Technically, since its listing, PB Fintech remained in a gradual decline, however, in the last few months the pace of the fall flatten, which is resulting in a positive divergence. It is an indication of the change in the prevailing trend.

Sunil Shankar Matkar

August 16, 2022 / 08:01 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] < 0){ // $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); // $ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); //} if(resData[stkKey][‘percentchange’] >= 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] < 0){ $ (‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”); //$ (‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); $ (‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”); } $ (‘#volumetxt_’+articleId).show(); $ (‘#vlmtxt_’+articleId).show(); $ (‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]); $ (‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]); $ (‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]); $ (‘#rightcol_’+articleId).show(); }else{ $ (‘#volumetxt_’+articleId).hide(); $ (‘#vlmtxt_’+articleId).hide(); $ (‘#stkvol_’+articleId).text(”); $ (‘#td-low_’+articleId).text(”); $ (‘#td-high_’+articleId).text(”); $ (‘#rightcol_’+articleId).hide(); } $ (‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’); } } } }); } $ (‘.bseliveselectbox’).click(function(){ $ (‘.bselivelist’).show(); }); function bindClicksForDropdown(articleId){ $ (‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){ stkId = jQuery.trim($ (this).find(‘a’).attr(‘stkid’)); $ (‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’); $ (this).find(‘a’).addClass(‘active’); stockWidget(‘N’,stkId,articleId); }); $ (‘#stk-b-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘B’,stkId,articleId); $ (‘.bselivelist’).hide(); }); $ (‘#stk-n-‘+articleId).click(function(){ stkId = jQuery.trim($ (this).attr(‘stkId’)); stockWidget(‘N’,stkId,articleId); $ (‘.bselivelist’).hide(); }); } $ (“.bselivelist”).focusout(function(){ $ (“.bselivelist”).hide(); //hide the results }); function bindMenuClicks(articleId){ $ (‘#watchlist-‘+articleId).click(function(){ var stkId = $ (this).attr(‘stkId’); overlayPopupWatchlist(0,2,1,stkId); }); $ (‘#portfolio-‘+articleId).click(function(){ var dispId = $ (this).attr(‘dispId’); pcSavePort(0,1,dispId); }); } $ (‘.mc-modal-close’).on(‘click’,function(){ $ (‘.mc-modal-wrap’).css(‘display’,’none’); $ (‘.mc-modal’).removeClass(‘success’); $ (‘.mc-modal’).removeClass(‘error’); }); function overlayPopupWatchlist(e, t, n,stkId) { $ (‘.srch_bx’).css(‘z-index’,’999′); typparam1 = n; if(readCookie(‘nnmc’)) { var lastRsrs =new Array(); lastRsrs[e]= stkId; if(lastRsrs.length > 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); }); function redirectToTradeOpenDematAccountOnline(){ if (stock_isinid && stock_tradeType) { window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=$ {stock_isinid}&ex=$ {stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’); } }

The market extended its northward journey for the fourth consecutive week ended August 12 and closed at fresh four-month high, driven by positive global cues with falling US inflation as well as India’s CPI inflation along with consistent FIIs buying.

The Nifty50 strongly respected its near-term support at 17,500 level, and rose 1.7 percent to settle the week at 17,698, the highest closing level since April 8.

With the recovery of more than 16 percent from June lows, the index is at crucial resistance area of 17,700-17,900, which fall within the long down sloping resistance line adjoining October 19, 2021 and January 18, 2022, as well as around previous swing high levels. The index may make a move towards these levels but then there could be a possibility of profit-booking with support at 17,500, experts said.

The broader markets also participated in an uptrend with the Nifty Midcap 100 and Smallcap 100 indices climbing 1.8 percent and 1 percent during the week.

“The falling trendline resistance of the previous swing highs is around 17,700-17,800 and we have ended right around the resistance end. In case the market surpasses this hurdle, then the 78.6 percent retracement of the previous correction is around 17,875. So, this entire 200-point range of 17,700-17,900 is a crucial hurdle for the index and the momentum readings are overbought,” Ruchit Jain, Lead Research at 5paisa, said.

He thinks that it is quite possible that markets would see a corrective phase again anytime soon. Traders should wait for a confirmation of any reversal before taking any contra trades, the expert advised.

The immediate support for the Nifty is placed around 17,630 and 17,500 and a close below the mentioned supports would be a sign of reversal.

