We expect the index to witness a breakout above its ongoing consolidation band of 14250-14850. The latest weekly price performance has been significant as the index never slipped below its previous week’s swing low despite a weak opening to the week, says Uttekar.

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

We expect Nifty to not only surpass 14,850 but to witness a firm directional momentum above 15,040 that could push it higher towards 15600, Sacchitanand Uttekar, DVP – Technical (Equity), Tradebulls Securities said in an interview with Moneycontrol’s Kshitij Anand. Edited excerpts:

Q) A volatile week but bulls remained in control of D-Street pushing Nifty50 above 14800 levels. What led to the price action?

A) Indian markets are now closely following the global trend. Barring India and Brazil, the rest of the world is coming out from COVID second wave. This has been demonstrated by strong economic recovery numbers from the US, China and Europe.

The decision by the US government to accept a temporary waiver of Trade-Related Aspects of Intellectual Property Rights (TRIPS) on COVID-19 vaccines also boosted the sentiment that developing countries could also have access to faster production of COVID vaccines.

All these factors led to the price action of Nifty surpassing 14800 despite the rising count of daily COVID cases.

Q) How do you see markets in the coming week? Which are the important levels that one should track going forward taking view of the FII and DII activity.

A) We expect the index to witness a breakout above its ongoing consolidation band of 14250-14850. The latest weekly price performance has been significant as the index never slipped below its previous week’s swing low despite a weak opening to the week.

Nifty Bank and Nifty Auto both have witnessed a breakout from their respective declining trendlines which adds further sectoral strength to the already positive metals, midcaps & pharma.

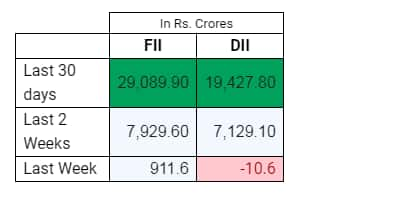

As seen in the above table, the institutional activity has largely been positive as net inflows continued despite the index oscillating within the broad range without a major directional momentum until now.

Hence, we expect that the index to not only to surpass 14,850 but to witness a firm directional momentum above 15,040 that could push it higher towards 15600.

The downside looks firmly capped till 14000 as indicated by strong PE OI additions at the beginning of the series, while the base is expected to levitate towards 14500 once the trend progresses above 15,040.

Q) Sectorally, the metal index outperformed for yet another month while consumer durable was the laggard. What led to the price action?

A) The latest parabolic movement in the metal index is led by the ongoing upsurge in the LME metals. LME Copper price is near its all-time high as the current stock of copper would only last for another 3.3 weeks based on current demand.

Current copper inventories, which are measured in metric tons, now stand at a level seen 15 years ago. The copper market’s deficits which have seen a massive drop in inventory is expected to continue through 2022 which is causing the prices to push upwards. China which is the world’s largest consumer of copper imports 50 percent of its copper from outside.

That coupled with the current infrastructure plans by US President Biden suggests that the need for copper and other base metals will only rise as economies worldwide recover from the recession created by the pandemic and slowly reopens their businesses worldwide.

On the other hand, the consumer durables saw profit booking as rising cases of COVID has shifted priorities of the Indian consumers.

The lockdown is impacting on common man’s finances and thus going forward, demand for consumer durables are expected to remain muted which is why we are seeing the consumer durable sector underperforming.

Q) After a flat April, ‘Sell in May Go Away’ echoes in the mind of investors. History suggests that bulls have mostly remained in control. Do you think May of 2021 will be different?

A) The present resilience of the market is irrational when viewed from the perspective of the health crisis and the pain that the nation and the economy are going through.

The disruption due to lockdowns would negatively affect most sectors in the coming months. Bulls have remained in control on the back of ‘hope trade’ being fuelled by global liquidity and expectation that the second wave will peak in May and normalcy would resume once the ongoing vaccination drive picks up pace.

The recent announcements by the RBI Governor with regards to the Rs 50,000 crore term liquidity facility for healthcare & SLTRO for Small Finance Banks helped the market sentiment to remain optimistic.

Though the investors have to be cautious since uncertainty has always remained high during this pandemic and the second wave impact on the economy is yet to be assessed fully.

Seasonality factor score for the last 5 years and 10 years data remains in favour of bulls. The index managed to form an elevated base around 14500 within the ongoing broader consolidation range of 14250-14850. Its rate-sensitive sectors like banks, auto and realty showing signs of bullish reversals we believe the month of May could bring in the much-awaited breakout above 15040 & a rally towards 15600.

Q) 13 stocks on BSE hit a fresh all-time High (Apollo Hosp, Adani Transport, JSW Energy, Prince Pipes, and Tata Steel etc.). Do you think these could be the momentum bets at least in the short term?

A) Midcaps have been relatively stronger as the Nifty Midcap 100 witnessed a fresh breakout on the final day of the week. Most of these midcap names are quoting near their all-time highs despite the index remaining range-bound.

With the expectation of a directional up move to unlock soon in the index, these names could continue to do well going forward with minor mandatory pullbacks within their respective ongoing bull trends.

Q) You top 3-5 trading ideas for the next 3-4 weeks:

A) Here is a list of top trading ideas for the short term:

Maruti Suzuki: Buy around Rs 6650 | LTP: Rs 6702 | Stop Loss: Rs 6430 | Target: Rs 7200 | Upside 7%

Falling wedge formation on its daily scale looks mature for a breakout. Engulfing bullish pattern on its weekly scale reconfirms the support zone near its 200 WEMA at Rs 6630.

Amongst key strength indicators, ADX 9 has triggered a buy with its ADX line showing strength above 20.

BASF India: Buy | LTP: Rs 2453 | Stop Loss: Rs 2270 | Target: Rs 2960 | Upside 20%

A breakout towards fresh life high above 2018 high also triggered a fresh breakout from the cup & handle formation on the weekly scale.

The pattern exhibits an immediate target up to Rs 2960. The pattern breakout is well supported with significant volumes despite its daily RSI entering the overbought zone while its ADX (another trend strength indicator) is confidently trending at 35.

Coal India: Buy | LTP: Rs 136 | Stop Loss: Rs 133 | Target: Rs 145 | Upside 6%

The recent reversal from the lower end of the Broadening formation followed by a positive crossover of its 5 & 20-Days EMA lead to a push above its 200-Days EMA.

We expect the ongoing up move to extend towards the upper end of the larger degree pattern which is placed around Rs 60.

Short-term traders too can participate with a momentum trading stop below Rs 133 for an immediate up move towards Rs 145.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.