(Image: Reuters)

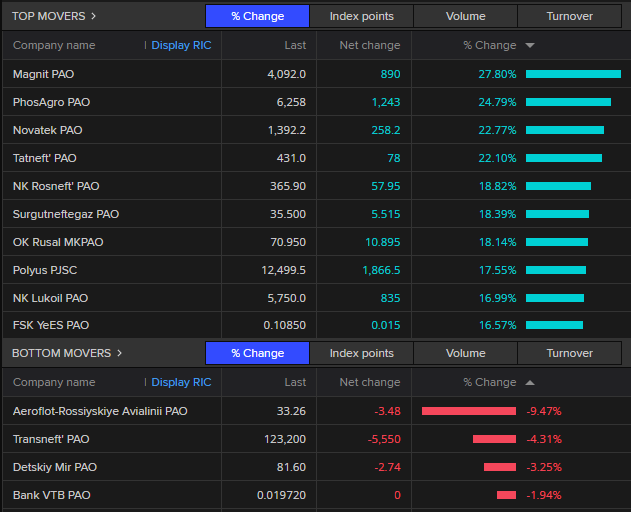

Energy and metals firms led a jump in Russian stocks on Thursday as trading resumed after a month’s suspension, reflecting soaring global prices for oil, gas and other commodities on fears the Ukraine crisis will threaten supply.

