Since hitting record highs in February 2021, the Indian markets have mostly traded sideways with a negative bias amid a resurgence in COVID which could potentially derail economic recovery. In the face of uncertainties, benchmark indices have dropped about 6 percent from life-time highs, but more than half their constituent stocks are down 10-20% from their respective 52-week high.

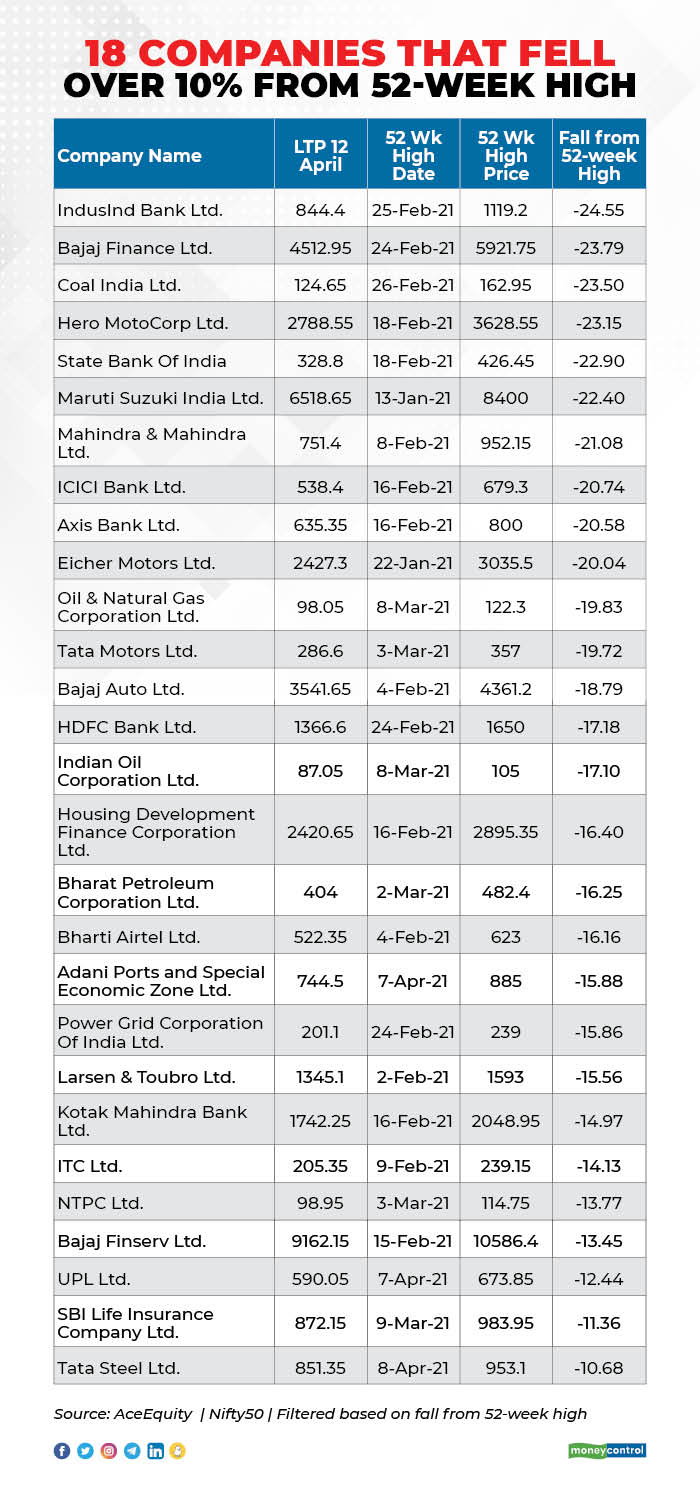

As many as 28 stocks in the Nifty50 have fallen more than 10% from their respective 52-week high recorded in 2021 itself. Stocks that are down in double digits include Tata Steel, UPL, Bajaj Finance, NTPC, Kotak Mahindra Bank, Bharti Airtel, Tata Motors, Axis Bank, Bajaj Finance, and IndusInd Bank among others.

The rise in COVID cases is a cause of concern as nearly 1.8 lakh new cases were registered in the last 24 hours, the Health Ministry said on Wednesday.

The second wave of COVID-19 has shaken Indian indices and stocks across the board have witnessed healthy corrections. Investors can pick stocks selectively in the sectors like autos, consumption, and avoid banking as well as NBFCs, suggest experts.

“Automobiles and auto ancillary is a space where investors should try to pick quality largecaps which includes companies like Maruti Suzuki Ltd, Hero Moto Corp, M&M, Tata Motors, Exide Ltd as these might turn out to be good bets to invest on,” Gaurav Garg, Head of Research, CapitalVia Global Research Limited told Moneycontrol.

“I would be a little cautious over banking and financial space, as there can be some more correction over the next few months as we get more detail around NPAs,” he said.

The second wave of COVID-19 is fierce. Data from Motilal Oswal shows that in the first wave, it took 102 days for the infections to rise from 10,000 to 100,000. In the second wave, it has taken just 47 days for cases to rise from 10,000 to 1,00,000.

The rise in infections is not limited to India alone but many other countries are also seeing a spike in COVID cases. Although, the rise in infections is limited to few states the government is trying to get additional vaccines to stop the chain.

Ten states, including Maharashtra, Uttar Pradesh, Chhattisgarh, Karnataka, and Kerala, have shown a steep rise in daily new COVID-19 cases accounting for 82.04 percent of the fresh infections being reported in a day, the Union Health Ministry said on Wednesday.

“These are short-term disruptions due to COVID. Government has announced approvals for the import of other vaccines off late,” Divam Sharma, Co-founder at Green Portfolio told Moneycontrol.

“Developed countries like the USA, UK, etc are improving and will have a positive impact on Indian businesses due to increased export demand in the coming months,” he said.

What should investors do?

The COVID is here to stay and so is volatility. Investors are advised to use these short term dips to get into quality stocks with quality management, visibility of growth, low leverage on books, and also those companies that could benefit from government policies.

“One needs to be selective and so we observed very stock-specific. Sectoral rotation is happening very fast,” Sandeep Porwal – Technical & Derivative Analyst at Ashika Group told Moneycontrol.

“The prevailing phase of volatility is good for swing traders, multiple swings are being observed on both index and stocks. One can pocket in good trading gains based on swing trading,” he said.

From a technical perspective, investors can use a lot of tools and a set of studies to empower one to make buy or sell decisions. “A few of the approaches include the Top-down approach where a holistic view of the index, sectors & underlying stocks will help a trader and investor to make a sustainable return,” highlights Porwal.

From a fundamental perspective, investors should look at factors like price-to-book, leverage on books or the debt-to-equity ratio, proven business model etc.

“Investors should look at factors like vulnerability to the business restrictions caused by covid, debt on books as the companies with high leverage can be more volatile in these times, sustainability of the business and future outlook through developments like PLI licenses, capex etc.,” says Sharma of Green Portfolio.

“Price/Book value is an important parameter to look at when we are looking at a phase of high liquidity. Companies which are comfortable on this parameter will outperform in the coming 2-3 years,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.