The initial public offering of food delivery company Zomato will open in the coming week. This will be the 27th public issue in 2021 so far.

It is the largest IPO in last 16 months after SBI Card (Rs 10,355 crore) that was launched in March 2020.

Here are 10 key things to know before subscribing the public issue:

1) Public Issue

The Rs 9,375-crore public offer comprises a fresh issuance of equity shares of Rs 9,000 crore, and an offer for sale of Rs 375 crore by existing selling shareholder Info Edge.

The public issue includes a reservation of up to 65 lakh equity shares for employees of the company.

2) IPO Dates

The offer will open for subscription on July 14 and the bidding will close on July 16. The anchor book, if any, will open for a day before the issue opening, i.e. July 13.

To Know All IPO Related News, Click Here

3) Price Band

The price band for the offer has been fixed at Rs 72-76 per equity share, by the company after consultation with merchant bankers.

4) Lot Size and Reserved Portion Category-wise

Investors can bid for a minimum of 195 equity shares and in multiples of 195 equity shares thereafter. Considering this lot size, retail investors can apply for a minimum of Rs 14,820 worth of shares and a maximum of Rs 1,92,660 shares at higher price band of Rs 76 per equity share.

Up to 75 percent of the total offer has been reserved for qualified institutional buyers, up to 10 percent for retail investors, and the rest 15 percent for non-institutional buyers.

Catch all the market action on our live blog

5) Objectives of the Issue

The food delivery giant will utilise its net proceeds from fresh issue for funding organic and inorganic growth initiatives (Rs 6,750 crore); and general corporate purposes.

6) Company Profile

Zomato’s technology platform connects customers, restaurant partners and delivery partners, serving their multiple needs. Customers use its platform to search and discover restaurants, read and write customer generated reviews and view and upload photos, order food delivery, book a table and make payments while dining-out at restaurants.

On the other hand, the company provides restaurant partners with industry-specific marketing tools which enable them to engage and acquire customers to grow their business while also providing a reliable and efficient last mile delivery service.

The company also operates a one-stop procurement solution, Hyperpure, which supplies high quality ingredients to restaurant partners. It also provide delivery partners with transparent and flexible earning opportunities.

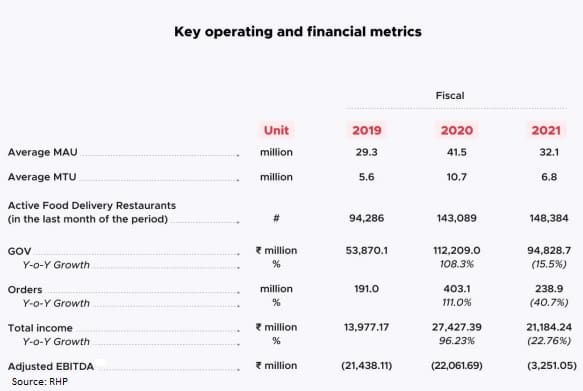

According to RedSeer, it is one of the leading food services platforms in India in terms of value of food sold, as of March 2021. During FY21, 32.1 million average monthly active users (MAU) visited its platform in India.

As of March 2021, the company was present in 525 cities in India, with 3,89,932 active restaurant listings.

Its mobile application is the most downloaded food and drinks application in India in each of the last three fiscal years since FY19-FY21 on iOS App store and Google Play combined, as per App Annie’s estimates.

7) Competitive Strengths & Strategies

Competitive Strengths

a) It has strong network effects driven by its unique content and transaction flywheels. Its end-to-end food services approach makes it the most unique food services platform globally combining the offerings of platforms such as Yelp, DoorDash and OpenTable in a single mobile app, according to RedSeer.

b) It has widespread and efficient on-demand hyperlocal delivery network.

c) The company is a technology first organization leveraging artificial intelligence, machine learning and deep data science to continuously drive innovations on platform for community of customers, delivery partners and restaurant partners.

d) Zomato is a strong consumer brand recognized across the length and breadth of India.

Long term growth strategy

a) It wants continuous focus on unit economics and growth, at the same time.

b) It intends to expand and strengthen community across its three businesses – food delivery, dining-out and Hyperpure.

c) It will invest in new products, technologies and features for the benefit of its customers.

d) It will continue to invest to build a strong consumer brand recognized across India.

