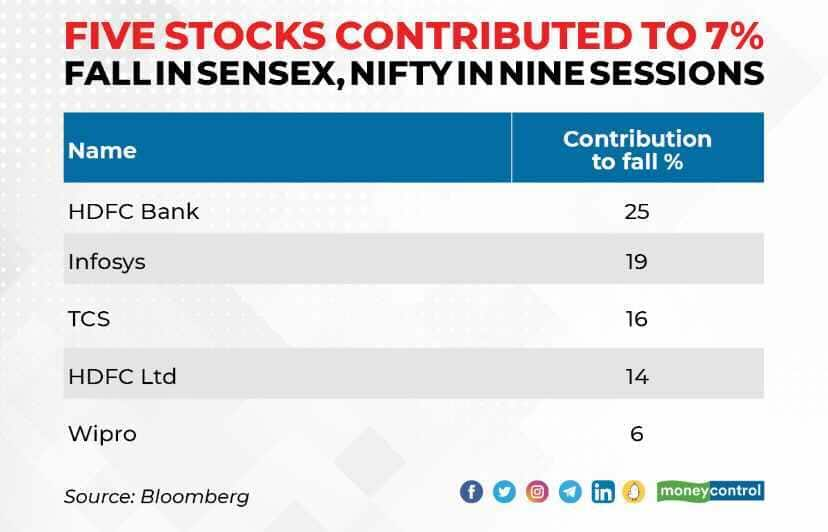

HDFC Bank, HDFC, Infosys, TCS and Wipro accounted for 80 percent of the drop in the nine trading days from April 5 to April 19

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

India’s benchmark Sensex and Nifty 50 lost about 4,150 points and 1,100 points, respectively, in the nine trading sessions that started April 5.

Five stocks– HDFC Bank, Housing Development Finance Corporation, Infosys, Tata Consultancy Services and Wipro—contributed about 80 percent to the fall.

HDFC Bank, which plans to merge with HDFC, contributed about 25 percent to the drop. Infosys and TCS contributed 19 percent and 16 percent, respectively, while HDFC’s share was 14 percent and Wipro’s 6 percent.

The shares of all five companies lost a combined Rs 5.6 lakh crore in market capitalisation during the period from April 5 to April 19.

The stocks were doing better on April 20, with both the Sensex and the Nifty climbing a 0.74 percent each.

At 2 pm, HDFC bank was trading at Rs 1,350 on BSE, up 0.56 percent and HDFC had gained 1.3 percent to Rs 2,166. Infosys was up 1.6 percent at Rs 1,587, while TCS rose 2.5 percent to Rs 3,559. Wipro gained a percent to Rs 535.

The big fall

Stocks started falling after renewed tensions between Ukraine and Russia and expectations of aggressive tightening by the US Federal Reserve. Continuous selling of Indian equity by foreign investors, the Reserve Bank of India’s policy tightening after surging inflation, and weaker earnings from Infosys and HDFC Bank also worried investors.

Both HDFC and HDFC Bank surged about 10 percent each on April 4 after they announced their merger plan. However, all the gains were erased on concerns over slowing growth and declining margins.

HDFC Bank shares fell to Rs 1,343.30 on April 19 from Rs 1,656.45 on April 4. The HDFC stock declined to Rs 2,138.65 from Rs 2,678.90 during this period.

Analysts said loan growth is likely to be slower and a lot more dependent on economic conditions after their merger. The ability to deliver superior loan growth would be challenging, the analysts said.

Infosys fell as analysts cut its margin estimates after it reported weaker margins due to fewer days, lower utilisation, and higher visa costs in the quarter ended March.

TCS also reported lower-than-expected 4Q earnings. TCS margins stood at 25 percent– little changed on-quarter and 189 basis points lower on-year due to price increases amid high attrition.

Investors also worried about the high attrition rates, wage inflation, lower utilisation, and companies cutting IT spending due to geopolitical and macroeconomic issues.

The BSE Sensex fell to 57,381.77 on April 19 from 59,764.13 on April 4.

“The dominant near-term feature of this market is the massive FII selling. In a context devoid of positive news, this massive delivery-based selling, particularly in blue chips, is dragging the market down,” said VK Vijayakumar, chief investment strategist at Geojit Financial Services. “An important point to note is that yesterday (April 19) the market collapse happened in the last hour. This indicates ETF selling. There is a clear see-saw battle between the pessimistic FIIs and the optimistic DIIs. Who will ultimately win this battle only time can tell.”

Foreign institutional investors have been net sellers of Indian equity since October. They have sold Rs 23,021.52 crore of shares so far in April.

“Meanwhile, retail investors can bottom-fish in this market where indiscriminate ETF selling has dragged down high quality stocks with good earnings visibility. There is good value emerging in telecom and select financials. If IT, which is weak now, corrects further, there will be opportunities for cherry-picking. Calibrated buying can begin now,” Vijayakumar added.

Download your money calendar for 2022-23 here and keep your dates with your moneybox, investments, taxes