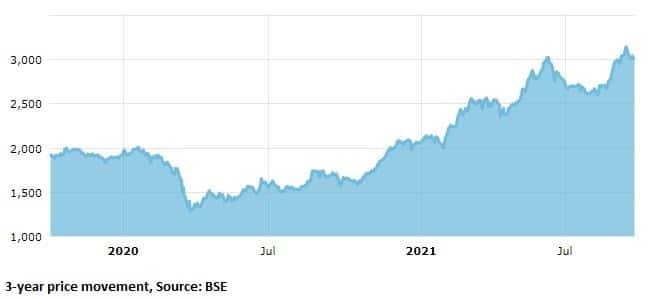

While the market is under pressure amid profit booking, the S&P BSE Power index is up over 2 percent. The index hit 3-year high of 3,111 level led by gains from Power Grid and Bharat Heavy Electricals which jumped over 5 percent each followed by NTPC, Tata Power, KEC and NHPC among others.

BHEL is in focus after the company won an order from Goa Shipyard for warship gun mount. “Goa Shipyard has placed a maiden order on Bharat Heavy Electricals Limited (BHEL) for supply of an upgraded Super Rapid Gun Mount (SRGM), the Main gun onboard most Warships of the Indian Navy,” company said in its press release.

Power Grid, on the other hand, received shareholders’ approval to raise up to Rs 6,000 crore through bonds or debentures on a private placement basis and REC received shareholders’ approval to raise up to Rs 85,000 crore through issuance of non-convertible bonds or debentures.

NTPC registered a fresh 52-week high after the company confirmed the winning of 1.9 GW solar projects under Central Public Sector Undertaking (CPSU) scheme.

According to a report by Motilal Oswal, “Demand has been improving with coal reporting a 33 percent YoY increase in offtake for 1QFY22. With improving offtake and realisations, we see operating leverage coming into play in FY22. Notwithstanding any further negative shocks, we expect coal’s profitability to recover in FY22E (+24 per cent YoY).”

“The capex run-rate is likely to increase in the near term, but higher dispatches and some normalisation in receivables should aid cash generation and maintain dividends (dividend yield: 12 percent),” the brokerage firm added.

Catch all the market action on our live blog

As Power stocks outperformed over 174 stocks hit new 52-week high on BSE including Power Grid Corporation, Power Finance Corporation, NTPC, Coal India, Diamond Power and NHPC among others.

Equity market was trading at day’s low at the time of writing this copy, following weak Asian cues with Sensex down 488.20 points, or 0.81 percent, at 59,589.68 and the Nifty falling 125.20 points, or 0.70 percent, at 17,729.90.

The market was largely dragged by sectors such as realty, the index fell over 3 percent, followed by IT, banks and pharma stocks.

According to VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, markets might consolidate for a while before making a decisive move. There are conflicting signals that might influence the markets in the short-term. Rise in US 10-year bond yield is a negative for emerging markets like India, particularly if this trend sustains and gathers momentum, going forward. Rise in Brent crude to USD 80 is a negative for India’s macros.

“We are witnessing sectoral rotation in Indian markets now. Buying in banks and autos is a reflection of increasing confidence in the domestic economy theme. There is profit booking in IT since the segment has given excellent returns of 82 percent one-year return,” he added.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.