note.