The expected diversified supply chains globally, secular uptick in energy and defence spending over the next few years, and significant growth in travel & leisure are the three key areas catalysing global growth in the years ahead, says Anshul Saigal of Kotak Mahindra Asset Management Company in an interview to Moneycontrol.

India’s GDP growth is the highest amongst competing large economies and robust growth is likely to sustain over the next few years. This will attract strong FPI interest toward the country, says portfolio Manager & Head of PMS with over 16 years of experience in the Indian capital markets.

Further, IMF estimate of 6.1 percent GDP growth for CY23 (FY24) is based upon stagnant export market share in the second decade of the millennium and decline in corporate capex. These expectations are likely to be surpassed, says Anshul who is an avid reader with particular interest in behavioural finance and an expert on value investing principles – preserving capital and generating market beating returns.

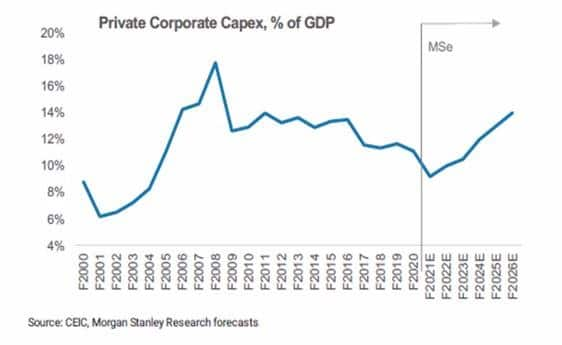

As per RBI data, new sanctions for private capex up 90 percent YoY, but still below pre-Covid level. What are your thoughts and can we expect private capex to hit the high of 2010 in current decade?

Private capex as a % of GDP peaked out in 2008 at 18 percent. Thereafter for the following reasons, private capex witnessed a lost decade and hit a low of 7-8 percent in 2021:

-> Excess capacity creation in the high capex period of 2005-2013

-> Elevated NPAs in the Indian banking system due to systemic excesses

-> Low bank capitalisation in this period hence the propensity to lend toward capacity building being limited

-> Initiation of a number of reform measures ranging from GST, RERA, Demonetisation , etc. leading to a temporary adverse impact on demand.

However, much of the excesses and adverse factors have been addressed. Systemic NPAs which peaked at 12 percent in 2008, are below 6 percent now. Credit growth as a result has accelerated to 15 percent for the first time in over 5 years. The government is incentivising exports and disincentivising imports.

The PLI (production-linked incentive) scheme of the government is an important step in that direction. Incentives given in the PLI scheme and in favour of exports will provide tailwinds to capacity creation. A globally competitive tax structure and labour reforms will add further strength to this trend.

Finally, aggregate capacity utilisation in the system has crossed 75 percent, which is an important trigger for new capacity addition. These factors combined with a lift-off in demand indicate a strong private capex cycle in the coming years. We could well hit the previous highs, in the coming decade.

After reading Q1FY23 GDP, do you see downside risks increasing for your economic growth forecast for FY23? Also will the RBI revise its full year growth forecast from 7.2 percent currently?

The recent GDP growth number of over 13 percent (on a low base) was robust, however it was below the market’s expectation. While this may lead to a tweak in RBI’s estimates, the markets would be more concerned about the trajectory of growth over the next 3-5 years than the number being a few decimal points higher or lower.

India’s GDP growth is the highest amongst competing large economies and robust growth is likely to sustain over the next few years. This will attract strong FPI interest toward the country. Further, IMF estimate of 6.1 percent GDP growth for CY23 (FY24) is based upon stagnant export market share in the second decade of the millennium and decline in corporate capex. In our judgement, these expectations are likely to be surpassed.

What are the two key risk factors that we need to keep an eye on, though India is the fastest growing economy in the world?

India is an island of Politico-Economic stability in a sea of floundering sovereign policies. At a time that the world was loosening its purse strings and giving out doles to citizens, India chose the path of distributing stored grains for sustenance of the population. There were many other fiscally conservative policies, which assisted in keeping India’s fiscal in check.

Hence, in a time of extreme risk (Covid period), India’s economy came away much less impacted than many other countries. As a result risks to the India story are far less from internal factors and largely emanate from global issues.

Two key risks we foresee are as follows:

-> A prospective credit event, triggered by a blow up in the Chinese property sector due to systemic excesses and their no-Covid policy. This could freeze the global capital markets, which in turn could impact the Indian economy

->A supply shock in the crude markets due to geopolitical issues, could take prices higher. Crude being the largest component of India’s import bill, would adversely impact the trade balance

What are the factors that will drive global growth going forward?

We see three key areas catalysing global growth in the years ahead:

The period of 2000-2020 was marked by systemic globalisation and a secular shift of supply chains toward low cost destinations (mainly China). Given recent rifts in geopolitics, we anticipate this phase may be over. Henceforth, duplicate capacities will be created for strategic reasons and cost-indifferent insourcing would take hold over lower-cost outsourcing. China + 1 as a strategy would gain prominence in the years ahead. Supply chains will be diversified and to service this requirement capacity building would take shape. This trend would be a key contributor to global investment growth.

The under-investment in energy security over the last 10 years has led to significant systemic imbalances. These imbalances are coming to the fore now, with geopolitical differences. ESG (environmental, social, governance) trends led to this underinvestment. ESG also adversely impacted investments in sovereign Defence. With energy & power prices shooting through the roof, Governments are waking up to the need for investments in energy. Further, the Russia-Ukraine war has put sovereign Defence in the limelight. We anticipate these factors would trigger a secular uptick in Energy and Defence spending over the next few years. Job & growth opportunities would be created in these sectors as a result.

The forced lockdowns during Covid period shifted household spends in favour of goods and away from experiences (travel, tourism, cinema, etc). We expect the balance to be tipped in favour of experiences over the coming years and hence travel and leisure could see a significant uptick. This has the makings of a multi-year cycle and a strong catalyst to global growth.

What is the reason behind lesser volatility in Indian equity markets compared to large emerging markets (EMs)?

Two key reasons for lower volatility in Indian equity markets are as follows:

Domestic investors have become a dominant pillar of the Indian markets. FPIs sold $ 33 billion equities in the 9 months ended June 2022 and DIIs bought almost all of this stake. Markets fell approximately 17 percent from top to bottom in this period. This was in stark contrast to the Global Financial crises period of 2008 when FPIs sold approximately $ 10 billion and markets corrected 55 percent. The difference was DIIs standing as a pillar of strength to support the Indian markets.

Margin rules in the country are far tighter now than any time in the past, as also versus any of the other major competing economies. Low leverage in the system prevented volatility in the recent bout of FPI selling

Do you see great buying opportunities in IT space that has been a big laggard this year?

IT space has seen a significant re-rating over the last 2 years. Despite the recent correction, IT stocks are trading at a premium to their 10 years average valuations.

Some of that may be justified due to the strong earnings momentum, but these stocks would also need to consolidate to justify such expansion in valuations. We expect this year to be a year of such consolidation.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.