The bulls have taken charge of Indian markets, pushing the Nifty50 to record highs on May 28 even as the market cap of BSE-listed companies has gone past $ 3 trillion for the first time.

The Nifty, which hit a record high of 15,455 on May 28, has rallied more than 10 percent in 2021. The rally has been led by gains in Sun Pharma, Divi’s Laboratories, SBI Life, IOC, Asian Paints, Wipro, Tata Steel, and JSW Steel, which are up 10-60 percent since February 16 when the index hit the previous high of 15,431.

Stocks that more than doubled investors’ wealth in the NSE500 index since February 16 are Adani Total Gas, Hindustan Copper, Angel Broking, Happiest Minds and MMTC.

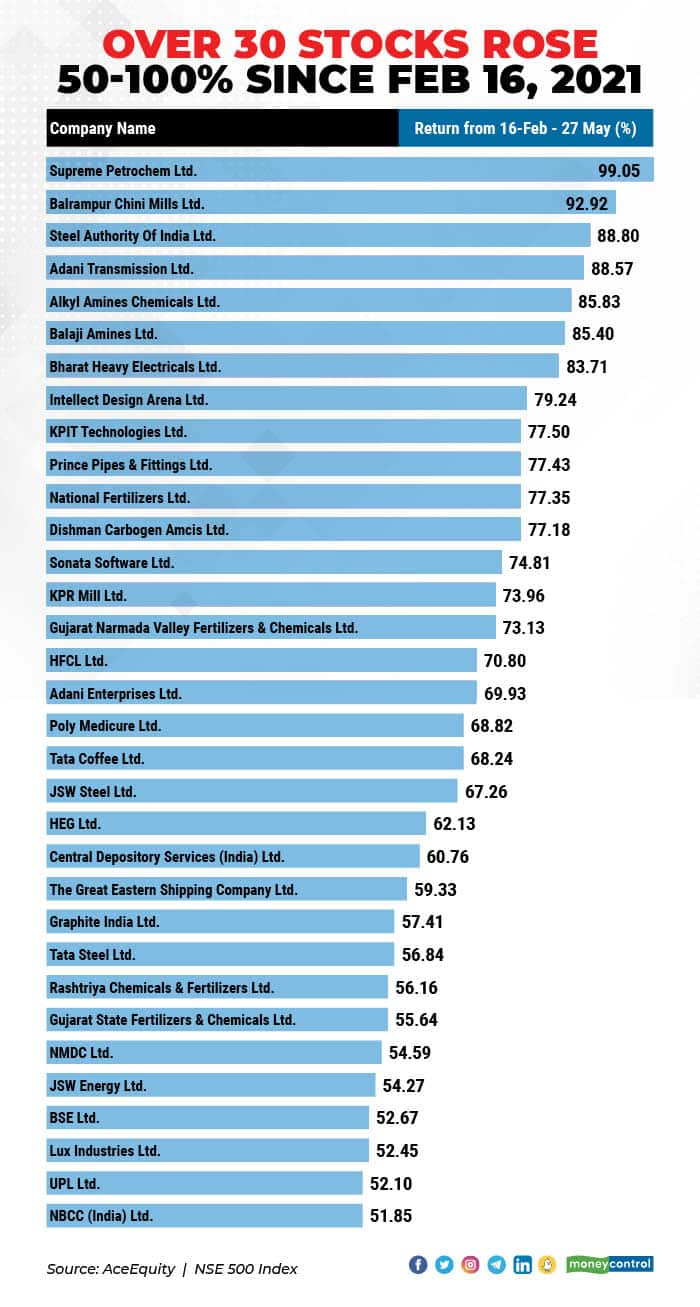

As many as 33 stocks in the NSE500 index rose 50-100 percent in the same period, including NBCC, LUX Industries, Tata Coffee, KPIT Technologies, Alkyl Amines, and Adani Transmission, SAIL, BHEL and Supreme Petrochem.

While the 30-pack S&P BSE Sensex is still 1,000 points away from a record high of 52,516 recorded on February 16, the market cap of BSE listed companies surpassed the $ 3 trillion- mark, making the Indian market the eighth largest in the world.

“BSE market cap has crossed $ 3 trillion and still counting. Foreign institutions have starting buying again as the second COVID wave is receding. Moreover, COVID is a known devil, market has stopped reacting to it,” Bhushan Mahajan, Managing Director, Arthbodh Shares and investments Private Ltd said.

“Most importantly the mother of all markets, the US markets are at an all-time high with expected GDP growth of 6.5 percen. The only unknown devil is the black fungus. As long as the preventive medical care is in place, barring minor speed breakers, I firmly believe that a new high for indices is round the corner,” he said.

Mahajan added that that the Nifty would soon touch 16,000 and the Sensex 54,500. The market cap may also reach around 3.4 trillion by end of the year, he said, adding the bulls are here to stay.

Technical take

The Nifty hit a fresh record high supported by strong global markets. Broader markets, too, started the day on a positive note, with the midcap 100 index rising to its lifetime high and the smallcap 100 index rising to its highest since January 2018.

“Technically, the Nifty’s trend has remained firm ever since the index broke above the neckline of a bullish Head and Shoulder pattern, earlier this month,” Abhishek Chinchalkar, CMT at FYERS said.

“The key pivot to now keep an eye on is the former record high, 15,431. If the index sustains above that level, it is likely to continue its march higher towards 15,800-16,000 levels in the days ahead. On the downside, the immediate support now lies at 15180,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.