Let’s consider India as a company, annual budget as the annual account for the current year and forecast for the next year and the budget presentation in the Parliament and subsequent press conference as the conference call with various stakeholders.

An investor who wants to invest in this company would want to objectively analyze:

(i) The past performance of the company in terms of growth;

(ii) The credibility of the management in terms of professionalism, integrity, execution and delivery on promises;

(iii) The future prospects in terms of growth, competitiveness, financial stability, cost of capital, price stability, etc.; and

(iv) The relative positioning in terms of expected returns, access to markets, regulatory flexibility, costs (taxation etc.).

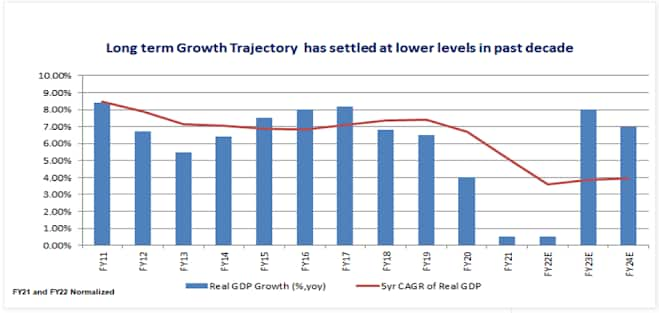

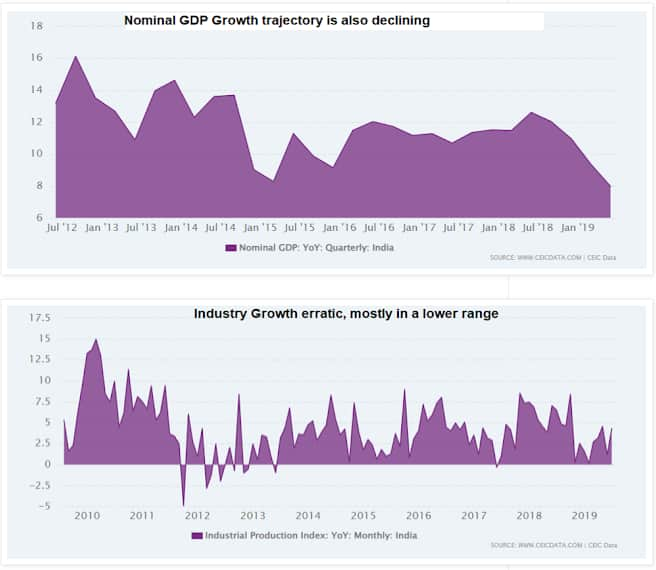

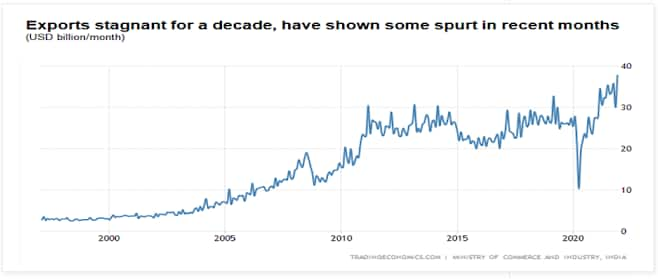

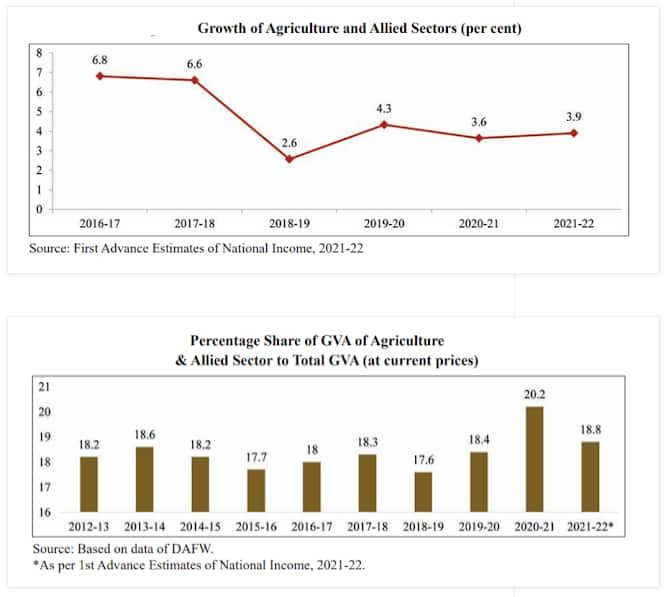

