The market snapped two-week sharp losing streak and clocked nearly 2.5 percent gains in the week ended February 4, thanks to the growth-oriented budget presented by Finance Minister by increasing capex by 35 percent to Rs 7.5 lakh crore for FY23 while keeping fiscal deficit target at 6.4 percent of GDP for the same year and having an achievable divestment target of Rs 65,000 crore indicating LIC IPO seems to be taking place by March 2022. However, the selling amid weak global cues in the last two sessions of the week capped some gains for the week.

The BSE Sensex surged 1,444.59 points to 58,644.82, and the Nifty50 jumped 414.35 points to 17,516.30, while the broader markets also joined the rally with the Nifty Midcap 100 and Smallcap 100 indices rising 2.14 percent and 1.87 percent respectively.

All sectors participated in the budget-driven rally with the Metal, Pharma, FMCG, IT, and Bank being prominent gainers rising 3-6.6 percent.

On Monday the market will first react to SBI, Tata Steel and IndiGo earnings. Overall the coming week is also going to be crucial as we have RBI policy and corporate earnings, hence the volatile swings may continue with more of a stock specific opportunities, while keeping other eye on global cues including elevated oil prices, experts feel.

“Markets have been witnessing volatile swings, mirroring their global counterparts and it may continue in near future. Besides, the upcoming event i.e. MPC’s monetary policy review and earnings would further add to the choppiness,” says Ajit Mishra, VP Research at Religare Broking.

He further says the market has been seeing consolidation in the index for the last 3 months and indications are in the favour of prevailing bias to extend. Hence he recommended focusing on sector-specific opportunities while keeping a check on leveraged positions.

Here are 10 key factors that will keep traders busy next week:

RBI Policy

The first Monetary Policy Committee meeting after the Union Budget, will start from Tuesday and will conclude on Thursday. The commentary by RBI Governor Shaktikanta Das will be keenly watched by the street looking at any hint about rate hikes in coming months, when the global central banks are indicating faster tightening.

Experts largely expect no change in key policy rates but given the expected widening fiscal deficit at 6.9 percent for FY22, it is a tough task for the RBI to maintain liquidity and inflation while supporting growth.

The rising oil prices in the international markets with Brent above $ 90 a barrel is another headache for the central bank.

“We expect the Monetary Policy Committee (MPC) to remain growth supportive and maintain its accommodative stance. Even though imported inflation (such as high crude oil prices) remain a concern, we expect the MPC to hold on to policy rates,” says Shiv Chanani, Head of Research at Elara Securities India.

Also read – Policy meeting to be challenging for RBI given oil prices above $ 90 a barrel, says Abhay Agarwal of Piper Serica

Earnings

As we are almost towards the end of December corporate earnings season, more than 1,600 companies (as per BSE website) will release their quarterly earnings scorecard in the coming week between Monday to Saturday. Key ones to watch out for would be Bharti Airtel, ACC, Bosch, Power Grid Corporation of India, Hero MotoCorp, Hindalco, Mahindra & Mahindra, Divis Labs, and ONGC.

Click Here To Read All Earnings Related News

Among others, IRCTC, PB Fintech, FSN E-Commerce Ventures (Nykaa), Zomato, Star Health and Allied Insurance Company, Tata Power, Castrol India, Chemcon Speciality Chemicals, Clean Science and Technology, Indian Bank, TVS Motor, Union Bank of India, Astrazeneca Pharma, Bajaj Electricals, Bata India, Data Patterns, Escorts, Godrej Consumer Products, Indraprastha Gas, Jindal Steel & Power, Latent View Analytics, NMDC, Tata Teleservices (Maharashtra), Aurobindo Pharma, Berger Paints, DCB Bank, Engineers India, Indiabulls Housing Finance, Nuvoco Vistas Corporation, Paras Defence and Space Technologies, Petronet LNG, Prestige Estates Projects, SAIL, ABB India, Amara Raja Batteries, Alembic Pharma, BEML, Bharat Forge, Computer Age Management Services, Cummins India, IRB Infrastructure Developers, Dr Lal PathLabs, MRF, MTAR Technologies, Quess Corp, Sun TV Network, Tata Chemicals, Trent, Apollo Hospitals Enterprise, Ashok Leyland, Glenmark Pharma, Honeywell Automation, India Cements, Kalpataru Power Transmission, Metropolis Healthcare, Motherson Sumi Systems, Nazara Technologies, NHPC, Oil India, RateGain Travel Technologies, Sobha, Ujjivan Financial Services, Voltas, Ashoka Buildcon, and Dilip Buildcon will also be keenly watched next week.

