Amit Jain is the Chief Strategist – Global Asset Class at Ashika Group

The market so far has discounted 70 percent of inflation risk but only 30 percent of possible geo-political risk at current levels, Amit Jain, Chief Strategist – Global Asset Class at Ashika Group said in an interview to Moneycontrol. He feels the world power equation is going to change significantly in next three years.

After more than Rs 2.75 lakh crore of FII outflow in FY22 so far, FIIs will be the biggest buyers in Indian markets for next financial year 2022-23, says Jain, who has more than 18 years of experience in the banking and financial services. Edited excerpts:

The second half of FY22 was a tough period for equities. As we are soon going to enter FY23, what are the biggest risk factors that the market can face?

As we see, Nifty has generated return on investment (ROI) of 19 percent in last 1 year compared to (-0.63 percent) in last 6 months. Even from hereon, market may be volatile in both direction depending upon the news flow on Russia-Ukraine War & Fed rate of interest move.

Also read – Don’t foresee India facing sanctions, but RBI’s forex reserves well-diversified, says Governor Das

There are two biggest risk in Global Markets – First, possible World War-3, which we already shared with you in our July 2021 interview; and second, some unwinding of unhedged derivatives position by one of the Global banks.

After more than Rs 2.75 lakh crore of outflow in FY22 so far, do you think the FII flow could significantly reverse soon?

We cannot predict directional reversal for FII’s on one-or-two-day data. In my view for next financial year 2022-23 FII’s will be the biggest buyers in Indian Markets.

Is it the time to buy new-age companies including Paytm, CarTrade, Zomato etc. which have come off sharply from their highs?

We never believe in such companies who do not earn profits even after 10 years of their existence, hence never tracked them.

But as an informed investors I will choose old profitable companies which has consistent track record of generating profits & now are available at much cheaper valuations today, rather than these bull story stocks, which has not passed through any bear cycle yet.

What is your outlook on the primary market for FY23?

To a great extent it will depend on Russia-Ukraine war twist & timings of LIC IPO. In my view if above 50 companies who are willing to raise funds, then they must come before LIC IPO, as post LIC IPO we may see lack of liquidity in markets.

Click Here To Read All IPO Related News

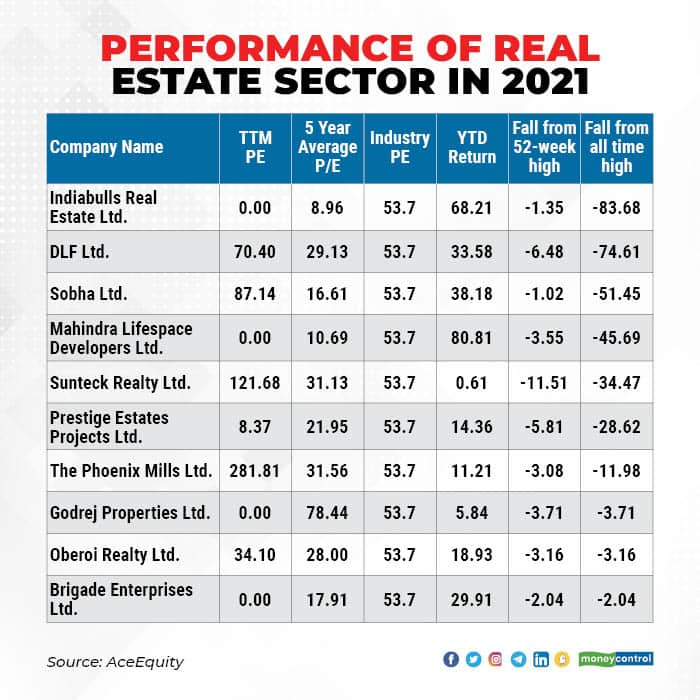

Do you recommend taking major exposure to real estate space at this point of time?

Both real estate sector & stocks have started performing after 10 years of bear market, hence we may see at least two to three years cyclical bull run in this sector. So, long term investors can choose quality stocks in this sector.

Click Here For Live Updates On Ukraine-Russia War

What could be total number of rate hikes by Federal Reserve in 2022 after a 25 bps hike for first time since 2018?

In my view we will have another 5 rate hikes by the US FED during this calendar year. Higher rate of interest will press all Global funds to do their long due rebalancing of Equity : Debt proportion from their medium term perspective.

Do you think most of risk related to geopolitical tensions, inflation and Fed already discounted by the market?

In my view market has discounted 70 percent of inflation risk but only 30 percent of possible geo-political risk at current levels.

We may have extremely volatile markets during this calendar year 2022 as World power equation is going to change significantly in next three years.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.