After some stiff competition from bears, bulls regained traction on D-Street and climbed crucial resistance levels to resume the uptrend. At the time of writing this copy, Nifty was trading comfortably above 15,000 and Sensex above 50,000 levels.

A strong showing from India Inc in earnings, and falling COVID cases have raised hopes of a strong economic recovery in coming quarters though the April-June 2021 quarter may take a big hit.

The broader markets also participated in the run as the BSE Midcap and Smallcap indices rallied 8 percent and 11 percent respectively from April lows.

“The positive trigger for the market now is the steadily declining fresh COVID cases and the steadily rising recovery rates. The latest infections numbers indicate a continuation of this positive trend. The market is discounting progressive lifting of the widespread lockdowns starting in early June. Even though growth & earnings will be impacted in Q1, smart recovery can be expected in the subsequent quarters,” said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

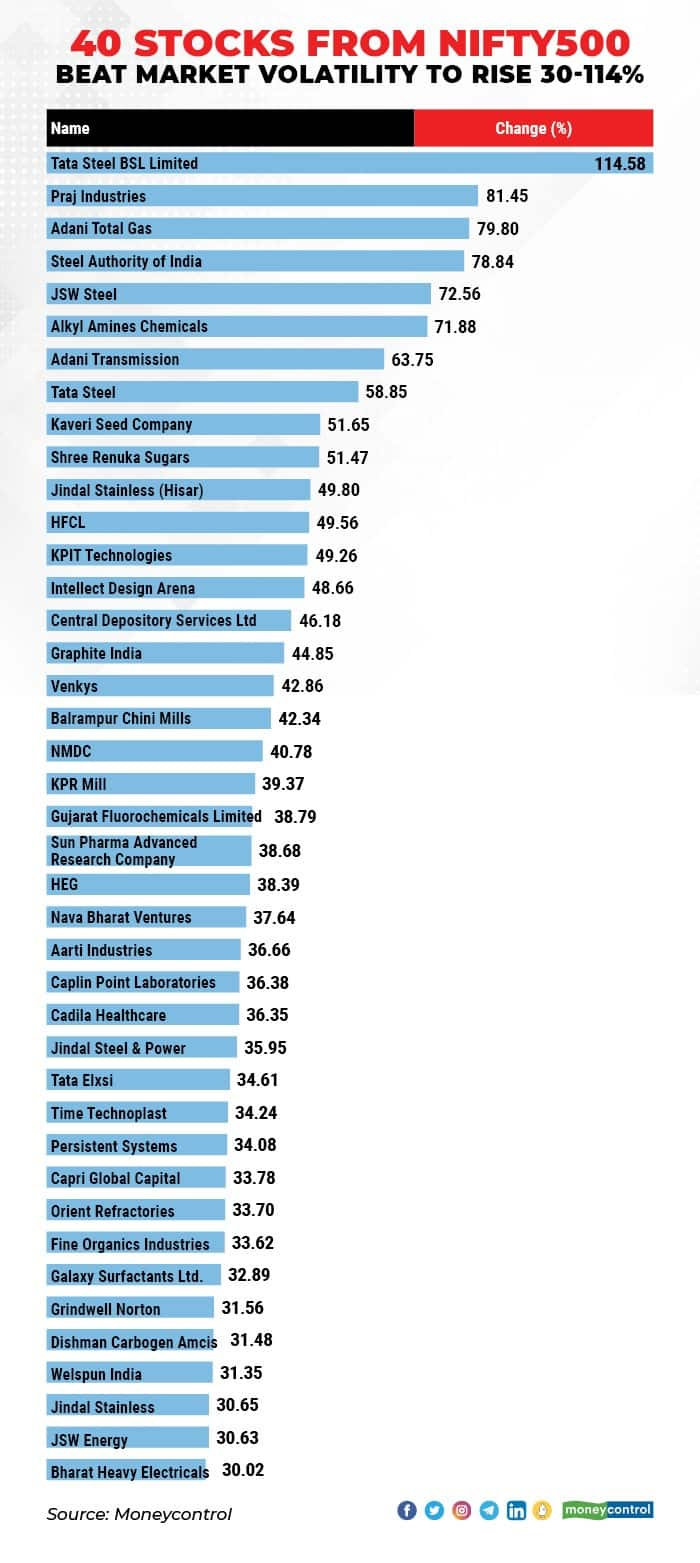

A renewed buying interest was seen across sectors amid hopes of reopening the economy from June onwards. From the Nifty500 universe, nearly half of the stocks were trading above their March levels. Tata Steel BSL was the top gainer, rising 114 percent over two months.

Meanwhile, 40 other stocks clocked double-digit gains. These include Praj Industries, Adani Total Gas, Steel Authority of India, JSW Steel, Alkyl Amines Chemicals, Adani Transmission, Tata Steel, HFCL, KPIT Technologies, CDSL, NMDC, Nava Bharat Ventures, Aarti Industries, Cadila Healthcare, Jindal Steel & Power, Persistent Systems, Fine Organics Industries, Galaxy Surfactants, Dishman Carbogen Amcis, Welspun India and JSW Energy among others.

The biggest gainer were from sectors such as metals, chemicals, power, pharma as was reflected in their benchmark gains. BSE Metal index shot up 38 percent since March, while Healthcare index was up over 13 percent and Basic Materials index added 20 percent. Among others, BSE Bankex, Finance and Auto indices trimmed losses to 5-6 percent now.

“The sectoral rotation & value buying is pushing up financials particularly banking stocks. The latest trends indicate that the stress in the banking system is not as bad as feared earlier. With progressive unlocking of the economy, credit growth is likely to pick up starting June improving the prospects for frontline financials,” Vijayakumar said.

Market action is likely to be stock specific in the coming days with the market responding to Q4 numbers & likely trends, he feels.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.