Overall quarterly earnings have been mixed, say experts adding banks and IT companies outperformed, but consumer sector companies faced the margin pressure due to higher input costs and slower recovery in rural markets.

Elevated Oil Prices

Oil is the crucial factor to watch out for as international benchmark Brent crude futures traded above $ 90 a barrel mark, which is a big risk for the country like India that imports 80-85 percent of oil and when the economy started picking up the growth pace. The rising oil price is also going to put pressure on corporates’ margin.

Oil prices jumped 34 percent in the last two months to close at $ 93.27 a barrel last Friday. Supply concerns amid rising geopoliticial tensions and winter storms in the United States, boosted the rally in prices.

“The sharp increase in oil prices is a big concern especially with the global economy opening up. It can potentially derail economic growth by increasing inflation and thereby the cost of borrowings. In the short term if crude spikes beyond $ 100 it will definitely be a negative event for markets though not cause a major correction by itself,” says Abhay Agarwal, Founder, and Fund Manager at Piper Serica.

Rising US Bond Yields

The US 10-year treasury yields spiked above 1.9 percent, for the first time since December 2019, to close at 1.91 percent last week especially after better-than-expected US jobs data raising expectations that the Federal Reserve would start increasing rates to fight inflationary pressure. In fact the yields surged significantly in the last two months from the level of 1.35 percent seen on December 4, 2021.

Experts feel the consistent rise in bond yields amid improving US economy and rising inflation could put more pressure on the Indian markets as it could result in massive FII outflow.

FII Selling

The foreign funds outflow remained relentless in Indian equities for fifth consecutive month now, restricting the market upside. In Fact the market has been gyrating in a range of 1,500-2,000 points on the Nifty50 since October 2021 as on the one side FIIs have been putting pressure and on other side, domestic institutional investors supporting the market on downside by buying every dip. Hence the flow will be closely watched.

FIIs have net sold Rs 7,700 crore worth of shares last week, taking the total outflow to Rs 1.46 lakh crore since October 2021, however, DIIs managed to compensate the same to major extent. They have been net buyers for every month since March 2021 and they have net bought Rs 5,924 crore worth of shares last week.

IPO and Listing

The initial public offering of Vedant Fashions, the operator of ‘Manyavar’ in the branded Indian wedding and celebration wear market, will remain open for subscription till Tuesday, February 8, 2022. The price band for the offer has been fixed at Rs 824-866 per share.

Click Here To Read All IPO Related News

So far the offer has been subscribed 14 percent on last Friday with retail investors putting in bids for 22 percent of shares reserved for them. The portion set aside for qualified and non-institutional investors were subscribed 6 percent each.

FMCG good company Adani Wilmar, the joint venture between Adani Group and Wilmar Group (Singapore), will make its debut on the bourses on Tuesday. The final issue price has been fixed at Rs 230 per share. The company has mopped up Rs 3,600 crore through maiden public issue. Its shares were available at a premium of Rs 25-30 in the grey market over the issue price, as per the IPO Watch and IPO Central.

Technical View

The Nifty50 managed to close above crucial 17,450 levels (around 50 days moving average placed around 17,438 levels) last week. Holding the same level in coming days could open up more upside towards 17,700-17,800 levels, however, breaking the same could bring bears back on Dalal Street, experts feel.

The index formed a bearish candle on the daily charts as it was down 44 points, whereas for the week it formed a bullish candle which resembles the Shooting Star kind of formation on the weekly scale.

“The short term weakness in the market remains intact. Though Nifty slowed down its decline on Friday, the overall chart pattern of daily and weekly indicate a higher chance of Nifty moving below 17,450 levels by next week and such action is likely to bring bears into action again. A sustainable move only above 17,800 levels could negate this bearish pattern,” says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

F&O Cues

The benchmark Nifty, on a weekly basis, witnessed maximum Call open interest at 17800 strike, followed by 18500 & 18000 strikes, while there was maximum Put open interest at 17500 strike, followed by 17000, 17400 & 17200 strikes.

