Representative image

The markets are on an upward swing, but the spread between Nifty earnings and ten-year G Sec yield may be pointing to a fall ahead.

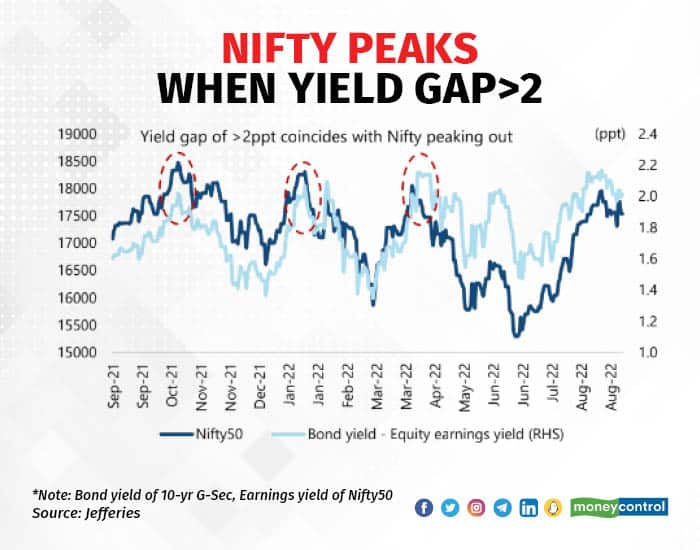

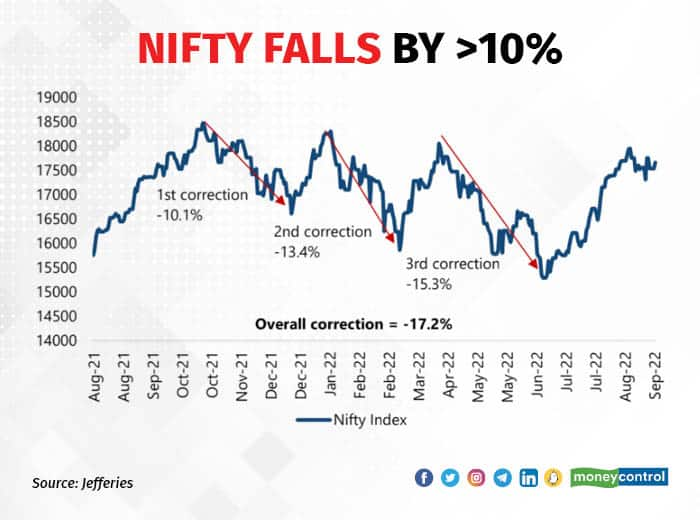

Ten-year G Sec yielded 7.13 percent and Nifty earnings yielded 4.78 percent as of September 12. The spread between the two yields is over two percentage points (2.35 pp), and recent history shows that this extent of difference often leads to Nifty correcting by over 10 percent.

It is what happened in October 2021, January 2022 and April 2022.

The resistance level seems to be always between 18,000 and 18,500, according to a recent report from Jefferies.

Why the correlation?

When bond yields rise, investors may or may not flock to equities. It depends on what is driving the bond yields up.

To elaborate, if the bond yields are going up because of a growing economy and resultant inflation, then investors may still find equities more attractive. This is because they believe that the companies can generate enough earnings to compensate for the risk they are taking in choosing equities.

Also read: If Nifty crosses 18,200, it can touch 19,400 in 5-6 months, says this Wave Trader

If the bond yields are rising because inflation has been persistent and the central banks are raising rates to rein in the price-rise, then investors may prefer the safety of bonds. This is because the investors may become unsure if the company can deliver good earnings in this inflationary environment.

Over the last year, whenever bond yields have gone up, investors have moved away from equities. Therefore, there may be more fear of inflation than confidence in economic growth.

After the Sensex closed above 60,000 on September 12, some market experts advised caution pointing to the sharp rise in bond yields.

“Sensex at 60000 level! Market has been performing well over the last few quarters owing to huge liquidity, upward earnings cycle, economic revival owing to fading Covid-19 effect. However market participants should be wary of the rising inflation and resulting removal of liquidity from the system… Rising inflation risk and hence withdrawal of ultra-easy monetary policy by global central banks (mainly Federal Reserve) may trigger a sharp rise in bond yields which can cause risk assets to correct sharply,” said Pankaj Pandey, head of research at ICICI Direct, in a note released on September 12.

He added, “One can stay invested with a vigilant eye on the move in yields world over which can result in sharp 10-15 percent correction from the current levels.”

Which sectors may outperform?

According to the analysts at Jefferies, “During the last three market corrections, among the larger sectors, autos, industrials and FMCG have outperformed while IT, healthcare and materials have underperformed.”

In the report, they have calculated the relative performance of various sectors between October 2021 and June 2022, the duration in which the three market corrections happened.

Also read: Here’s why the markets are going higher

Autos, industrials and FMCG outperformed by 10.5 percent, 6.7 percent and 3.9 percent, while healthcare, IT and materials underperformed Nifty 50 by 2.7 percent, 6.8 percent and 8.9 percent.

The brokerage that sees a strong chance of a repeat of the market correction “given the clues from the US Fed” has gone Underweight on IT and Overweight on staples. “We believe IT remains at significant risk of sell-off if Nifty were to correct. We move that weight to staples expecting the staples to be defensive in the event of a market correction,” the analysts wrote.

(Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.)