Looking at the price action, Karan Pai of GEPL Capital believes that the 17,200 mark is going to act as a make-or-break level. If the prices manage to breach below the 17,200 mark we might see an acceleration in bearish momentum.

Karan Pai, CMT

December 17, 2021 / 07:23 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Karan Pai, Technical Analyst at GEPL Capital

Nifty50 on the medium-term time frame seems to be very rangebound and is in moving between 17,600-16,700 mark. On the daily chart we can see that the index has been facing strong rejection near the 17,600 level. On December 13, the prices tested a high of 17,639 post which some selloff came in, that pulled the index lower toward the 17,180 mark.

We can also see that the 20-day SMA (simple moving average) breached below the 100-day SMA for the first time since June 2020. Pointing towards the presence of some bearishness in the trend.

On the indicator front, the RSI plotted on the daily time frame can be seen taking resistance at the 50 mark and moving lower, indicating towards the presence of bearish momentum in the prices.

Looking at the price action, we believe that the 17,200 mark is going to act as a make-or-break level. If the prices manage to breach below the 17,200 mark we might see an acceleration in bearish momentum and we might see the prices move lower towards 17,050-17,000 and eventually towards the 16,700 mark.

Here are three buy calls for next 2-3 weeks:

Bajaj Electricals: Buy | LTP: Rs 1,259.45 | Stop-Loss: Rs 1,190 | Target: Rs 1,442 | Return: 14 percent

Bajaj Electricals on the weekly time frame can be seen moving higher after finding a support near the Rs 900 mark. In the week started December 13, 2021 the prices gained momentum and managed to break above the 20-week SMA (simple moving average). This up move was backed by good volume build up, indicating participation in the up move.

On the indicator front the RSI (relative strength index) plotted on the weekly time frame can be seen placed above the 50 mark and moving higher towards the overbought level, indicating increasing bullish momentum in the prices.

Looking at the prices action and the technical parameters mentioned above we expect Bajaj Electricals to move higher immediately towards Rs 1,440, post which we might see the prices test Rs 1,591.

Bajaj Electricals seem to be a good buying candidate with upside targets of Rs 1,440 and Rs 1,591, we recommend a stop loss level of Rs 1,190 on daily closing basis for this setup.

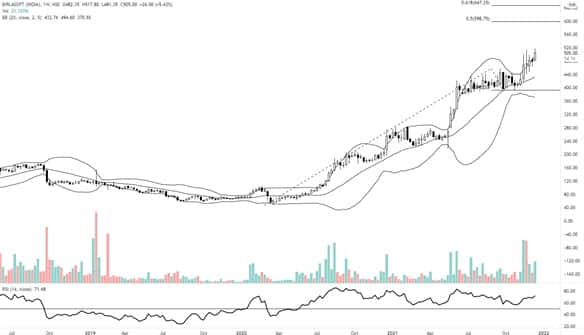

Birlasoft: Buy | LTP: Rs 505.30 | Stop-Loss: Rs 455 | Target: Rs 647 | Return: 28 percent

Birlasoft on the long term charts can be seen forming a higher high higher low pattern since March 2020.

On the weekly chart we can see the prices drifting higher and testing fresh 52-week highs after breaking out of a consolidation. The drift higher is backed by good volume build up, indictaing increasing participation as the prices move higher.

On the indicator front the RSI plotted on the weekly time frame witnessed a range shift and has been above the 50 mark since May 2020. Currently it is placed above the 50 mark and is moving higher towards the overbought level, indicating increasing bullishness in the trend.

The prices action and the technical parameters mentioned above point towards the possibility of the prices moving higher towards the Rs 598 mark. If the prices sustain above the 598 mark, we might see the prices move higher towards the Rs 647.

Birlasoft is currently moving higher after breaking out of a consolidation, going ahead we expect the prices to move higher and test the Rs 598 and Rs 647 mark. We recommend a strict stop loss of Rs 455 on closing basis.

Kajaria Ceramics: Buy | LTP: Rs 1,223.1 0 | Stop-Loss: Rs 1,150 | Target: Rs 1,441 | Return: 17.8 percent

Kajaria Ceramics on the weekly time frame has been forming a higher high higher low pattern after bouncing off the Rs 1,045 mark on November 29, 2021. In the week that started the prices managed to move a notch above the 20-week SMA (Rs 1,163). This was followed by the prices rallying in the following week.

The RSI plotted on the weekly chart can be seen moving higher after forming a bullish hinge near the 50 mark, indicating increasing bullish momentum in the prices.

The momentum indicators and the technical parameters all point towards the possibility of the prices moving higher towards the Rs 1,357 mark immediately. If this level is breach above the Rs 1,357 mark, we might see the prices move towards Rs 1,441 level eventually.

Our bullish view will be negated if the prices breach below the Rs 1,150. We also recommend this level to be a strict stop loss on closing basis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.