Call writing was seen at 17800, 18400 & 18000 strike with Call unwinding at 17400 strike, whereas Put writing was seen at 17500, 17400 & 17200 strikes with Put unwinding at 17700 & 17800 strikes.

The abovementioned option data indicated that 17,200 could be crucial support while the 17,800 could be a major hurdle for the Nifty in coming days.

“The Nifty holds highest Put concentration at ATM 17500 strike while Call option concentration is placed at 17800 strike for the coming weekly settlement. Call options concentration is much higher than the Put for the coming week suggesting limited upsides. We expect the Nifty to consolidate for sometime after witnessing significant volatility in the last one month,” says ICICI Direct.

The volatility declined sharply by 8.7 percent during the last week to fall below 20 levels at 18.70. “We believe it will further decline in coming weeks in line with global markets and fresh negative bias should be formed only if it sustains above 20 levels,” says ICICI Direct.

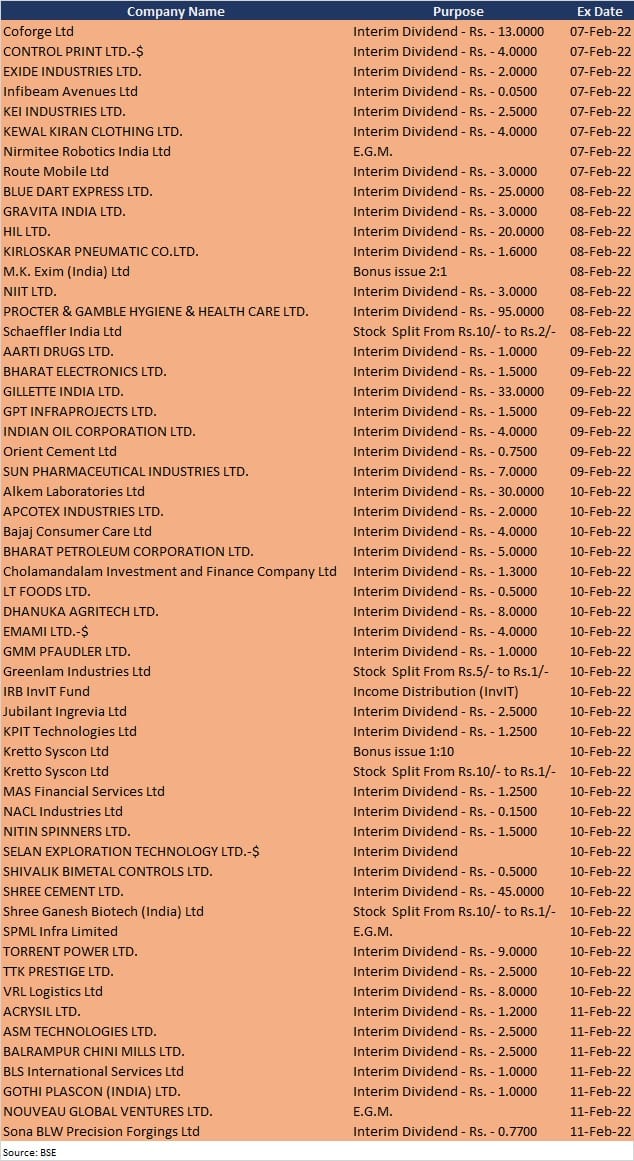

Corporate Action & Economic Data Points

Here are key corporate actions taking place in the coming week:

On the economic front, industrial production data for December will be released on Friday. Bank loan & deposit growth for the fortnight ended January 28 and foreign exchange reserves for the week ended February 4 will also be released on Friday.

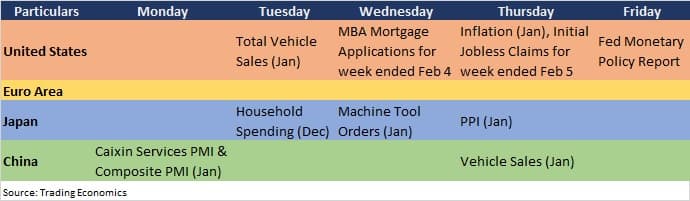

Global Data Points

Here are key global data points to watch out for:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.