Retirement at first is fun and feels pretty good. No more setting an alarm. No more dealing with a long commute. No demanding work schedule that leaves you exhausted most evenings.

Best of all, no one is telling you what to do. You can sleep in or travel to all those places you dreamed about. You can golf as much as you like or spend lots of time with the grandkids.

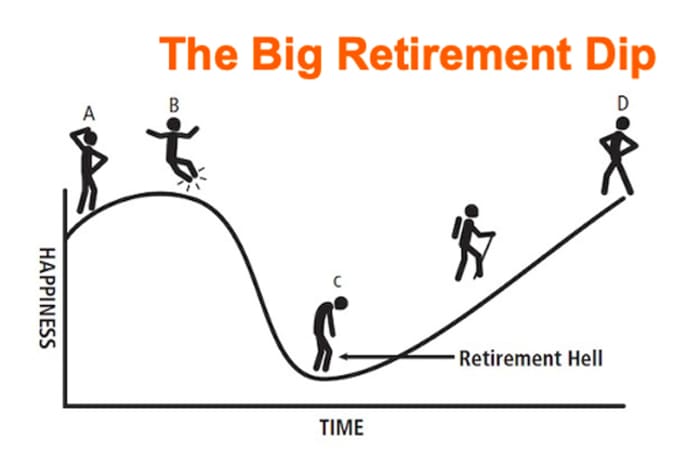

You’re as free as a bird. For some—those I call comfort-oriented retirees—this will be enough. But at some point, many retirees will feel a need to do something else—something more meaningful, interesting and challenging. This is when the slide down into retirement hell begins. That brings me to the graph below, which is from my new book.

Retirement Heaven or Hell

In retirement hell, you get a feeling of being incredibly lost and vulnerable. Your heart isn’t into the hobbies and activities that used to bring you joy. The life of leisure that you dreamed about for so long becomes empty and meaningless. This is when the depression sinks in.

When I was forced out of my banking career, I was happy. I had been planning on leaving anyway because the stress was getting to me and I really didn’t like working there anymore. Getting that severance check at age 59 made me feel like I’d won the lottery. Things seemed good until that first Monday morning hit.

My wife had gone to work and I found myself sitting at home alone. Things were pretty quiet. I missed the phone calls and daily emails I used to get at work. I started to get a little antsy. I couldn’t even hang out with my friends because all of them were still working.

What was really frustrating was that neither my friends nor my wife could understand what I was going through. They couldn’t relate to me being unhappy. It just didn’t make any sense to them.

I had trouble sleeping most nights and would get this ringing in my ears from all the stress I was experiencing. After falling asleep, I’d usually wake up around 2 a.m. and spend the rest of the night tossing and turning. That’s when the fear would creep in.

My wife would sometimes wake up and ask me what’s wrong.

I would say something like, “I’m worried we don’t have enough money saved up.”

She’d say, “Don’t worry, we’re fine.”

For the record, my wife is an investment adviser who manages our portfolio and pays the bills, so she has a good grasp of what fine is. But hearing her say that just stressed me out more. I couldn’t relate to what fine was. I sure wasn’t feeling fine.

Eventually, I realized it was my fault. The problem: I wasn’t able to define fine. I didn’t know what I wanted to do in retirement, nor how much that would cost. Until I nailed that down, I couldn’t feel fine. Instead, I felt uneasy, with the need to have just a little bit more in savings.

Once I finally figured out what I wanted to do in retirement—and confirmed that we had sufficient retirement cash flow to cover that—I slept better at night. Knowing that we had enough allowed me to start focusing on the possibilities instead of the problems. That’s when I started on the road out of retirement hell.

This column originally appeared on Humble Dollar. It was republished with permission.

Mike Drak is a 38-year veteran of the financial services industry. He’s the author of Retirement Heaven or Hell, which was just published, as well as an earlier book, Victory Lap Retirement. Mike works with his wife, an investment adviser, to help clients design a fulfilling retirement. For more on Mike, head to BoomingEncore.com. His previous articles were Who Are You and Retirement Preview.