PhonePe App (PC- Twitter/@PhonePe_)

Visit a mid-sized store in an Indian city, and you’d wonder if it exists to make any money. It might just as well be there to process transactions for half-a-dozen payment apps: PhonePe, Paytm, Google Pay, BharatPe, Amazon Pay, and MobiKwik.

Add up the merchants who have downloaded the digital services and the figure quickly reaches 80 million.

A third of India’s 60 million-plus small businesses are using an average of four different platforms, according to Raman Khanduja, the chief executive officer of Mintoak, a Mumbai-based fintech.

“The neighbourhood shopkeepers’ bandwidth is getting sucked into accepting money,” he says. “When do they run their business?”

There are several juggling acts going on here, apart from the millions of small businesspeople reconciling their accounts across the many services that have sprung up as an alternative to cash and plastic. The payment apps don’t make any money out of this activity because they all run on a shared public utility. What they get is data they can analyse to predict the creditworthiness of the small shops. It’s the banks that ultimately issue loans to these ‘thin-file’ customers but fintech controls the flow of information — and gets remunerated by the lenders for finding creditworthy merchants. But why have the banks let fintech get between them and all these potential clients?

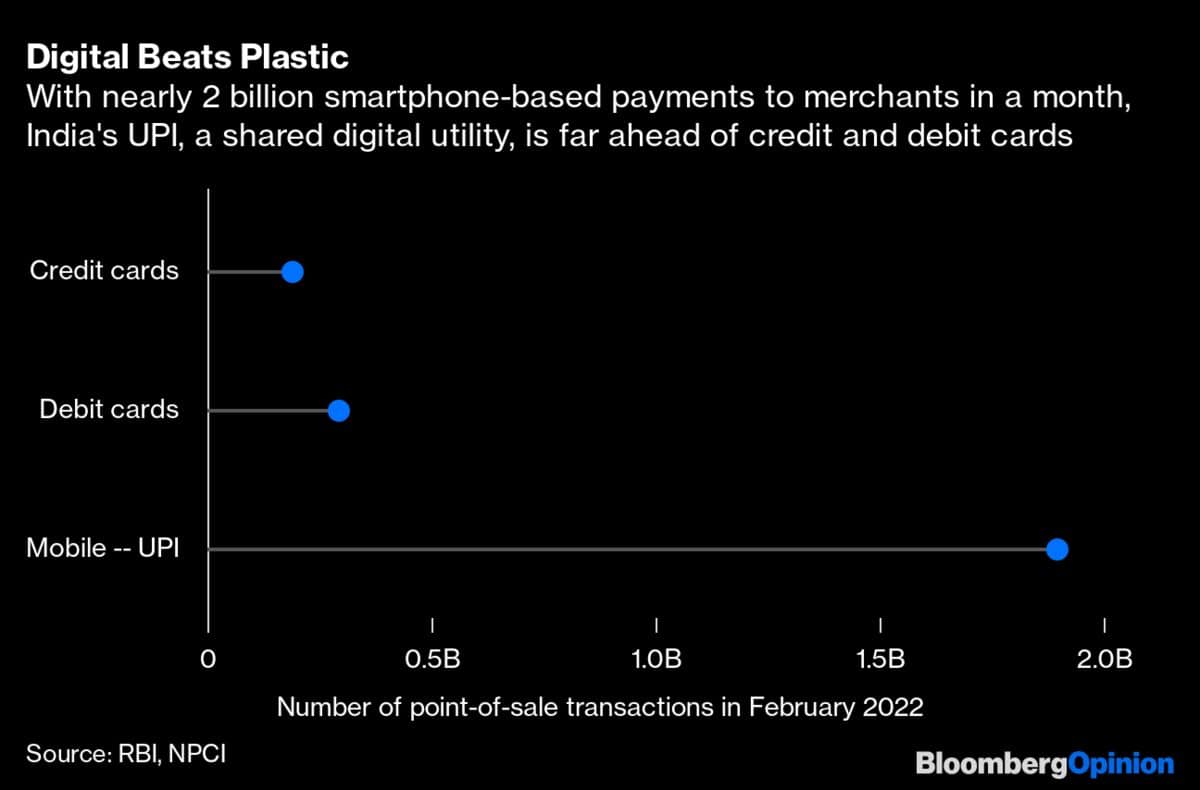

Historically, depository institutions in emerging markets like India didn’t see much business in democratising cashless payments. Card readers were costly pieces of hardware, and could only be deployed at shops that were well-established. These point-of-sales devices were also dumb: Even when the lenders got data about a store that was swiping a lot of cards issued by them, to advance money to a retailer based on that knowledge required multiple sales calls. It wasn’t worth the trouble then, and makes even less sense now that India’s digital revolution has put plastic in the shade. Credit and debit cards get swiped in two out of 10 transactions — usually for higher-value purchases and at bigger retailers.

But banks also fell behind in embracing payments on smartphones. They don’t have a tech DNA, and the weight of their legacy infrastructure made their own online products clunky. Fintech, which was far nimbler and more willing to shower generous cash-backs at early adopters, jumped on the opportunity created by India’s six-year-old Unified Payments Interface (UPI).

Using this highly popular, open-source protocol, mobile apps in India move funds in real time — using phone numbers for person-to-person transfers and QR codes to settle shopping bills. Nearly 2 billion such merchant transactions got done last month. The government mandates that all UPI transactions be free of charge.