The past performance of the Indian economy in terms of growth has not been particularly outstanding, especially in the past one decade. The growth trend appears to have stabilized at lower trajectory and is showing no sign of transcending to the higher orbit anytime soon. Industrial growth has remained volatile but overall in a lower range. Exports have stagnated for more than a decade; though some spurt has been seen in recent months.

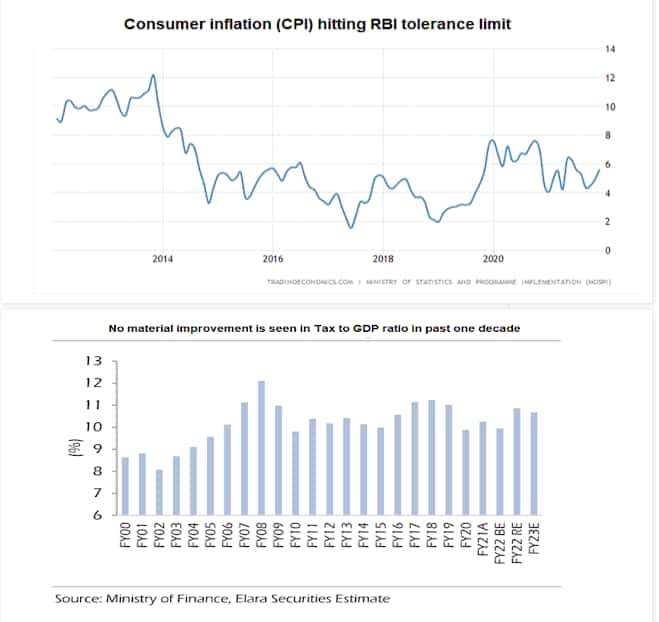

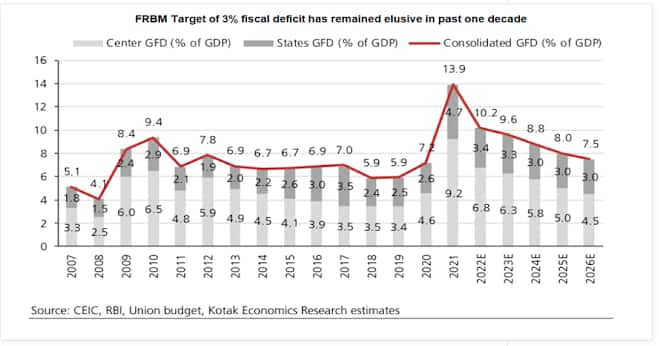

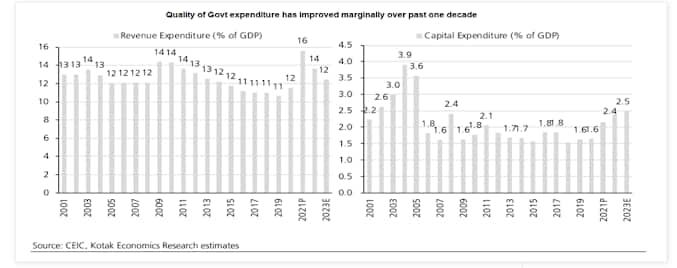

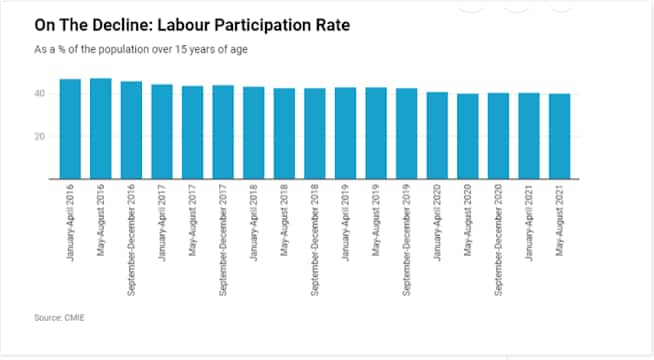

The credibility of the top management (Prime Minister) is high, but few of his managers enjoy the similar ratings. The execution and delivery of promises have been much below par on many counts. For example, the government has not achieved its disinvestment targets in the past one decade. The tax to GDP ratio has not improved. The unemployment situation has worsened only. The FRBM targets have never been achieved. The goalposts for the big infrastructure investments are being shifted consistently.

