An environment of rising interest rates has made the Nasdaq Composite COMP, -2.75% hard to love the past year, but its 22% drop seems to be opening opportunities for some.

Tesla shares TSLA, -0.89% are climbing in premarket after UBS lifted the EV maker to buy, citing opportunity via a 31% share drop this year.

That brings us to our call of the day, from Chul Chang, a manager on Vontobel’s U.S. Equity Institutional Fund VTUIX, -2.07%. He says investors have so busy chasing companies that can handle unexpected macro worries, they’ve overlooked gems with “mission critical products” that are well-armored for economic downturns.

“We’re looking for durable franchises that we think…can outgrow their competition, outgrow the market and get into positions where they will be stronger and bigger on the other side of any macro weakness,” Chang told MarketWatch in an interview on Wednesday.

His fund holds staples such as Coca-Cola KO, -1.73%, and top holding Microsoft MSFT, -2.08%.

As for those diamonds in the dust, the manager highlights Synopsys SNPS, -1.80%, a maker of software tools for electronic design automation. Investors get defensive posturing, a business with predictive nature and good growth, said Chang.

“The reason why we know through a downside, through an upcycle, that [Synopsys] is going to be durable is that they have high recurring revenues that chip engineers need mission critical to do their jobs,” he said. “So it’s not a tool that you decide you’re going to cut off because you think in the next 12 months recession is near or rates are going higher.”

Back in even 2008 and 2009 when the chip industry actually shrank, Synopsys saw flat revenue and delivered earnings, he said. Shares are down 12% this year.

He also likes ServiceNow NOW, -2.61%, down 22% so far this year. The software company and its cloud computing platform is the “main player” used by corporates to systemize their workflow.

“It’s early innings when we talk about digital transformation, so there’s a lot of growth ahead just from share gains in that one category,” he said. ServiceNow has expanded into operations, employee management and customer service management.

“So again, going back to the theme of being defensive during weaker times, this is a company we think that continues to grow not only from the secular trends that they’re seeing, but just given the subscription model and the defensiveness of their profile,” he said.

Chang’s last pick is Keysight Technologies KEYS, -0.70%, a leading measurement company that has the “broadest offerings of equipment for measuring electric signals or radio signals,” with growth also supported by sector trends. Keysight has dropped 29% this year.

“In this case, 5G, but also what 5G is going to be doing for the Internet of Things, or AI or EVs,” he said, noting that Keysight’s tools are used to test EV infrastructure, batteries, inverters, so there is a lot of “increasing usage that’s only getting started.”

Keysight also sell manufacturing tools, which are being used by customers as they develop newer cars, products or smartphones. So those clients see Keysight tools as “mission critical” and “won’t be cheap about it,” making it a company “that can deliver, we think double-digit earnings growth over the longer term,” he said.

The chart

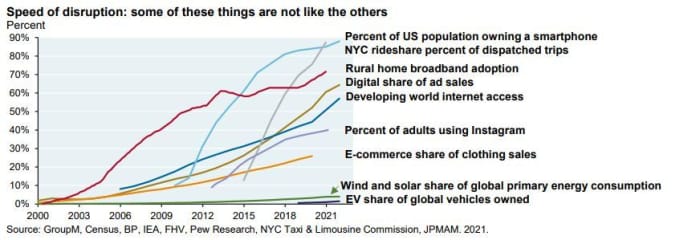

Our chart of the day is from Michael Cembalest, chairman of market and investment strategy at JP Morgan Asset Management, laying out trends in energy transition. He includes a chart that shows how disruption over the past 20 years has gone slower in some areas of the economy than others. For example, everyone seems to have a smartphone, but far fewer people than you think own an electric car.

Also check out: The EV trend has just barely begun, as this JPMorgan chart of global disruptive trends tells us

Random reads

American tourists fined after throwing a scooter down the steps of a UNESCO World Heritage site in Rome, causing $ 26,000 in damages.

Late-night talk show host Jimmy Kimmel tells President Biden he “needs to start yelling at people.”

Tik Tok trend blends sparkling water and balsamic vinegar for the summer’s hottest, healthiest new Coke.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.