8) Financials

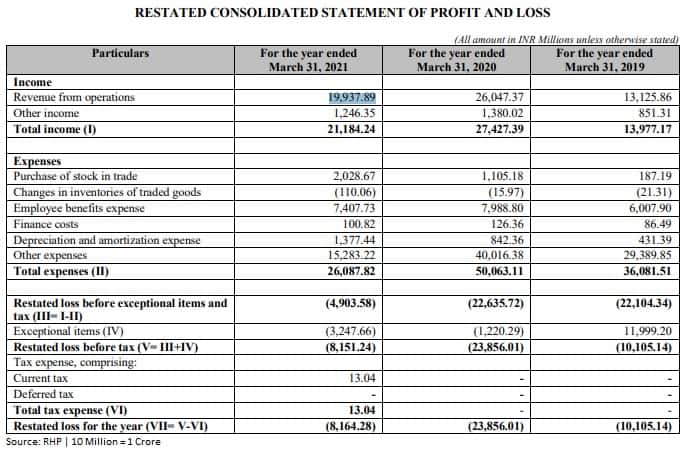

The food delivery company’s consolidated loss at Rs 2,385.6 crore in financial year ended March 2020 widened from loss of Rs 1,010.2 crore in previous year. But revenue nearly doubled to Rs 2,604.7 crore from Rs 1,312.58 crore in the same period.

Consolidated loss for financial year FY21 stood at Rs 816.43 crore on revenue of Rs 1,993.78 crore. The decline in revenue was largely due to the impact of Covid-19.

The company has no listed comparable entity in India.

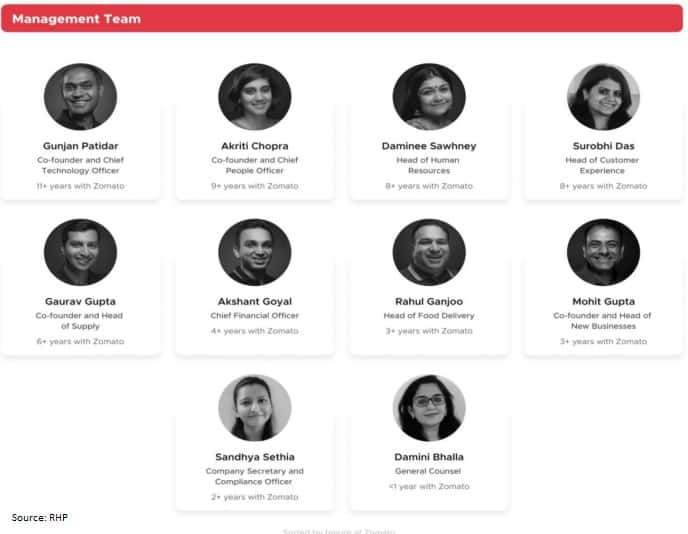

9) Promoters and Management

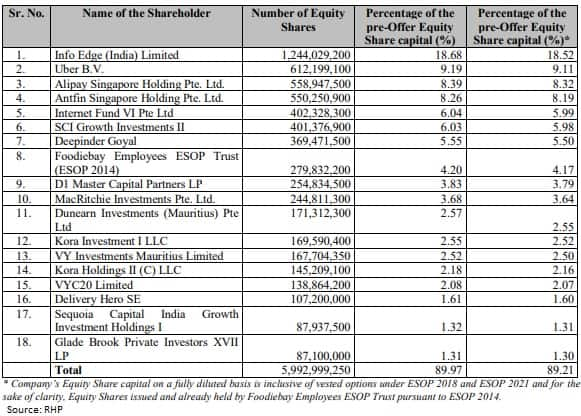

Zomato is a professionally managed company and hence, there are no members forming part of the ‘promoter group’. As of July 6, the company has 74 shareholders.

Pure play internet company Info Edge (India) is the largest shareholder in Zomato with 18.68 percent pre-offer equity stake, followed by Uber B V (9.19 percent stake), Alipay Singapore Holding (8.39 percent), Antfin Singapore Holding (8.26 percent), Internet Fund VI Pte Ltd (6.04 percent), SCI Growth Investments II (6.03 percent), and Deepinder Goyal (5.55 percent).