You’d think the apps, looking for ways to make money from payments, would attack the banks’ deposit-taking franchise, then. They are, actually. BharatPe part-owns a bank and is thus in a position to lure retailers to switch their current accounts. Similarly, Alphabet Inc.’s Google Pay, the second-most-popular consumer wallet in India after Walmart Inc.-owned PhonePe, is using its sway to promote fixed deposits. If lenders lose control of both demand and time deposits, what’s even the point of their banking license?

Lending in a digital world is proving to be equally problematic. Banks aren’t intuitively geared to handle the unique requirements of small businesses. Suppose the salesperson for Unilever Plc’s local unit shows up at a store and says: “Since I have to meet my quarterly target, you can have another 5% discount if you pay upfront.” Traditional lenders’ internal processes are too slow to clear an immediate loan like that. What’s needed are pre-approved credit limits based on the borrower’s digital cash flows and innovative products like buy-now-pay-later — but for retailers. This is what banks have been missing out on. Now they want to reclaim the lost ground. But can they?

Perhaps. They’d have to come in as consolidators, leveraging the trust advantage they still have over fintech, which is hobbled by its own ubiquity. Because there are already so many apps on an average shopkeeper’s phone, each service obtains only a fragment of actual sales. “Nobody is getting enough data to offer meaningful financial services,” Khanduja says.

That’s why the former Visa Inc. executive, together with a couple of his colleagues, came up with the idea of Mintoak, a white-label merchant-payment platform for banks that can accept all digital payments as well as cash and cards. It produces a single report, leaving retailers free to run their business. Mintoak, which works with HDFC Bank Ltd. and State Bank of India, two of India’s largest lenders, earns a subscription fee and gets a cut on products that banks sell on the platform. HDFC Bank owns 5.2 percent of the startup.

India’s success in digital finance has inspired many emerging markets to design payments along similar lines, giving Mintoak a foothold in West Asia and the prospect of its first client in Africa. “We want to reconnect banks with SMEs,” says Khanduja.

Payments aren’t the only way to tap small businesses. A vast chunk of the working capital retailers need is embedded in the inventory. This credit used to reach them informally via distributors of brands, but it’s increasingly being provided by e-commerce platforms like venture capital-backed Udaan and billionaire Mukesh Ambani’s JioMart app for neighbourhood stores.

The UK-based Standard Chartered Plc has made an attempt to get into India’s business-to-business e-commerce with the hope of replicating the model in Kenya and other emerging markets. Most other banks, though, would rather stick to what they know. Luckily for them, none of the existing merchant-payment apps still has the revenue heft of a Block Inc. — formerly Square Inc. — in the US. Before a dominant player emerges in the fragmented market, India’s banks need to find their way back to the cash counter.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. Views are personal, and do not represent the stand of this publication.