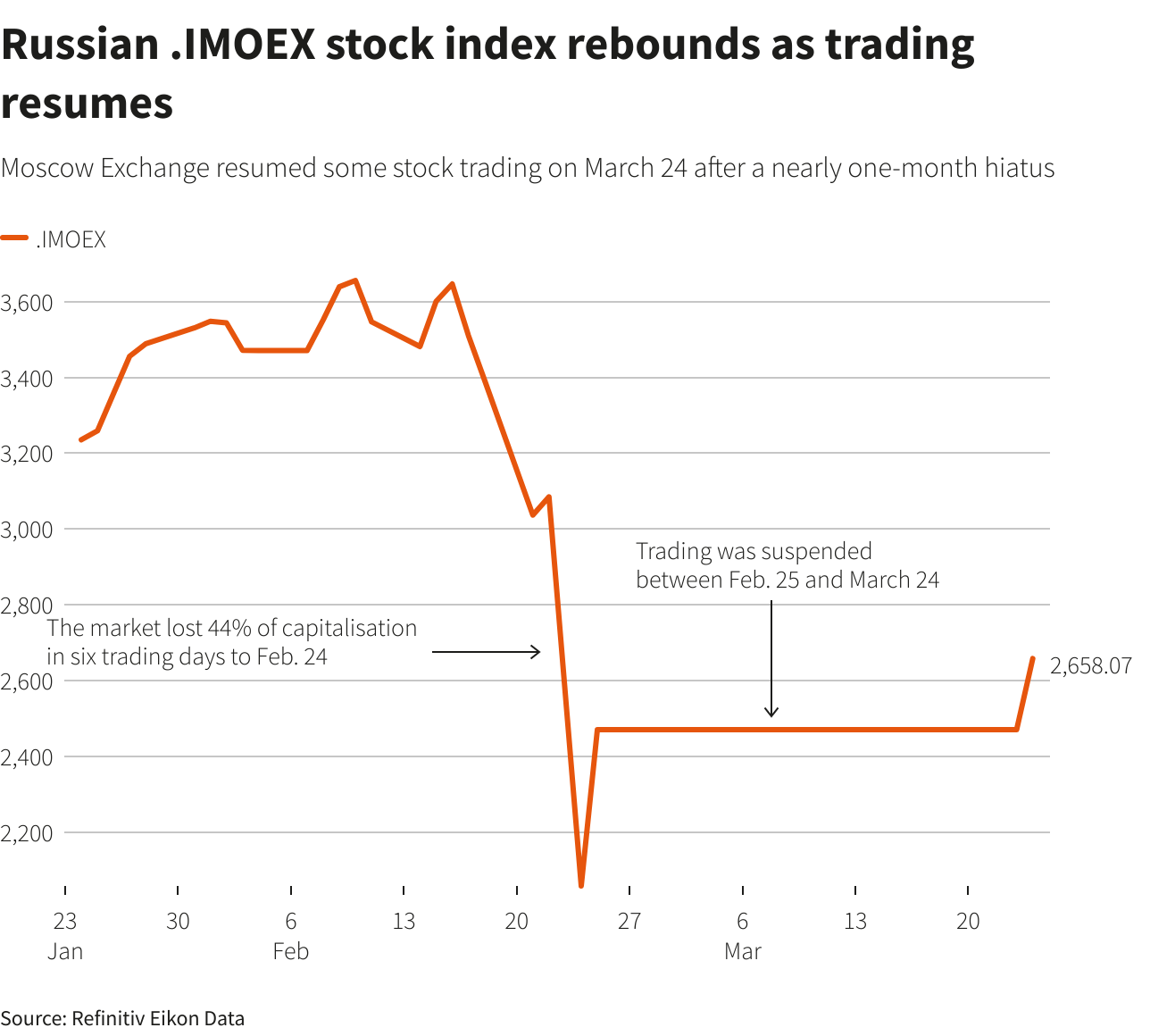

Stocks had not traded on Moscow’s bourse since February 25, the day after President Vladimir Putin sent troops into neighbouring Ukraine, prompting Western sanctions aimed at isolating Russia economically and then Russian countermeasures.

The reaction has cut off Russian financial markets from global networks and sent the rouble currency tumbling. Stocks had also plunged immediately after Moscow launched what it calls “a special military operation” to disarm and “denazify” its southern neighbour.

Restrictions on trade with foreigners and a ban on short selling remained in place on Thursday as the Moscow Exchange cautiously resumed equities trading.

“We will do everything possible to open all segments of the stock market soon,” Boris Blokhin, head of Moscow Exchange’s stock market department, said.

The short session saw energy firms make stellar gains, with gas producer Novatek, oil majors Rosneft and Lukoil and gas giant Gazprom up 12 percent-18.5 percent.

Brent crude oil , a global benchmark for Russia’s main export, was trading near $ 121.4 per barrel on Thursday, having jumped more than 21 percent from a month ago as worries about supply disruptions from the Ukraine crisis drive up prices.

Shares in mining giant Nornickel also gained 10.2 percent.

“Large bids to buy Russian shares have been seen since the market opening,” BCS Brokerage said in a note, adding that a promise Russia’s rainy-day fund will buy shares was also underpinning the market.

“The overall sentiment is supported by the confidence that the finance ministry will buy stocks,” BCS said.

The government said on March 1 that it would use up to 1 trillion roubles ($ 10.4 billion) from the National Wealth Fund to buy battered Russian stocks, although it was not clear whether any purchases were being made on Thursday.

The finance ministry did not immediately respond to a request for comment.

An interior view shows the headquarters of Moscow Exchange in Moscow, Russia April 27, 2021. REUTERS/Maxim Shemetov

A senior U.S. official dismissed the limited resumption of trading as a “a charade: a Potemkin market opening” and said the Russian government’s commitment to buy amounted to artificially propping up shares.

“This is not a real market and not a sustainable model – which only underscores Russia’s isolation from the global financial system,” deputy White House national security adviser Daleep Singh said in a statement.

The benchmark MOEX stock index ended the short trading session 4.4 percent higher at 2,578.51 points, having earlier reached a day peak of 2,761.17.

The dollar-denominated RTS index fell 9 percent on the day to 852.64, pressured by the weaker rouble, according to MOEX data that was suspended in the Eikon terminal.

The negative impact of sanctions was clear in some sectors, with shares in Russia’s second-largest lender VTB down 5.5 percent. And with most European airspace closed to Russian planes, flagship carrier Aeroflot sank 16.44 percent.

Trading apps of major brokerages with leading banks, including Sberbank, VTB and Alfa, reported temporary problems with processing clients’ orders following the restart.

Moscow equity trading resumes

The rouble meanwhile extended its recovery, gaining 1.8 percent to hover close to 96 against the dollar in Moscow trade. The currency had hit its strongest level in three weeks at 94.975 on Wednesday after Putin said Russia would start selling its gas to “unfriendly” countries in roubles.

Against the euro, the rouble was 2.5 percent higher at 105.34 , pulling further away from an all-time low of 132.4 it hit in Moscow trading earlier in March, but far from levels of around 90 seen before Feb. 24.

Russia resumed trading of OFZ treasury bonds on Monday with the central bank helping to stabilise the market with interventions, the amount of which it has not yet disclosed.

Yields of benchmark 10-year OFZ bonds, which move inversely to their prices, stood at 13.64 percent after hitting an all-time high of 19.74 percent on Monday .

Trading in Russian companies listed on the London Stock Exchange remains suspended. Prices of some instruments had plunged to almost zero before the bourse halted trading of them in early March.