The finance cost during the quarter reduced considerably to Rs 377.18 crore, down by 25.5 percent YoY. Likewise, for the year FY21, the finance cost declined 25.4 percent to Rs 1,485.65 crore.

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Country’s largest cement manufacturer UltraTech Cement on May 7 registered a 45.2 percent year-on-year (YoY) decline in consolidated profit at Rs 1,775.23 crore for the quarter ended March 2021 due to high base in the year-ago quarter. However, the number beat estimates. The company had a big tax write-back in Q4FY20 that lifted profit to Rs 3,240.23 crore.

But the adjusted profit grew by 57 percent, compared to Rs 1,129 crore in the year-ago quarter. “One time gain on account of reversal of deferred tax liabilities of Rs 2,112 crore in the consolidated performance has been eliminated to derive the normalised PAT (Rs 1,129 crore) for FY20 for a correct comparison with FY21,” the Aditya Birla Group company explained.

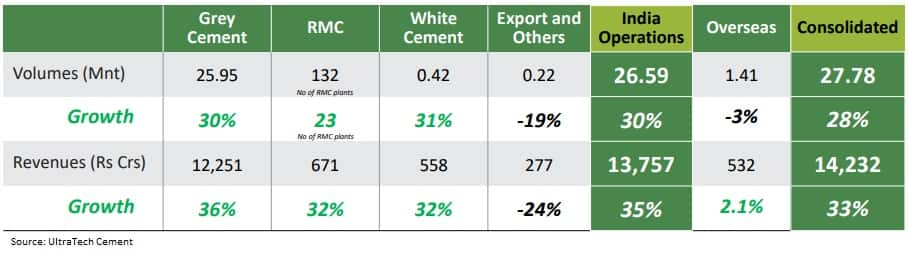

Consolidated revenue grew by 32.7 percent YoY to Rs 14,405.61 crore in March 2021 quarter, with volume growth at 28 percent YoY.

“The ‘overheads control programme’, prudent working capital management and control on cash flows were the main drivers, aided by quick revival of demand and supply side restoration. All of these have resulted in company’s superlative performance, even during such trying times. It achieved an effective capacity utilisation of 93 percent during the quarter,” said UltraTech Cement in its BSE filing.

Numbers were ahead of analysts’ expectations. Profit was estimated at Rs 1,665 crore on revenue of Rs 13,550 crore for the quarter, according to the average estimates of analysts polled by CNBC-TV18.

The operating numbers, too, came in ahead of analysts’ estimates. EBITDA (earnings before interest, tax, depreciation and amortisation) grew by 50.9 percent YoY to Rs 3,690.4 crore and margin jumped 309 bps YoY to 25.61 percent in March quarter. The CNBC-TV18 poll estimates for the same were at Rs 3,270 crore and margin at 24.1 percent, respectively.

UltraTech said its capital and financial resources remained fully protected and its liquidity position was adequately covered. “While rural and semi-urban housing continue to drive growth, pick-up in government led infrastructure aided incremental cement demand. Pent-up urban demand is also expected to improve,” it added.

The company said it was closely monitoring the impact of the second wave of the pandemic on its operations. “With its focus on operational efficiencies and cost control, UltraTech is better prepared for any resulting slowdown in the economy.”

To Know All Earnings Related News, Click Here

In Q4FY21, power & fuel cost increased 26.6 percent YoY, freight & forwarding expenses increased 22.6 percent, and cost of raw materials jumped 27.2 percent YoY, whereas other income declined 69.8 percent YoY to Rs 60.33 crore in March 2021 quarter.

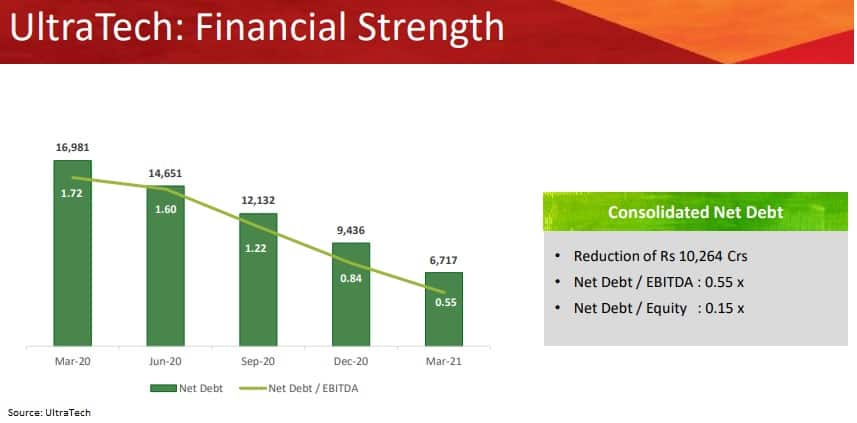

The finance cost during the quarter reduced considerably to Rs 377.18 crore, down by 25.5 percent YoY, and in the year FY21, the finance cost declined 25.4 percent to Rs 1,485.65 crore compared to previous year.

UltraTech said with the prudence and deft financial management, it has successfully reduced net debt-to-EBITDA ratio to 0.55x from 1.72x as on March 31, 2021, which is in line with its endeavour to maintain optimal capital structure.

“The loan repayments have been made through free cash flows that the company has generated during the year, despite the challenging circumstances and severe business interruptions during Q1FY21,” the company added.

In the year FY21, consolidated profit declined 5.1 percent to Rs 5,463.1 crore and revenue rose 5.4 percent to Rs 44,725.8 crore compared to previous year.

UltraTech said the board of directors have recommended dividend of Rs 37 per share, aggregating Rs 1,068.02 crore.