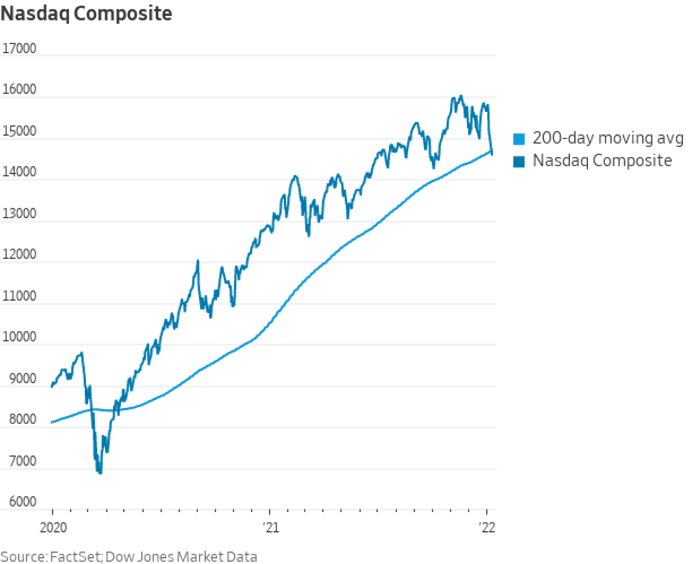

The Nasdaq Composite Index was facing its fifth straight decline on Monday, which was putting the index on the verge of closing below its long-term 200-day moving average for the first time in about 20 months.

At last check, the Nasdaq Composite COMP, -1.92% was trading down 2.7% at around 14,536, with its 200-day moving average at 14,688.73. The technology laden index hasn’t closed below its 200-day MA since April 21, 2020, FactSet data show.

Dow Jones Market Data

Pressure on the Nasdaq Composite also was pushing it perilously close to a correction, commonly defined as a decline of at least 10% from a recent peak. The index needs to stay above 14,451.69 to avoid a correction from its Nov. 19 record close peak.

Many market technicians watching moving averages to help gauge short-term and long-term trend lines in an asset.

Rising benchmark yields for government bonds, such as the 10-year Treasury note TMUBMUSD10Y, 1.792%, have been rising and putting pressure on yield-sensitive assets.

Yields have been rising as investors anticipate tighter policy from the Federal Reserve and as many as three interest-rate increases in 2022 starting possibly in March. Goldman Sachs analysts, in a recent research note, estimate that there could be as many as four interest rate increases this year.

Read: Why New Year’s chaos may signal a more balanced—but volatile—stock market in 2022 as investors grapple with a hawkish Fed