Until then, Ruchit advised traders to adopt a stock-specific approach and lower the capital allocation in trading as the risk reward is getting unfavourable for fresh investments. Also, traders are advised to book timely profits and take some money off the table in the resistance zone.

Let’s take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the August 12 closing prices:

Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

InterGlobe Aviation: Buy | LTP: Rs 2,014.15 | Stop-Loss: Rs 1,900 | Target: Rs 2,250 | Return: 12 percent

The stock has formed a double bottom between Rs 1,550 and Rs 1,600 levels in March and July 2022. Technically, the stock has proven to form a double bottom by crossing the level of Rs 2,050.

Technically it is heading towards Rs 2,500 level in the next few months. The strategy for medium-term positional traders requires dip buying between Rs 2,000-1,950, with a stop-loss at Rs 1,900. Resistance will be Rs 2,150 and Rs 2,250.

PB Fintech: Buy | LTP: Rs 573.15 | Stop-Loss: Rs 520 | Target: Rs 690 | Return: 20 percent

Technically, since its listing the stock remained in a gradual decline, however, in the last few months the pace of the fall flatten, which is resulting in a positive divergence. It is an indication of the change in the prevailing trend.

It could bounce back to the equilibrium level of the last 8 months, which is around Rs 690. It’s a buy at current levels of Rs 580 and a balance buy at Rs 550 with a short-term to medium-term view. One can place a stop-loss at Rs 520.

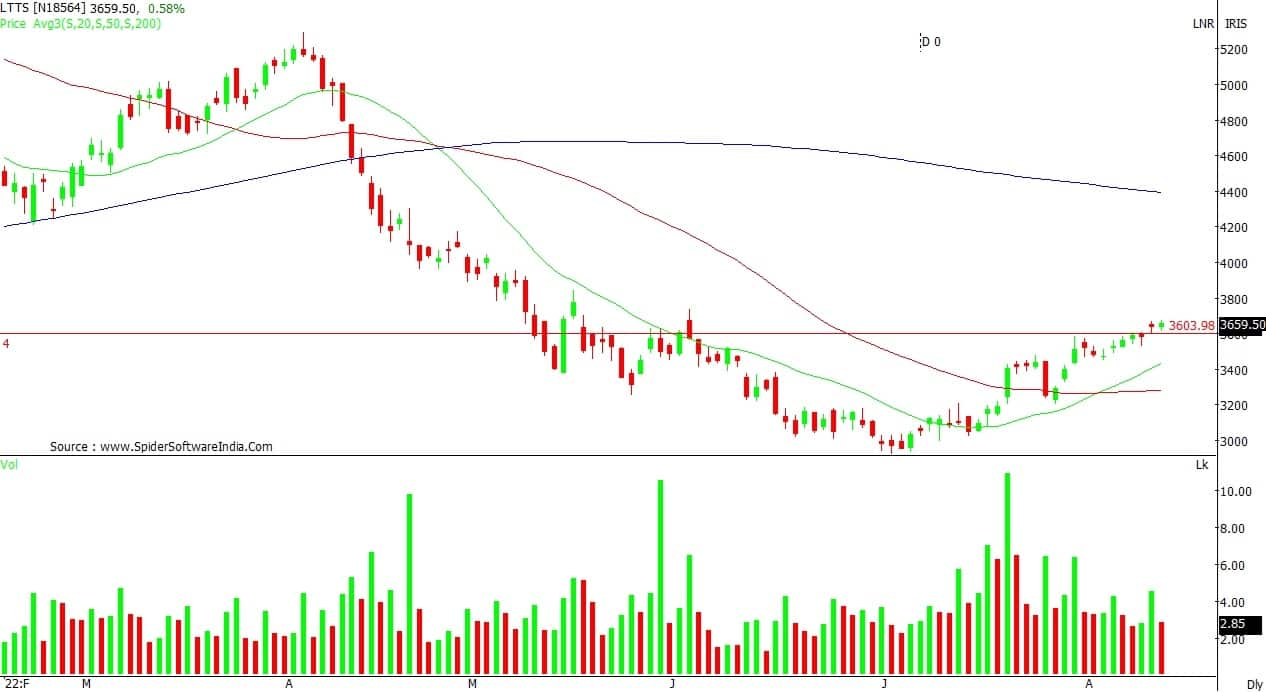

L&T Technology Services: Buy | LTP: Rs 3,659.5 | Stop-Loss: Rs 3,590 | Target: Rs 3,820 | Return: 4.4 percent

Technically, the price is crossing all-important levels. On a daily basis, it has broken a crucial level, which was at Rs 3,620. It is forming a series of rising tops and rising bottoms, and volumes are rising at the top of the rally, which is an indication of further activity in the near term.