Also read: Budget 2022: A Stock trader’s guide to what may happen today

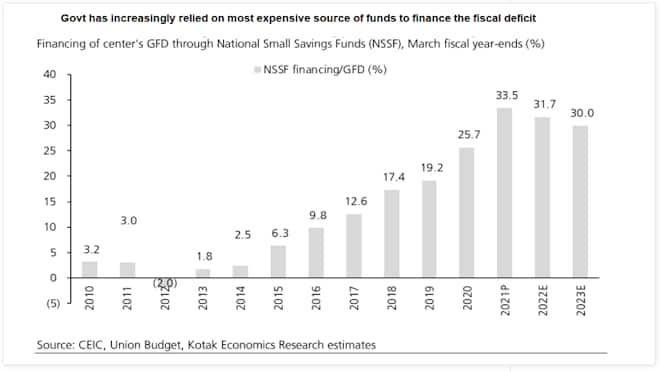

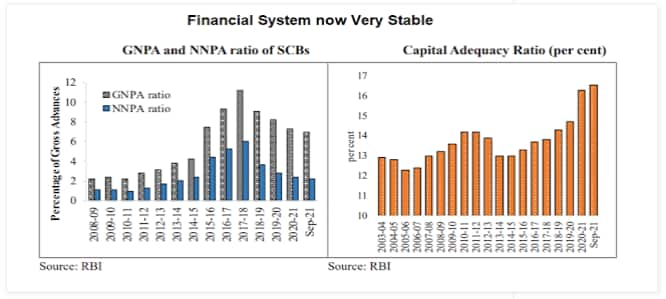

The future prospects in terms of growth do not appear particularly promising. The growth rate is likely to settle in below potential 6-7% range once the low base effect of FY21 and FY22 wanes. The financial stability remains very strong; though the cost of capital is rising. The government is consistently reliant on the most expensive source of funds to finance the fiscal deficit, which is feeding through the economy. Inflation has remained close to the upper bound of RBI’s tolerance range for many months, raising questions about the “growth over inflation” strategy of RBI, since a majority of the population seems to be facing Stagflationary conditions.

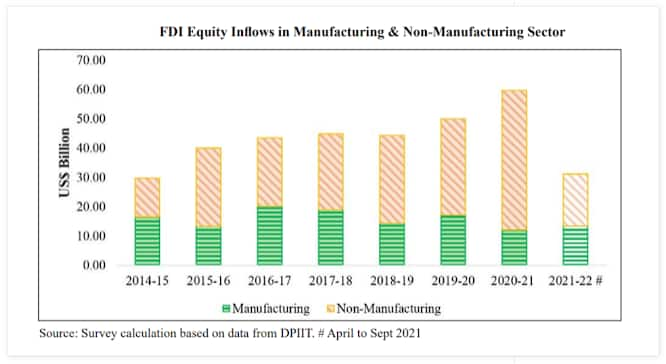

In terms of relative positioning, India has not been able to capture any substantive part of China+1 global shift. Many smaller economies like Bangladesh, Vietnam, Taiwan, etc. appear to have become much more competitive than India. Despite stated policy position, the access to Indian markets has remained highly regulated and costs (taxation) elevated. Many global players have announced major investments into Indian manufacturing, but the actual flows have been slow to come due to regulatory and other hurdles. The economy has lost critical time due to these delays.

Overall, India as a company appears a stable business with decent fundamentals. It however lacks strong growth drivers in the near term. The only moat for India is its pool of skilled tech workers; not many of whom hold loyalty for India as a business. If I am a global fund manager I would be too glad to invest in Indians, but remain underweight (unexcited) on India for now.