Shares of Lear Corp. lost ground Friday, after the auto seating and electronics systems company came up short on second-quarter revenue and slashed its full-year outlook, citing semiconductor supply issues and a record surge in steel costs.

The company reported before the open that it swung to net income of $ 175.2 million, or $ 2.89 a share, for the quarter to July 3, from a loss of $ 293.9 million, or $ 4.89 a share, in the same period a year ago.

Excluding nonrecurring items, adjusted earnings per share came in at $ 2.45, after a per-share loss of $ 4.14 last year, and above the FactSet EPS consensus of $ 2.41.

Sales soared 94.8% to $ 4.76 billion, reflecting increased production and new business in both of its segments, but came up short of the FactSet consensus of $ 4.81 billion.

The stock LEA, -0.11% slipped 0.4% in midday trading, paring earlier losses of as much as 3.2% to an intraday low of $ 164.22. It has lost 17% since closing at a three-year high of $ 203.13 on June 3.

Among Lear’s business segments, Seating sales rose 105.6% to $ 3.61 billion, but was just below the FactSet consensus of $ 3.64 billion, while E-Systems sales grew 67.1% to $ 1.15 billion to match expectations.

“Our customers experienced significant production disruptions which reduced Lear’s second-quarter revenue by approximately $ 1 billion,” said Chief Financial Officer Jason Cardew, according to a FactSet transcript of the post-earnings conference call with analysts. Read more about what caused chip shortages.

Production downtime related to chip shortages reduced Seating sales by about 15%, or $ 660 million, and hurt E-Systems sales by 24%, or $ 360 million, Cardew said.

Also read: Inogen stock suffers record plunge as chip shortage to hurt sales, margins for another year.

“While our financial outlook in May reflected significant customer downtime due to components shortages, the extent of the disruptions worsens considerably in the last several weeks of the second quarter and is continued into August,” Cardew said.

As a result, the company cut its guidance range for 2021 sales to $ 19.7 billion to $ 20.5 billion, from previous guidance of $ 20.35 billion to $ 21.15 billion provided in May.

The company also cut its outlook for core operating earnings to a range of $ 920 million to $ 1.11 billion from $ 1.14 billion to $ 1.31 billion, and for free cash flow to $ 350 million to $ 500 million from $ 550 million to $ 700 million.

But component shortages aren’t the only thing that pulled down Lear’s outlook. There’s also the recent sharp run up in steel costs.

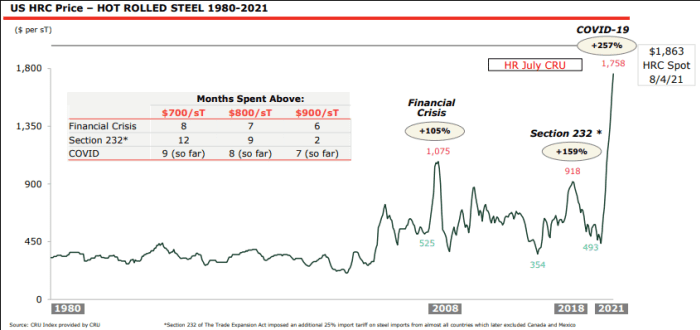

Lear Corp., CRU Index provided by CRU

Cardew noted that except for short-duration price spikes, hot-rolled steel costs have remained in the range of $ 400 to $ 700 per ton for the last several years. But prices started surging late last year, and have broken records each month in 2021.

Now, prices are $ 600 to $ 700 per ton higher than industry experts were expecting three months ago, when Lear issued its previous full-year guidance, he said.

“Historically, the typical spike above $ 900 [per ton] has lasted two to six months,” Cardew said. “We’re now seven months into the current cycle.”

Lear’s stock has shed 12.2% over the past three months but has gained 6.2% year to date, while the S&P 500 index SPX, +0.15% has tacked on 5.6% the past three months and rallied 18.1% this year.