Representative image

In the second week of upside, Nifty gained more than 10% from the bottom of 15,676. The Nifty Futures during this week ranged from 16,556 to 17,385. On the open interest (OI) front, long unwinding was witnessed in Nifty over the week gone by as there is almost 10% drop in OI.

In another week of huge volatility, Bank Nifty also closed with significant gain of more than five percent around 36,400.

Bank Nifty Futures gyrated 34,615 to 36,612 in the last week. Overall, Bank Nifty ended the week with a gain of around 1,800 points. It also witnessed long unwinding on OI front in the week gone by.

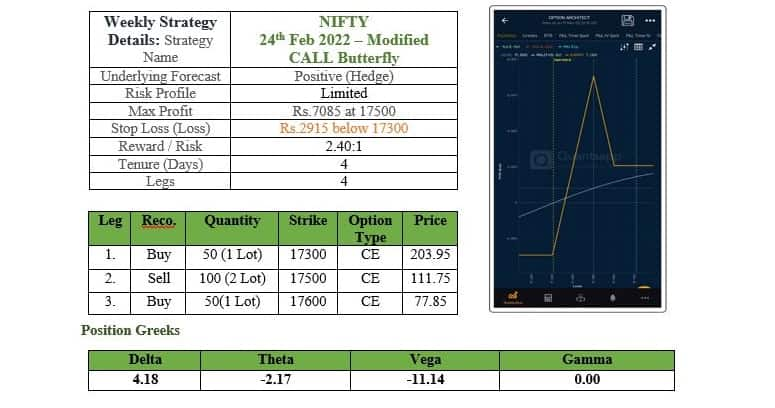

Further diving into the Nifty upcoming weekly expiry PE option writers showing aggression, Nifty immediate resistance stands at 17,500 and vital resistance at 18,000 levels where nearly 19 and 27 lakh shares have been added respectively. On the lower side immediate and vital support level is at 17,300 followed by 17,000 where nearly 14 and 23 lakh shares have been added respectively.

Bank Nifty upcoming weekly expiry data. On the downside, Bank Nifty immediate support at 36,000 where nearly seven lakh shares have been added followed by vital support at 35,000 where nearly seven lakh shares have been added. On the higher side, immediate resistance stands at 36,500 where nearly seven lakh shares have been added followed by vital resistance at 37,000 with nine lakh share addition.

India VIX still trading on the upper regime. It cooled off by 11 percent from 25.68 to 22.62 over the week. Cooloff in the VIX has given relaxation to market. Further, any downticks in India VIX can push upwards momentum in Nifty.

Looking at the sentimental indicator Nifty OI PCR for the week has increased significantly from 1.03 to 1.323. Bank Nifty OIPCR over the week increased from 0.673 to 0.893 compared to last Friday. Overall data indicates PE writers are more aggressive than CE writers in Nifty.

Weekly contribution of sectors to Nifty Most sectoral indices show positive contribution. PVTB, NBFC and FMGC have contributed the most on the positive side in the Nifty gain of 674 points last week, while only power contributed marginally negative to Nifty.

Looking towards the top gainer and loser stocks of the week in the F&O segment Bandhan Bank topped by gaining over 14.6%, followed by SRF 14.5%, and PEL 12.5%. Jubilant FoodWorks lost over 10.5%, Hindustan Copper 5.4%, and Mphasis 5.2% over the week.

Considering the bullish momentum, upcoming week can be approached with a low-risk strategy like modified call butterfly in Nifty.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.