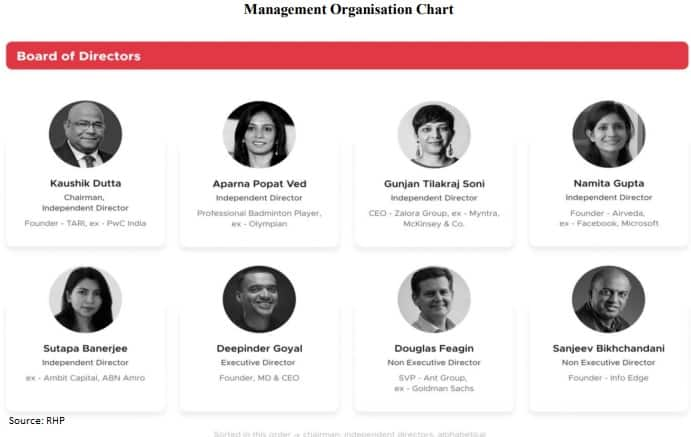

Kaushik Dutta is the Chairman and an Independent Director of the company. He is a fellow member of the Institute of Chartered Accountants of India with over 25 years of experience. He is co-founder of Thought Arbitrage Research Institute, an independent not-for-profit research think tank working in areas of corporate governance, public policy and sustainability. He was also associated with Price Waterhouse & Co., Chartered Accountants LLP, and Lovelock & Lewes, Chartered Accountants as Partner for over 25 years.

Deepinder Goyal is the Founder and is the Managing Director and the Chief Executive Officer of the company. He holds an integrated master’s degree of technology in mathematics and computing from the Indian Institute of Technology, Delhi. Prior to founding Zomato, he worked with Bain and Company.

Sanjeev Bikhchandani, and Douglas Lehman Feagin are Non-Executive Directors of the company. Aparna Popat Ved, Gunjan Tilak Raj Soni, Namita Gupta, and Sutapa Banerjee are Independent Directors on the company’s board.

Gunjan Patidar is co-founder of the company and currently the chief technology officer. He holds a bachelor’s degree of technology in textile engineering from the Indian Institute of Technology, Delhi.

Akriti Chopra is currently the co-founder and chief people officer at the company. Prior to joining the company, she was associated with PricewaterhouseCoopers group through its network firm Lovelock & Lewes, Chartered Accountants for three years.

Gaurav Gupta is co-founder and currently the head of supply at the company. He holds a bachelor’s degree of technology in chemical engineering from the Indian Institute of Technology, Delhi, and a post graduate diploma in computer aided management from the Indian Institute of Management, Calcutta. Prior to joining the company, he worked with A.T. Kearney Limited for over 10 years.

Akshant Goyal is currently the Chief Financial Officer of the company. He holds a bachelor’s degree of engineering in computer science from the University of Delhi and a post graduate diploma in management from the Indian Institute of Management, Bangalore. Prior to joining the company, he worked in different roles with Kotak Mahindra Capital Company and a fin-tech start up.

Rahul Ganjoo is currently the head of food delivery at the company. He holds a bachelor’s degree of engineering in computer science from the University of Pune and a master’s degree of science in software engineering from the Birla Institute of Technology & Science, Pilani, Rajasthan. Prior to joining the company, he worked for over 16 years in different roles with Wipro, ThoughtWorks Inc., Symantec Corporation, SAY Media (formerly SixApart), Twitter Inc., and Jasper Infotech Private Limited (Snapdeal).

Mohit Gupta is co-founder and currently the head of new businesses at the company. He holds a bachelor’s degree of engineering in mechanical from Sardar Patel University, Gujarat and a post graduate diploma in management from the Indian Institute of Management, Calcutta. Prior to joining the company, he worked for over 19 years in different roles with Pepsi Foods, and MakeMyTrip (India).

10) Allotment, refunds and listing dates

The company will finalise the IPO share allotment around July 22, and the funds will be refunded or unblocked from ASBA account around July 23, 2021.

Equity shares issued will be credited to eligible investors’ demat accounts around July 26, and shares will debut on the bourses on July 27.

Kotak Mahindra Capital Company, Morgan Stanley India Company, and Credit Suisse Securities (India) are the global co-ordinators and book running lead managers to the issue. BofA Securities India, and Citigroup Global Markets India are the book running lead managers to the offer.