The Nifty opened strong but profit-taking during the day trimmed gains and the index settled 35 points higher at 17,833.

The index formed a Bearish Belt Hold pattern on the daily chart. The pattern is formed when the opening price becomes the highest point of the day and the index declines throughout the session, making the large body. The candle will either have a small or no upper shadow and a small lower shadow.

The next hurdle for the Nifty would be 17,992, the recent swing high, whereas 17,786, the day’s low, would be crucial for the downside. If that gets broken, 17,500 would be the next support, experts said.

On the weekly basis, the index formed a bullish candlestick pattern, as it gained 1.7 percent during the week.

“The price action since August 19 appears to be unfolding like a ‘Flat’ in Elliot wave parlance with 3 moves on the downside and another three in the counter-trend direction.

“If this observation holds true then sooner than later a downswing should unfold, with eventual targets present below 17,166 levels, though confirmations are awaited in this regard,” Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia said.

For the index to gain momentum, it needs a close above 17,992 and then 18,114, for the trend to favour the bulls. Till then, bears can make a come back anytime, he said.

Also read: Taking Stock | Markets end the week on a positive note, IT stocks gains

The volatility index India VIX was down 3.20 percent at 17.71. It needs to cool a bit more for the market to stabilise, experts said.

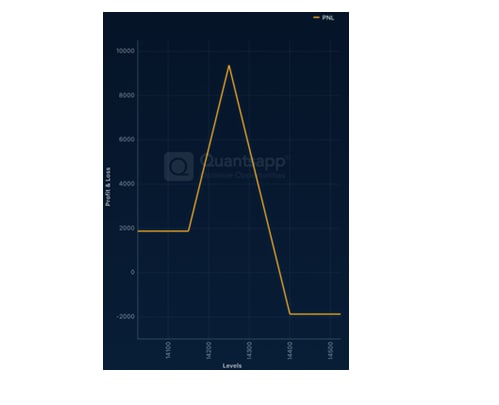

On the options front, the maximum Call open interest was seen at 18,000 strike followed 18,500 strike, while the maximum Put open interest was seen at 17,000 strike then 17,500 strike.

Call writing was seen at 17,900 strike followed by 18,200 strike, while marginal Put writing was seen at 17,800 strike then 17,600 strike.

Options data indicates that in the immediate term, the Nifty can trade in the 17,500-18,000 range.

Banking index

The Bank Nifty opened 300 points higher but consolidated throughout the session. It ended 207 points higher at 40,416, its highest closing in the last 216 sessions.

The index formed a bullish candle on the weekly scale and gave its highest weekly close, up 2.5 percent.

It has to hold above 40,250 to march towards 40,750 and 41,000, whereas supports are placed at 40,000 and 39,750 levels, Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.