The strategy should be to buy at current levels at Rs 3,660 and further on dips to Rs 3,620. The stop-loss for position traders should be at Rs 3,590. On the upside, the stock would find resistance at Rs 3,750 and Rs 3,820.

Nandish Shah, Senior Derivative & Technical Analyst, HDFC Securities

Mahindra Holidays and Resorts India: Buy | LTP: Rs 262 | Stop-Loss: Rs 240 | Target: Rs 285-310 | Return: 18 percent

The stock price has broken out from the downward sloping trendline, adjoining the highs of April 19, 2022 and July 22. Primary trend of stock is positive as it is trading above its 50, 100 and 200 days moving averages.

Plus DI is trading above minus DI while ADX (average directional index) line is placed above 25, indicating momentum in the current uptrend.

Momentum Oscillators like RSI (relative strength index) and MFI (money flow index) are in rising mode and placed above 60, indicating strength in the current uptrend. One can buy the stock in the range of Rs 262-250.

Union Bank of India: Buy | LTP: Rs 40 | Stop-Loss: Rs 37 | Target: Rs 43-45 | Return: 13 percent

The stock price has broken out from the downward sloping trendline on the daily chart. Short term trend of the stock is positive as it is trading above its 5 and 20 days EMA (exponential moving average). Momentum Oscillators – RSI (11) is placed above 60 and sloping upwards, indicating strength in the current uptrend of the stock.

PSU banks as a sector are looking strong on the chart. One can buy the stock in the range of Rs 40-38.5.

Jatin Gohil – Technical and Derivative Research Analyst at Reliance Securities

Zydus Lifesciences: Buy | LTP: Rs 386.85 | Stop-Loss: Rs 340 | Target: Rs 487 | Return: 26 percent

On week ended August 12, 2022, the stock managed to cross its 200-week SMA (simple moving average) after multi-week consolidation and rose to fresh 5-month high of Rs 389. Steady rise in volume and future open interest signals that major market participants are in favour of the bulls.

The key technical indicators witnessed bullish crossover on the long-term timeframe chart, while medium-term indicators are positively poised. The stock has potential to move towards its 100-week SMA (Rs 464) initially and the highest level of December 2021 (Rs 487) subsequently.

In case of any decline, the stock will find support around its recent higher low formation, which is placed at Rs 340.

