After a fabulous upside rally, Nifty witnessed a big sell-off from the levels of 18,600. Nifty made fresh all-time high of 18,594 in mid-October, but slipped to the level of 17,650 on October 29.

The Nifty futures during this week ranged from 18,350 to 17,659. On the OI (Open Interest) front, long-unwinding was witnessed in Nifty over the week gone by.

Bank Nifty also gave up its gains after hitting fresh all-time high of 41,820 and fell from there with loss of approx 1,000 points. The broader range for Bank Nifty was 41,820-38,600.

Bank Nifty shut shop with loss of approximately 2.3 percent last week. On the OI front, short built-up was witnessed in Bank Nifty over the week gone by.

Further diving into the Nifty’s upcoming weekly expiry, Call writers are showing aggression by building more positions compared to put writers.

Nifty immediate resistance stands at the 18,000 levels where nearly 72 lakh were added – highest among all strikes – followed by vital resistance at 19,000 levels with 52 lakh shares.

On the lower side, immediate support level is at 17,500 where nearly 22 lakh shares were added, followed by 17,000 with addition of 22 lakh shares.

Looking at the Bank Nifty’s upcoming weekly expiry data – on the upper side, immediate resistance stands at 40,000 (13 lakh shares) followed by 41,000 (18 lakh shares). Whereas, on the downside, 39,000 (9 lakh shares) stand at the immediate support level and followed by 38,500 (7 lakh shares) as the vital support level.

India VIX, fear gauge, decreased marginally by 2.50% from 17.55 to 17.11 over the week. India VIX is trading near the lowest level of pre-covid crash. Cool-off in the IV has given relaxation to market. Further, any downtick in India VIX can push the upward momentum in Nifty.

Looking at the sentimental indicator, Nifty OI PCR for the week has decreased from 0.818 to 0.75. Bank Nifty OIPCR over the week decreased from 1.017 to 0.617 compared to last Friday. Overall data indicates more of call writers over put writers in Nifty.

Nifty monthly rollover stands 71.68% in Sept series expiry while Bank Nifty rollover stands at 73.52 in Sept series expiry. Bandhan Bank has saw the highest stock wise rollover of 96.63% followed by Grasim & JK Cement with rollover standing at 95.91 And 94.88% respectively.

Looking towards the top gainer & loser stocks of the month in the F&O segment. Tata Motors topped by gaining over 46.4%, followed by Tata Power 36.5%, Canara Bank 24.30%. Whereas, IDEA has lost over 19.7%, Indiamart -14.50 %, Ipca Lab -12.20% over the month.

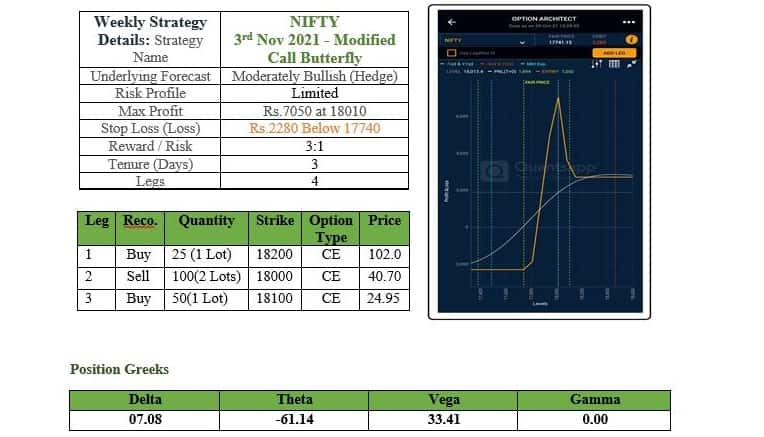

Considering the bullish momentum, this week can be approached with a low-risk strategy like Modified Call Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.