The bull run in the stock market may continue as long-term fundamentals are strong but investors need to tone down their expectations and brace for some volatility as valuations are high and the trajectory of the pandemic is uncertain, experts said.

The market rally, which has continued so far in June, has been broad based. Nifty50 has risen 12 percent this year to the 15,693 on June 3, while the Nifty Midcap index gained 26 percent and the Nifty Smallcap 100 index is up 33 percent in the same period. The S&P BSE Sensex is less than 1 percent short of its record high of 52,516 registered on February 16.

Money managers which Moneycontrol spoke to are not bearish, but cautious at current levels, and advise investors to book profits, and then re-enter at lower levels.

“Bull market rally shall continue, but return expectations need to be moderated. A lot of companies have reached reasonable valuation, and some are already above that,” Hemang Kapasi, Head of Equities, Sanctum Wealth Management said.

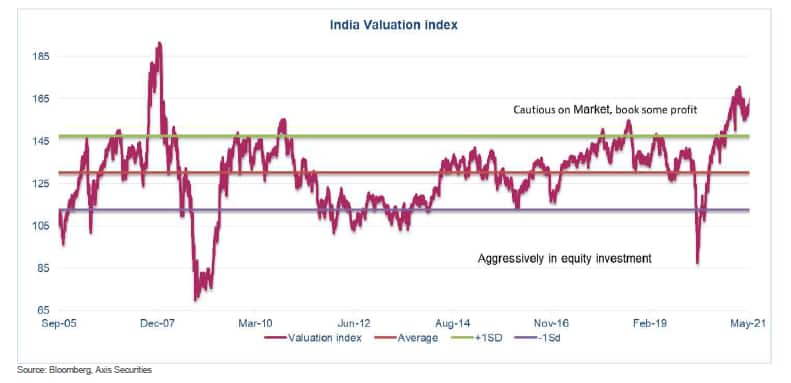

India Valuation Index computed by Axis Securities for June 2021 highlighted that the valuation index has retraced back to the cautions zone after the recent run-up (earlier seen in 2018). The Nifty50 rose 4 percent in 2018.

“The index value was one standard deviation below its long-term average in March 2020 which meant one should have aggressively invested in Equity. However, current levels indicate some profit booking in the market (especially large caps),” added the report.

The calculation of the India valuation index is based on four fundamental market parameters (12-M Forward PE, 12-M Forward PB, Bond Equity Earning yield ratio, and Mcap-to-GDP ratio).

In terms of valuations, the Nifty is currently trading at 20.4x on 12m fwd PE, 2 std above its long-term average while Nifty is trading 1.0 std on 12m fwd Price-to-book P/B).

India’s total market cap to GDP ratio has risen to 114 percent, far above the long-term average of 71 percent which also signals caution.

“Market has gained strength on expectations of economic recovery post containment of COVID cases in the second wave and the ongoing vaccination drive. Market movement for the rest of the year is likely to be driven by the progress on these same factors,” Harsha Upadhyaya, President & Chief Investment Officer – Equity, Kotak Mahindra AMC said.

“However, valuations have remained at higher levels compared to the historical range and could result in higher volatility if there is any unforeseen negative development,” he said.

What should investors do now?

There are risks to the current market rally such as pace of vaccination, a new variant of COVID-19, FY22 earnings downgrades as well as rising commodity prices that could lead to higher interest rates as inflation rises which will be negative for equities.

Experts said the market is currently running high on momentum and on track to create history, but investors should look at opportunities to book some profit, use the cash to build a diversified portfolio, and remain fully invested.

“It is never advisable to sit on cash as one can never time the market. It may turn out that one may miss the bigger rally while waiting doe the correction. Thus, investors should keep booking profit intermittently but should stay fully invested,” Ajay Menon-CEO, Broking & Distribution, MOFSL said.

“Though the markets have touched new lifetime highs and valuations are slightly on a higher side, but still the long-term fundamentals remain intact, and thus the market may not witness large corrections,” he said.

He said an investor should focus on asset allocation and build a diversified portfolio to navigate any volatility or bearishness.

But it is not easy to decide when to book profits.

“The strategy to Sell/book profits and buy later at lower levels sounds like a great thing, but in most scenarios it’s easier said than done. The key to figuring this out is the direction of Primary Trend of the markets/economy over next two years,” Sachin Shah, Fund Manager, Emkay Investment Managers Limited said.

“If one believes that the primary trend is pointing northwards, then trying to sell and buy-back for a gain of less than 5%-15% is not only tax-inefficient but also risks a high probability of missing out on the big upside that’s lying ahead just a few quarters away,” he said.

Shah said that in this process most investors tend to end up trading their good quality stocks/businesses with low-quality stocks and eventually get stuck with them almost perennially.

Experts recommend a bottom-up approach rather than a top-down approach that could be more appropriate in the case of mid and small caps which have hit fresh record highs in May and the trend continued in June as well.

After a swift rally of 20-30% seen in the Mid & Smallcap indices, largecaps may now see some traction.

“We could see some rotation in the market cap orientation post Q4 result season whereby large caps might outperform the mid and small caps,” Rusmik Oza, Executive Vice President, Head of Fundamental Research said.

“Investors should book profit in stocks whose valuations are near highs and which captures earnings growth of next two years. Ideal strategy should be to buy on every dip,” he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.