The third quarter of FY22 is widely seen as having been a strong one for India’s banks, both in terms of balance-sheet growth and asset quality. This optimism is reflected in the movement of bank stocks over the month.

Analysts expect lenders to report a surge in net profit as provisions may reduce with a dip in delinquencies. Jefferies India Pvt Ltd estimates an increase of 37 percent year-on-year in net profits of banks at the aggregate level.

The brokerage firm said that healthy retail loans may contribute to a broader loan growth and, therefore, core income growth as well.

Indeed, early releases of key numbers for Q3FY22 by select banks show that loan growth has seen a sharp improvement sequentially. Of course, some lenders have lagged here. However, large lenders such as ICICI Bank, HDFC Bank and Axis Bank are expected to report double-digit loan growth. “Private banks, with healthy capitalisation, should grow at 10 percent, gaining market share from PSBs (public sector banks),” analysts wrote in an ICICI Direct Research note.

For the industry, loan growth has improved to 7.4 percent in December from below 6 percent in June (see chart).

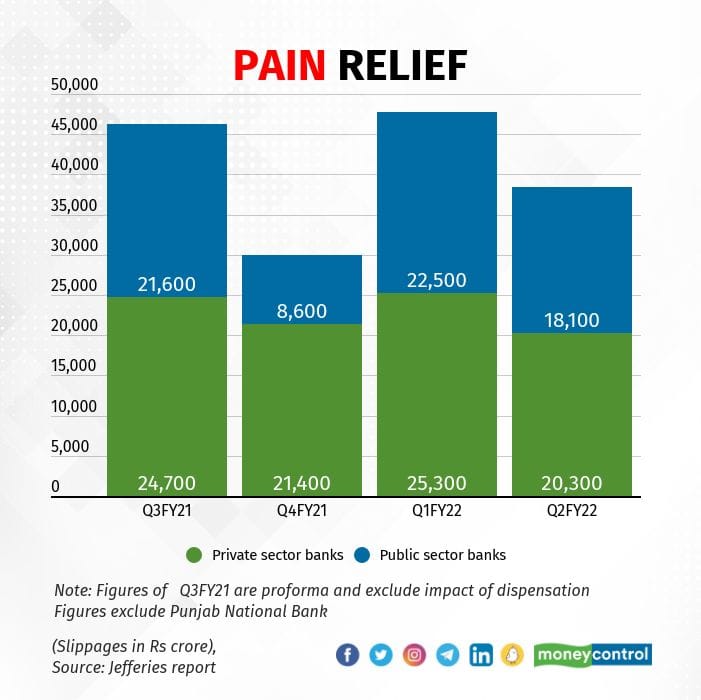

Core interest income growth has been found wanting in the past two quarters and could see some improvement in Q3FY22. That is because incremental slippages are likely to be low for banks.

If fewer loans turn bad, the loss of interest payment is also recouped to some extent, which would reduce the impact on net interest income for banks.

A dip in slippages would also mean the potential provisioning need would be lower. This would have a direct impact on profitability.

As such, lenders have built enough provisioning in the past two quarters for future stress. “We expect a slight moderation in slippages and credit costs as banks may see the tail end of downgrades and provisioning from Covid Wave-2. We see slippages moderating to 2.3 percent of past year loans (annualised),” said analysts at Jefferies in their preview report.

While the third quarter would bring good tidings for bank earnings and stocks, investors cannot rest easy as yet.

The restructured loan pile of most banks showed a sharp increase for the September quarter. The performance of this pile is key.

Further, loans extended under the government’s credit guarantee scheme have shown incipient signs of stress.

Then there is the resurgence in Covid cases and the new Omicron threat. States have begun to put restrictions on activity, which may impact businesses to some extent. Vulnerable segments such as microfinance and small business loans need to be watched closely.

“We believe Q3FY22 would be a better quarter sequentially as most business parameters show improvement. However, with the third wave of the pandemic gathering pace, management commentary on business growth outlook and asset quality would be important factors to watch,” said analysts at ICICI Direct Research.

The outlook provided by the management of banks would be critical to assess FY22 performance as a whole. For now, the impact of rising Covid cases on the economic activity does not seem intense and may be limited to already weak pockets of credit.