Is there a way to invest in residential real estate as an asset class?

It’s a timely question since, as I pointed out last week, residential real estate can play an important role in reducing the probabilities you will run out of money in your retirement. Yet there’s no straightforward way to invest in the asset class itself. Unlike what exists for stocks or bonds, there is no index fund benchmarked to residential real estate generally.

Absent such a fund, the challenge facing those who want to allocate some of their retirement portfolios to residential real estate is to find homes that perform at least as well as the asset class itself.

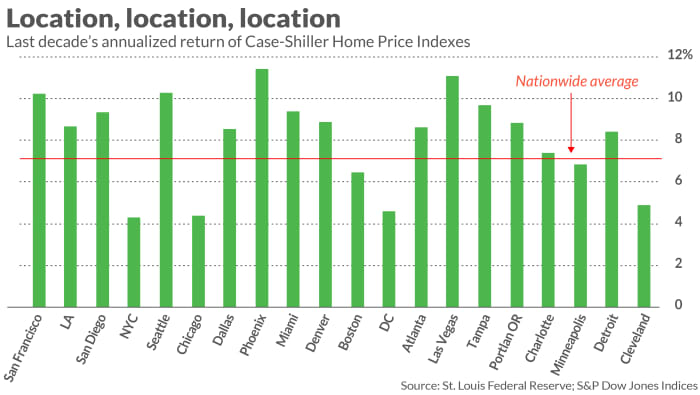

That’s easier said than done, unfortunately. Imagine trying to predict, 10 years ago, which major U.S. city would experience the greatest house price appreciation over the subsequent decade. A lot was riding on getting it right: The city with the highest rate experienced an annualized increase in its Case-Shiller Home Price Index that was nearly three times that of the city with the lowest rate.

Those cities, as you can see from the accompanying chart, are Phoenix and New York City, with annualized ten-year increases of 11.4% and 4.3%, respectively.

Not sure where to live in retirement? Check out MarketWatch’s Where’s the Best Place for Me to Retire? tool

What about REZ?

A helpful reader emailed me to suggest a possible solution to the challenge of matching the asset class’s average return: The iShares Residential & Multisector Real Estate ETF REZ, -0.76%. I’m nevertheless skeptical.

Whatever other virtues this ETF has, it’s a stretch to claim it is representative of the residential real estate asset class as a whole. Its largest current holding, representing more than 10% of its portfolio, is Public Storage PSA, -1.00%, which owns and operates self-storage facilities. Its second largest holding, representing an additional seven percent of its portfolio, is Welltower WELL, -2.40%, which invests in healthcare infrastructure.

Consider the correlation over the last decade in the monthly returns of REZ and the Case-Shiller U.S. National Home Price Index. I calculate that the r-squared of this correlation is just 0.6%, which means that monthly changes in the Case-Shiller index explain less than 1% of the contemporaneous monthly changes of REZ.

Why it’s important to still try

These data certainly suggest there is no easy way to invest in residential real estate as an asset class. But that doesn’t mean we should give up. The asset class has several virtues that are compelling enough to suggest we shouldn’t let the lack of an easy solution lead us to avoid it altogether.

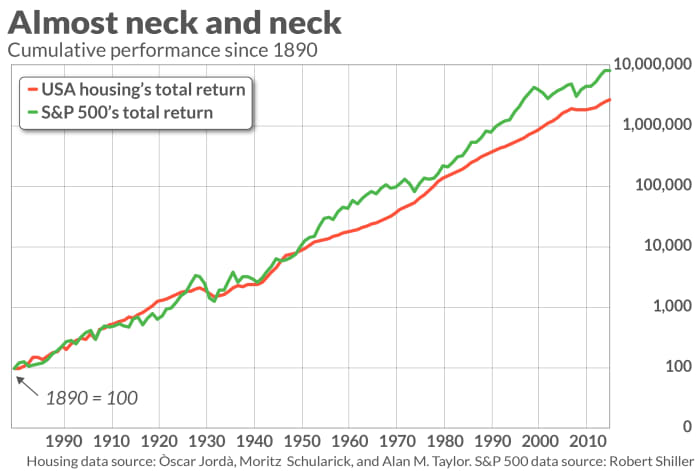

Raw returns are just one of those virtues. Just as important is the low correlation between the stock market and residential real estate. Also important is its low volatility.

These additional virtues are illustrated by the accompanying chart, which plots residential real estate’s total return since 1890 alongside the S&P 500’s. Notice that residential real estate’s cumulative performance line is far smoother than the S&P 500’s. Also notice how, with the exception of the Great Financial Crisis, residential real estate tends to hold its own during equity bear markets.

My hunch is that these additional virtues often remain even when a particular investment in residential estate produces raw returns that are below those of the overall asset class. If so, then that investment could still play a powerful role in ensuring that your retirement portfolio lasts along as you do.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.