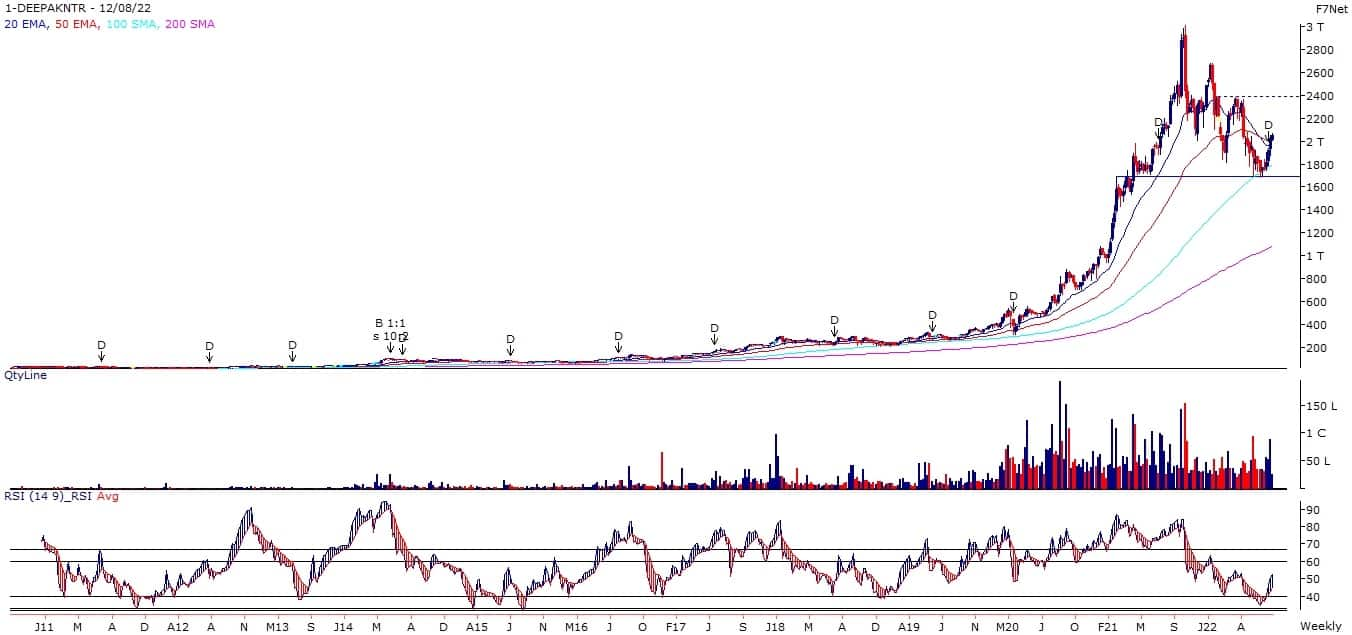

Deepak Nitrite: Buy | LTP: Rs 2,053.8 | Stop-Loss: Rs 1,792 | Target: Rs 2,390 | Return: 16 percent

After a higher level of reversal, the stock found support around its point of polarity, which was placed at around Rs 1,700. Later, the stock formed a base around that point and moved above its key moving averages (20-week and 50-week EMAs).

Its weekly RSI again reversed from its bull market support zone (40-33) and gave a buy signal. In the past, the stock witnessed a substantial rebound after an identical reversal in the RSI. We believe history repeats itself, which will support a healthy bounce in the stock.

We continue to believe that a stable move above its key moving averages will accelerate undergoing positive momentum, which could take the stock towards Rs 2,390, where its prior swing high is placed. Fresh long position can be initiated at current juncture and on dips towards Rs 2,000 for a desired action.

On the lower side, the stock will find support around its 100-week SMA (placed at Rs 1,792).

Strides Pharma Science: Buy | LTP: Rs 349.25 | Stop-Loss: Rs 284 | Target: Rs 430 | Return: 23 percent

After a higher level of reversal (i.e. 74 percent fall from its prior peak level of Rs 999), the stock formed a base around its long-term demand zone (placed between Rs 265 and Rs 290) and poised for a rebound.

On week ended June 24, 2022, the stock had formed a bullish pattern around that demand zone managed to hold gain with the help of a consolidation.

The key technical indicators are positively poised signals that the stock is on a verge of a turnaround. The stock has potential to move towards Rs 390-405-430 in the short-term. In case of any decline, the stock will respect its long-term demand zone.

Osho Krishan, Senior Analyst – Technical & Derivative Research at Angel One

Aditya Birla Fashion and Retail: Buy | LTP: Rs 289.90 | Stop-Loss: Rs 275.80 | Target: Rs 315 | Return: 9 percent

ABFRL has been in a secular uptrend post the swing low of Rs 221 odd levels and is currently hovering well above all its major exponential moving averages on the daily chart.

The stock has gained traction in terms of volume from the past couple of trading sessions and has recently seen a breakout from the stiff resistance zone of Rs 280.

Also, on the technical front, the primary indicators are in the bullish trajectory, favouring the continuation of the uptrend. Hence, we recommend buying the stock for a trading target of Rs 315. The stop-loss to be placed at Rs 275.80.

United Breweries: Buy | LTP: Rs 1,644.30 | Stop-Loss: Rs 1,570 | Target: Rs 1,720 | Return: 4.6 percent

UBL has seen a strong reversal from the recent breakout zone and is currently hovering well above all its major exponential moving averages on the daily chart. Meantime, the stock has reversed from the lower band of the Bollinger and is settled above the mean.

Even on the technical front, the 14-period RSI (relative strength index) has been placed in the comfort zone post the positive crossover, which suggests the momentum to continue in the near term. Hence, we recommend buying the stock for a trading target of Rs 1,720. The stop-loss to be placed at Rs 1,570.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.