Chalet has been forming a higher high – higher low pattern for the past couple of weeks after finding support near the Rs 211 mark.

Sunil Shankar Matkar

February 22, 2022 / 07:44 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

The market continued to be volatile and closed with marginal loss for fourth consecutive session on February 21 as traders closely monitor the developments related to Ukraine-Russia tensions to get the clear direction.

The BSE Sensex declined 149.38 points or 0.26 percent to 57,684, and the Nifty50 dropped 69.65 points or 0.40 percent at 17,207. Broader markets too underperformed as the Nifty Midcap 100 index fell 1.24 percent, while the Smallcap 100 index slipped 2.73 percent.

Sell-off in metal, pharma, FMCG and auto stocks dragged the market, but buying across select IT and private bank stocks capped losses.

Stocks that were in action include Coforge and Federal Bank, which were the second and third largest gainers in the futures & options segment. Coforge rose 2.14 percent to Rs 4,412.90, while Federal Bank advanced 1.89 percent to Rs 99.75.

Stocks that witnessed only buyers amid market nervousness include Linde India which was up 10 percent at Rs 2,971.35 and Agri-Tech (India) which also gained 10 percent at Rs 80.60.

Chalet Hotels, rising 12.27 percent to Rs 282.75, saw a sudden surge in the stock price and got included in the list of price shockers.

Here’s what Malay Thakkar of GEPL Capital recommends investors should do with these stocks when the market resumes trading today:

Chalet Hotels

Chalet has been forming a higher high – higher low pattern for the past couple of weeks after finding support near the Rs 211 mark.

On February 21, 2022 the stock gained momentum and managed to break above the previous swing high of Rs 292 on intraday basis. This up move was backed by good volume build up, indicating participation in the up move.

On the indicator front, the RSI (relative strength index) plotted on the weekly time frame is placed above the 50 mark and is moving higher towards the overbought level, indicating increasing bullish momentum in the prices.

In the sessions to come, we believe the stock has some resistance near the Rs 316 level. If this level is breached, we might see the prices move higher towards Rs 360 followed by Rs 380 mark.

Investors holding this stock can continue to hold on to their position with a target of Rs 360-380 and maintain a strict stop-loss of Rs 240 on daily closing basis.

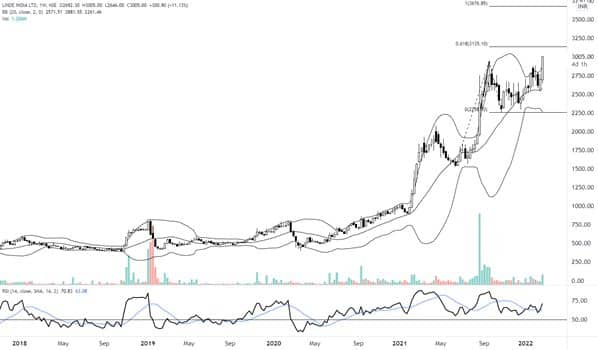

Linde India

Linde India, for the past 2 weeks, has been forming strong bullish candles after bouncing off the 20-week SMA (Rs 2,571) (simple moving average). On February 21, the stock formed a strong bullish candle and managed to move and close above the previous swing high of Rs 2,945. This upmove was backed by good volume buildup, indicating participation in the up move.

On the indicator front the RSI plotted on the weekly time frame can be seen place above the 50 mark and is moving higher towards the overbought level, indicating increasing bullish momentum in the prices.

In the sessions to come, we might see the prices move higher towards Rs 3,135. If the prices manage to breach and sustain above this level, we might see further up move towards Rs 3,676.

Traders holding this stock can continue to hold this position with a target of Rs 3,676 from a longer time horizon. We will recommend a strict stop-loss of Rs 2,500 in daily closing basis.

Agri-Tech (India)

Agri-Tech (India) on the weekly chart seems to be moving higher after a correction. On February 21, the stock gained momentum and tested a fresh 52-week high. This upmove was backed by good volume build up, indicating participation in the stock as the prices test fresh 52-week highs.

The Bollinger bands plotted on the weekly chart can be seen expanding as the prices move higher, indicating increasing volatility during a breakout.

In the sessions to come, we might see the prices move higher towards Rs 86. If this level is breached, we might see further up move towards Rs 94 and eventually towards Rs 105.

We recommend the investors to maintain a strict stop-loss of Rs 71 on daily closing basis.

Coforge

Coforge has seen a deep correction of nearly 30 percent from January 2021 highs of Rs 6,135. In today’s session, the stock has bounced sharply from intraday lows of Rs 4,240 irrespective of the weakness in the markets.

The RSI indicator plotted on daily is forming a positive divergence and giving early bottoming out signals.

Traders can continue holding the stock with a contrarian view and a break above Rs 4,500 can increase the momentum and push the stock higher towards Rs 4,820 followed by Rs 5,000 level.

A strict stop-loss of Rs 4,240 should be followed for this trade.

Federal Bank

Federal Bank is moving in a range between Rs 80-110 for past 6 months. The stock is facing strong rejection in Rs 105-110 zone. Currently the stock is trading above the 20-week SMA (Rs 95) and inching towards the resistance zone.

The RSI indicator manages to sustain above the 50 mark and move higher.

Traders and investors can continue holding the stock with a strict stop-loss of Rs 94. We expect the prices to move towards Rs 110, and if it breaks above the same, it can take the prices to Rs 120 levels.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.