Foreign Portfolio Investors’ (FPI) holdings in companies listed on the NSE went down to 21.66 percent, as on June 30, 2021, from 22.46 percent, as on March 31, 2021, on an aggregate basis by value percentage, data from primeinfobase.com highlighted.

In rupee terms, FPI holdings stood at Rs 48.82 lakh crore. This was an increase of 8.46 percent over the last quarter.

In terms of ownership by number of shares (average of ‘FPI holdings as a percentage of total share capital’ across all NSE-listed companies), FPI ownership went down to 5.89 percent, as on June 30, 2021, from 5.94 percent on March 31, 2021, data showed.

On an overall basis, FPI holdings went up in 543 companies listed on the NSE in the last one quarter. The average stock price of these companies in the same period increased by 39.93 percent.

On the other hand, FPI holdings went down in 477 companies listed on the NSE. The average stock price of these companies in the same period increased by a much lower 30.18 percent.

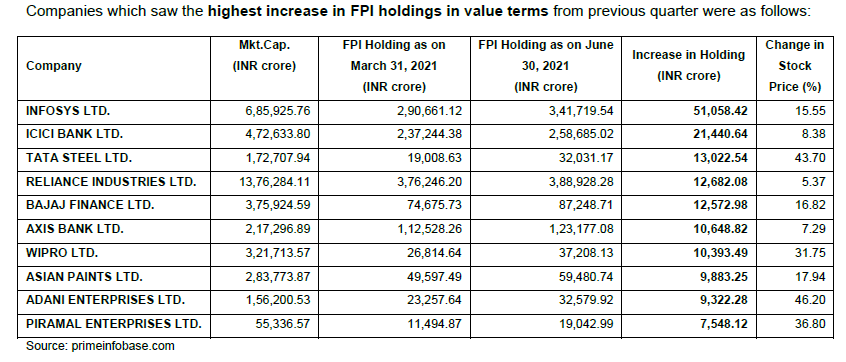

The top 10 companies that saw the highest increase in FPI holdings in value terms in the June quarter from the previous quarter include names like Infosys, ICICI Bank, Tata Steel, RIL, Bajaj Finance, Axis Bank, Wipro, Adani Enterprises, and Piramal Enterprises, etc.

“FII investment trends are pointing towards more value investments. Allocations towards value stocks has been the strategy for many smart investors over the last few quarters,” Divam Sharma, Co-founder, Green Portfolio, said.

“Power, Commodities, IT, Pharma & Chemicals are expected to do well over the next few years. A lot of investments and capital expenditure have gone into these industries that will pave the way for future growth, and, hence, they are seeing a lot of interest from FIIs,” he said.

Note: Data is for reference and not buy or sell ideas

FPIs have raised stake in about 50 percent companies in the BSE 500 index. Buying has been broad-based by foreign investors. Analysts suggest that the focus of foreign investors is to pick companies that could gain from the pandemic.

“Recent changes in FII shareholdings suggest foreign investors are preferring sectors that can gain from the pandemic and are cyclical — like BFSI, Metals and Pharmaceuticals. They can bounce back quickly when the situation starts improving,” Siddharth Sedani, Vice-President, Equity Advisory, Anand Rathi Shares and Stock Brokers, said.

“FIIs were net sellers in April and continued their buying streak in June 2021 at $ 1.5 billion, increasing stakes in about 50 percent companies in the BSE 500 Index. In the last 12 months, midcaps have risen 83 percent, against a rise of 44 percent for the BSE,” he said.

Sedani further added that FII inflow is important but the individual focus should be on growth along with reasonable valuation.

In terms of value, the highest decrease in FPI holding was seen in stocks like Kotak Mahindra Bank, HDFC Ltd, ITC, Vedanta, Adani Ports, HCL Technologies, AU Small Finance Bank, YES Bank, Havells India, and M&M Financial Services.

Analysts see these changes more focused on portfolio churning towards growth stocks. “These are portfolio re-allocations from the popular largecap stocks to a wider market where there are more opportunities to make money on investments,” says Sharma of Green Portfolio.

What should investors do?

Based on what FPIs are doing every quarter, investors can track the themes but replicating a similar portfolio should be avoided.

Investments should always be tuned in such a way that can meet individual objectives and at the same time maintain the risk profile. FPI portfolio risk profile, as well as investment objectives, could vary.

Apart from tracking what FPIs are doing, investors should also look at other valuation parameters to take a sound buy or a sell decision.

“There are certain core parameters an individual can look into before investing in any individual stock, like promoters’ holding which shows their own skin in the game, return on equity, debt to equity, business and product viability and current micro and macro-economic situation in the country,” advises Sedani of Anand Rathi Shares and Stock Brokers.

“If any stock is available at attractive valuations with visibility of earnings growth, one should accumulate a few good quality stocks,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.