Shubham Agarwal

Option is a versatile instrument and is used by all kinds of market participants – be it traders or arbitragers or investors.

Traders use it for short-term trading. Arbitragers look for mispricing and take trades wherever they find tiny riskless profit. And, investors use Options to aid their investments.

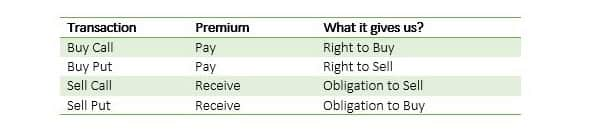

We are all aware that before a big event like a company result or a Union Budget, many investors do use Put Options to hedge their investments. But, we can also use Options in making our investments profitable while making a bargain buying as well. Before we learn about the technique to make bargain hunting more lucrative using Options, let us refresh our knowledge on Option transactions and what they mean.

We all know that Buying Puts of stocks we have invested into is called hedging. This is because we have a right to sell the stock at the strike price of the Put option. Now, if the stock falls, we can sell the stock at the strike price. If it does not, the only premium paid is the loss.

There is also one more use of the same Put option. But before that let us understand what we mean by bargain hunting. It is an exercise where we like to invest in a stock but are waiting for it to fall. If it falls, we will definitely buy it.

In other words, can we say we are willing to be ‘Obliged to Buy’ at a lower price?

If the answer is yes, and if we have made up our mind to definitely buy at lower levels, then instead of waiting for the price to come down, we can right away sell Put Option of the strike price that is closest to that low price where we would want to bargain hunt.

What happens now?

A. Stock falls below the Strike Price of the Put Option on the day of Expiry:

In such case we will have to buy the Stock at the strike price. In other words, honor our obligation to buy. This is what we wanted to do in the first place.

Or,

B. Stock remains above the strike price of the Put option on the day of expiry:

In such case, we will not do anything, because the buyer of the Put option will not exercise the right to Sell the stock at a lower Price than the market price. Hence, we will have no obligation.

How does this make our investments lucrative?

Let us not forget for selling Puts we do receive premium. So, in either of the cases of scenario A or B, we will still receive premium.

In case of scenario A, we will buy investment at the price decided to buy but our cost of investment will be: strike price – premium received.

In case of scenario B, we did not get an opportunity to Buy but we still got the Premium. That is the profit we could not have had in case of traditional Bargain Hunting of just wait and watch.

Thus, with the use of selling Put options in the activity of bargain hunting we can make additional money and make this activity more Lucrative.

If the stock falls our right to sell at the Strike Price of the Put option bought, will help us compensate any loss on the Investment.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.