Karan Pai of GEPL Capital believes that for the coming session, the 20-week SMA (17,200) is going to act as a make-or-break level. If the prices breach the 17,200 mark, we might see the prices move lower towards the psychological level of the 17,000.

Karan Pai

November 25, 2021 / 07:15 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Karan Pai, Technical Analyst, GEPL Capital

For the past two weeks, the Nifty50 has been moving lower, the profit-booking spree that has been going on for a couple of sessions pushed the prices lower towards the 20-week SMA (simple moving average), where the prices seem to have found support.

The price action on the shorter time frame seems to be very indecisive, hinting at the possibility of the prices moving in a range.

On the option open interest (December 30, 2021), highest open interest addition was seen in the 17,900 Call and good participation was seen in the 17,000 Put contracts. Thus, we can expect the broader range of the index to be 17,000-17,900.

Looking at the chart, we believe, that for the coming session, the 20-week SMA (17,200) is going to act as a make-or-break level. If the prices breach below the 17,200 mark, we might see the prices move lower towards the psychological level of the 17,000.

On the upside, 17,900, the 20-day SMA will be the level to watch in the coming week. If the prices breach this level, we might see the prices move towards 18,400-18,600 mark.

Here are three buy calls for next 2-3 weeks:

Zee Entertainment Enterprises: Buy | LTP: Rs 334.40 | Stop Loss: Rs 300 | Target: Rs 405 | Return: 21.1 percent

Zee Entertainment for the past couple of weeks has been moving in a range despite the benchmark indices (Nifty and Sensex) witnessing profit-booking. On November 22, the stock tested a low of Rs 292, after which it witnessed a sharp bounce, and the prices have been forming a higher high pattern ever since.

On the indicator front, the RSI (relative strength index) plotted on the weekly chart can be seen moving higher towards the overbought level, indicating increasing bullish momentum in the prices.

Looking at the price action and the technical parameters mentioned above, we expect Zee to move higher immediately towards the previous swing high of Rs 363, after which we might see the prices test Rs 405.

Zee seems to be a good buying candidate with upside targets of Rs 363 and Rs 405. We recommend a stop loss level of Rs 300 for this setup.

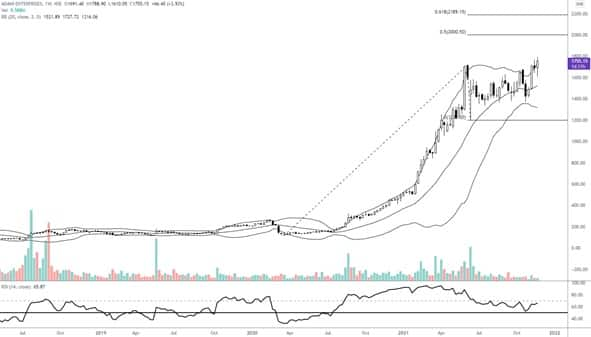

Adani Enterprises: Buy | LTP: Rs 1,755.15 | Stop Loss: Rs 1,600 | Target: Rs 2,000 | Return: 14 percent

After a long consolidation of about 25 weeks, the prices finally managed to gain momentum and break above the previous swing high of Rs 1,716.

The Bollinger bands plotted on the weekly chart can be seen expanding after a bit of a contraction, indicating increasing volatility as the prices break out of a long consolidation.

The RSI plotted on the weekly time frame can be seen moving higher towards the over-bought level after forming a bullish hinge near the 50 mark, indicating increasing bullish momentum in the trend.

The price action points towards the possibility of increasing momentum and the prices moving towards fresh lifetime highs.

Investors can accumulate Adani Enterprises at this point and hold with a target of Rs 2,000 and Rs 2,189 and maintain a stop loss at Rs 1,600 on closing basis.

Raymond: Buy | LTP: Rs 620.40 | Stop Loss: Rs 580 | Target: Rs 707 | Return: 14 percent

Raymond has been moving higher in a well channelled manner since October 2020. In the current week, the prices gained momentum and breached above the upper trendline of the channel. This was backed by highest volume since August 2010.

The momentum indicators and the technical parameters point towards the possibility of the prices moving higher towards the Rs 707 mark immediately; if this level is breached, we might see the prices move towards Rs 838 level eventually.

Our bullish view will be negated if the prices breach below the Rs 580. We also recommend this level to be a strict stop loss level.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.