If you are planning to invest fresh money in the stock market – the words premium, overvalued, overbought or correction might cloud your decision. Well, you are not alone as most investors who plan to put in fresh money want to time the market.

Rather than timing the market, spending time in the market creates wealth. But, yes, there is some truth to the concerns as well.

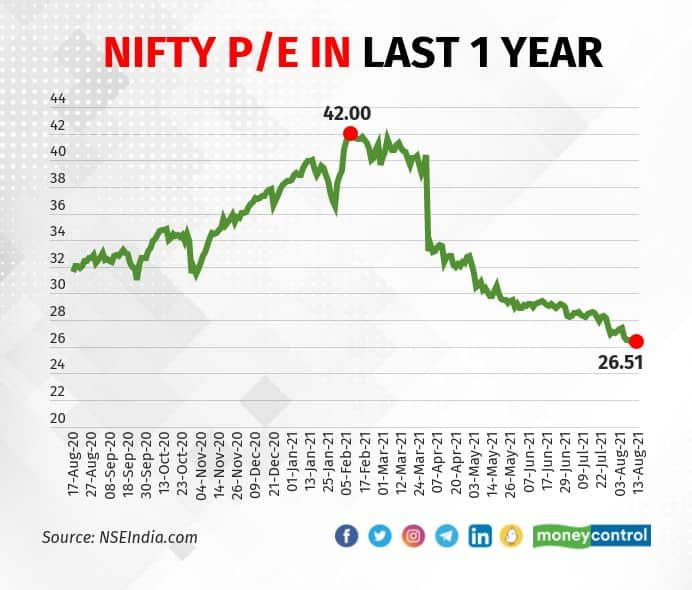

The Nifty50, which hit a fresh record high of 16,614 on August 17, was trading at a trailing price to earnings (P/E) of 26.51x as on August 13, NSE data showed. This multiple has fallen from the high of 42x in February, when the markets attempted to exceed the 15,000 barrier for the first time.

Why the abrupt drop in P/E multiple?

The abrupt drop in the P/E multiple is largely on two counts – one, there has been a change in methodology for calculating PE in the Nifty50 from the standalone EPS to consolidated earnings of companies; and, two, the rise in earnings of India Inc.

The P/E ratio is a function of earnings growth. This ratio shows you how many times the actual or anticipated annual earnings a stock is trading at.

“Since February 2021, we have had the advantage of two quarters of earnings announcements, and they are on the higher side in comparison to the previous quarters,” Gopal Kavalireddi, Head of Research, FYERS, said.

“In addition to this, earlier, the Nifty PE ratio was measured based on the standalone earnings of its 50 constituents. But the methodology has been changed to take the consolidated results into consideration. These two factors have resulted in a dramatic fall in the trailing Nifty PE ratio from a high of 42X in February, all the way down to 26.1X currently,” he added.

Despite the drop, experts are of the view that valuations are on the expensive side across most sectors, but higher liquidity will help markets stay at elevated levels.

“Valuations are a product of liquidity and future outlook. Even though we are trading at a premium compared to historical averages of 20x, what market participants must realise is that we’ve never seen this sort of liquidity influx,” Divam Sharma, Co-founder of Green Portfolio, said.

“Besides the liquidity story, the future looks bright for Indian companies on the back of anti-China sentiments and the growth of the middle class. We expect the stock market to further push higher and P/E to fall as earnings continue to impress,” he said.

What does future earnings picture suggest?

It is said that stock prices are the slaves to earnings, and if you go by the commentary from experts, future prospects of earnings growth are in double digits for FY22 as well as FY23.

“The Nifty marched to new lifetime highs and is currently trading at 22.4x on FY22E and 19.5x on FY23E earnings. We expect Nifty50 earnings to grow by 29.2 percent in FY22E (EPS Rs 727) and by 14.8 percent in FY23E (EPS Rs 835),” Shrikant Chouhan, Executive Vice President at Kotak Securities Ltd, said.

“From now, till the end of FY22, we expect modest returns from the Indian market, considering the strong economic recovery and gradual increase in global and domestic bond yields. By the end of FY22, investors would start discounting FY23 earnings,” he said.

Chouhan further added that considering a 300-400 bps premium of equity PE over bond PE, we can justify forward PE of 20x for Nifty50. On FY23E EPS of Rs 835, we can expect Nifty50 to end FY22 somewhere around 16,700 (+/- 500 points).

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.